Dollar Tree 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

From time to time, we also acquire the rights to store leases through bankruptcy or other proceedings. We will continue to

take advantage of these opportunities as they arise depending upon several factors including their fit within our location and

selling square footage size parameters.

Merchandising and Distribution. Expanding our customer base is important to our growth plans. We plan to continue to

stock our stores with a compelling mix of ever-changing merchandise that our customers have come to appreciate.

Consumable merchandise typically leads to more frequent return trips to our stores resulting in increased sales. The

presentation and display of merchandise in our stores are critical to communicating value to our customers and creating a more

exciting shopping experience. We believe our approach to visual merchandising results in higher sales volume and an

environment that encourages impulse purchases.

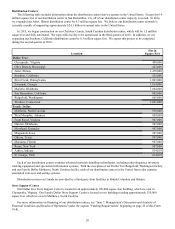

A strong and efficient distribution network is critical to our ability to grow and to maintain a low-cost operating structure.

In 2015, we began construction on our Cherokee County, South Carolina distribution center, which will be 1.5 million square

feet and fully automated. We expect this facility to be operational in the third quarter of 2016. In addition, we are expanding

our Stockton, California distribution center by 0.3 million square feet. We expect this project to be completed during the

second quarter of 2016. In 2014, we expanded our Joliet, Illinois distribution center to 1.5 million square feet. We are also in

the process of enabling our distribution centers to ship merchandise to both Dollar Tree and Family Dollar stores. We expect

our first pilot facility to be operational in the third quarter of 2016. We believe our distribution center network is currently

capable of supporting approximately $24.1 billion in annual sales in the United States. New distribution sites are strategically

located to reduce stem miles, maintain flexibility and improve efficiency in our store service areas. We also are a party to an

agreement which provides distribution services from two facilities in Canada.

Our Dollar Tree stores receive approximately 90% of their inventory from our distribution centers via contract carriers and

our Family Dollar stores receive approximately 72% of their inventory from our distribution centers. The remaining store

inventory, primarily perishable consumable items and other vendor-maintained display items, are delivered directly to our

stores from vendors. Our Family Dollar stores receive approximately 16% of their merchandise from McLane Company, Inc.

For more information on our distribution center network, see "Item 2. Properties" beginning on page 18 of this Form 10-K.

Competition

Our segment of the retail industry is highly competitive and we expect competition to increase in the future. We operate in

the discount retail business, which is currently and is expected to continue to be highly competitive with respect to price, store

location, merchandise quality, assortment and presentation and customer service. Our competitors include single-price dollar

stores, multi-price dollar stores, mass merchandisers, discount retailers, drug stores, convenience stores, independently-

operated discount stores, and a wide variety of other retailers. In addition, several competitors have sections within their stores

devoted to "one dollar" price point merchandise, which further increases competition. We believe we differentiate ourselves

from other retailers by providing high-value, high-quality, low-cost merchandise in attractively-designed stores that are

conveniently located. Our sales and profits could be reduced by increases in competition. There are no significant economic

barriers for others to enter our retail sector.

Trademarks

We are the owners of several federal service mark registrations including "Dollar Tree," the "Dollar Tree" logo, the Dollar

Tree logo with a “1” and "One Price...One Dollar." In addition, we own a concurrent use registration for "Dollar Bill$" and the

related logo. We also acquired the rights to use trade names previously owned by Everything's A Dollar, a former competitor in

the $1.00 price point industry. Several trade names were included in the purchase, including the marks "Everything's $1.00 We

Mean Everything!" and "Everything's $1.00." With the acquisition of Deals, we became the owners of the trademark "Deal

$.” With the acquisition of Dollar Giant, we became the owners of the trademark “Dollar Giant” and others in Canada. With

the acquisition of Family Dollar, we became the owners of the trademarks "Family Dollar," "Family Dollar Stores" and other

names and designs of certain merchandise sold in Family Dollar stores, such as "Family Gourmet," "Family Pet," "Kidgets" and

"Outdoors by Design." We have federal trademark registrations for a variety of private labels that we use to market some of

our product lines. Our trademark registrations have various expiration dates; however, assuming that the trademark

registrations are properly renewed, they have a perpetual duration.

Employees

We employed approximately 55,300 full-time and 112,500 part-time associates on January 30, 2016. Part-time associates

work an average of less than 30 hours per week. The number of part-time associates fluctuates depending on seasonal

needs. We consider our relationship with our associates to be good, and we have not experienced significant interruptions of

operations due to labor disagreements.