Dollar Tree 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

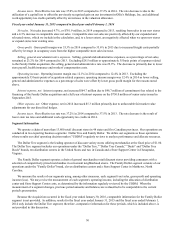

market conditions over the projected period, including growth rates in revenue, gross margin and expense. The cash

flows are based on our most recent business operating plans and various growth rates have been assumed for years

beyond the current business plan period. We believe that the assumptions and rates used in our 2015 impairment

evaluations are reasonable; however, variations in the assumptions and rates could result in significantly different

estimates of fair value.

• Selection of an appropriate discount rate. Calculating the present value of future cash flows requires the selection of

an appropriate discount rate, which is based on a weighted-average cost of capital analysis. The discount rate is

affected by changes in short-term interest rates and long-term yield as well as variances in the typical capital structure

of marketplace participants. Given current economic conditions, it is possible that the discount rate will fluctuate in

the near term. The weighted-average cost of capital used to discount the cash flows for our reporting units ranged

from 10.0% to 13.3% for the 2015 analysis.

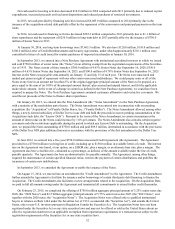

Indefinite-lived intangible assets, such as the Family Dollar tradename, are not subject to amortization but are reviewed at

least annually for impairment. The indefinite-lived intangible asset impairment evaluations are performed by comparing the

fair value of the indefinite-lived intangible assets to their carrying values. We estimate the fair value of tradename intangible

assets based on an income approach using the relief-from-royalty method. This approach is dependent upon a number of

factors, including estimates of future growth and trends, royalty rates, discount rates and other variables. We base our fair

value estimates on assumptions we believe to be reasonable, but which are unpredictable and inherently uncertain. Our

impairment evaluation of indefinite-lived intangible assets did not result in an impairment charge.

Income Taxes

On a quarterly basis, we estimate our required income tax liability and assess the recoverability of our deferred tax

assets. Our income taxes payable are estimated based on currently enacted tax rates and estimated state apportionment

factors. Management assesses the recoverability of deferred tax assets based on the availability of carrybacks of future

deductible amounts and management’s projections for future taxable income. We cannot guarantee that we will generate

taxable income in future years. Historically, we have not experienced significant differences in our estimates of our tax accrual.

In addition, we have a recorded liability for our estimate of uncertain tax positions taken or expected to be taken in our tax

returns. Judgment is required in evaluating the application of federal and state tax laws, including relevant case law, and

assessing whether it is more likely than not that a tax position will be sustained on examination and, if so, judgment is also

required as to the measurement of the amount of tax benefit that will be realized upon settlement with the taxing

authority. Income tax expense is adjusted in the period in which new information about a tax position becomes available or the

final outcome differs from the amounts recorded. We believe that our liability for uncertain tax positions is adequate. For

further discussion of our changes in reserves during 2015, see "Note 4 - Income Taxes" in "Item 8. Financial Statements and

Supplementary Data" beginning on page 56 of this Form 10-K.

Seasonality and Quarterly Fluctuations

We experience seasonal fluctuations in our net sales, comparable store net sales, operating income and net income and

expect this trend to continue. Our results of operations may also fluctuate significantly as a result of a variety of factors,

including:

• shifts in the timing of certain holidays, especially Easter;

• the timing of new store openings;

• the net sales contributed by new stores;

• changes in our merchandise mix; and

• competition.

Our highest sales periods are the Christmas and Easter seasons. Easter was observed on April 20, 2014 and on April 5,

2015, and will be observed on March 27, 2016. We believe that the earlier Easter in 2016 could result in a $10.0 million

decrease in sales in the first quarter of 2016 as compared to the first quarter of 2015. We generally realize a disproportionate

amount of our net sales and of our operating and net income during the fourth quarter. In anticipation of increased sales

activity during these months, we purchase substantial amounts of inventory and hire a significant number of temporary

employees to supplement our continuing store staff. Our operating results, particularly operating and net income, could suffer

if our net sales were below seasonal norms during the fourth quarter or during the Easter season for any reason, including

merchandise delivery delays due to receiving or distribution problems, changes in consumer sentiment or inclement weather.

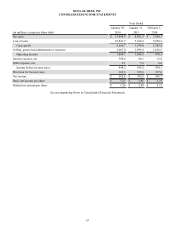

Our unaudited results of operations for the eight most recent quarters are shown in a table in "Note 12 - Quarterly Financial

Information (Unaudited)" in "Item 8. Financial Statements and Supplementary Data" beginning on page 75 of this Form 10-K.