Dollar Tree 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

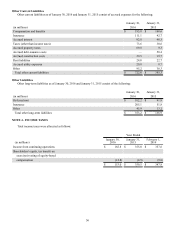

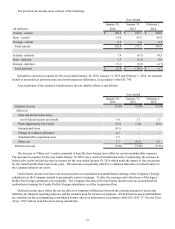

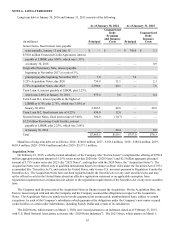

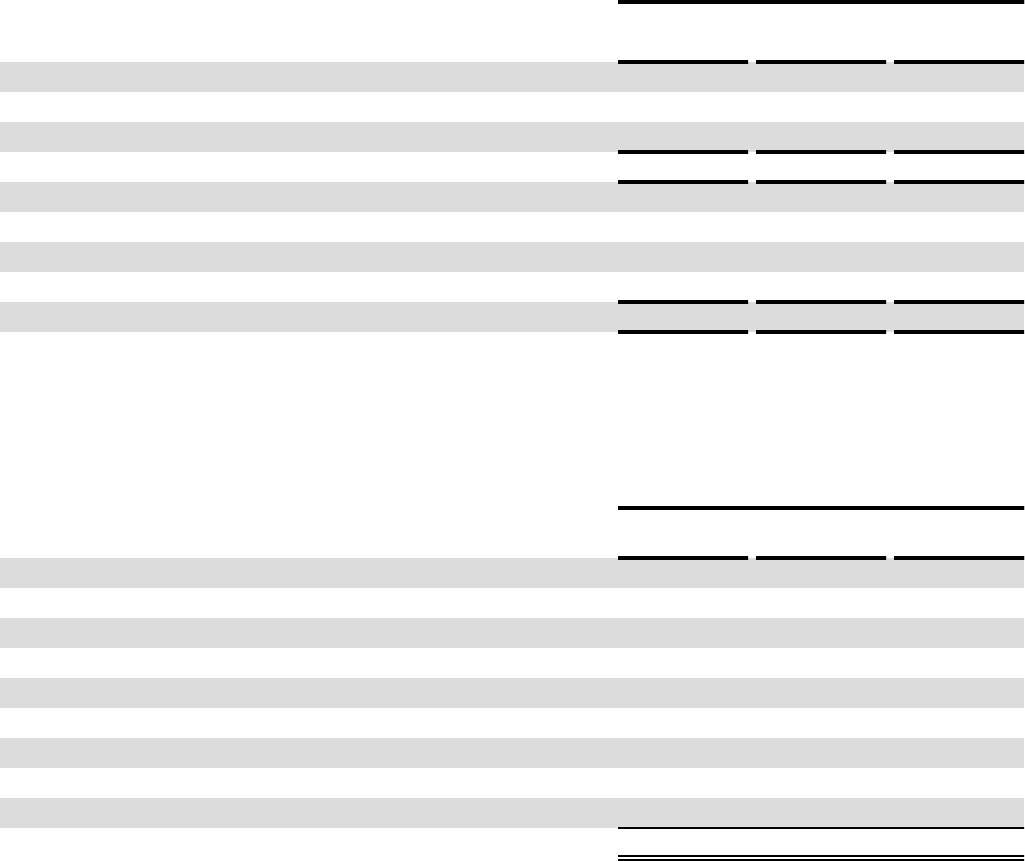

The provision for income taxes consists of the following:

Year Ended

January 30, January 31, February 1,

(in millions) 2016 2015 2014

Federal - current $ 126.9 $ 325.1 $ 304.6

State - current 14.6 47.6 45.9

Foreign - current 0.5 0.4 0.4

Total current 142.0 373.1 350.9

Federal - deferred 7.4 (9.7) 10.5

State - deferred 3.3 (3.2) 0.9

Foreign - deferred 13.1 (5.2)(4.7)

Total deferred $ 23.8 $ (18.1) $ 6.7

Included in current tax expense for the years ended January 30, 2016, January 31, 2015 and February 1, 2014, are amounts

related to uncertain tax positions associated with temporary differences, in accordance with ASC 740.

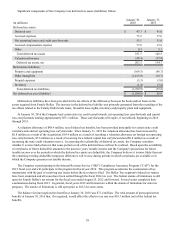

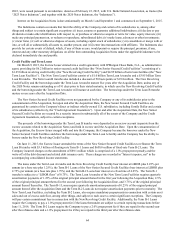

A reconciliation of the statutory federal income tax rate and the effective rate follows:

Year Ended

January 30,

2016 January 31,

2015 February 1,

2014

Statutory tax rate 35.0% 35.0% 35.0%

Effect of:

State and local income taxes,

net of federal income tax benefit 3.0 3.3 3.3

Work Opportunity Tax Credit (3.8)(1.0)(0.9)

International taxes (4.5) — —

Change in valuation allowance 4.1 — —

Nondeductible acquisition costs 1.5 — —

Other, net 1.7 (0.1) 0.1

Effective tax rate 37.0% 37.2% 37.5%

The increase in “Other, net” consists primarily of benefits from foreign taxes offset by certain nondeductible expenses.

The decrease in expense for the year ended January 30, 2016 was a result of international entity restructuring, the increase in

federal jobs credits and the decrease in income for the year ended January 30, 2016 which made the impact to the rate greater

for the stated benefits than in previous years. This decrease was partially offset by a valuation allowance recorded relative to

the Canadian deferred tax assets.

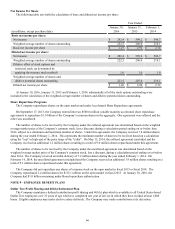

United States income taxes have not been provided on accumulated but undistributed earnings of the Company's foreign

subsidiaries as the Company intends to permanently reinvest earnings. To date, the earnings and related taxes of the legacy

Dollar Tree foreign subsidiaries are negligible. The Company has reserved United States income taxes on accumulated but

undistributed earnings for Family Dollar's foreign subsidiaries as of the Acquisition Date.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. All deferred tax assets and liabilities

are classified on the accompanying consolidated balance sheets as noncurrent in accordance with ASU 2015-17 "Income Taxes

(Topic 740)" and are netted based on taxing jurisdiction.