Dollar Tree 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

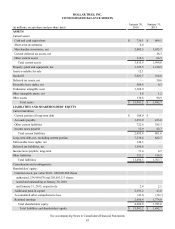

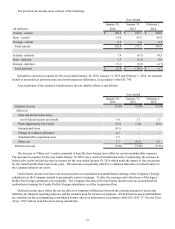

Deferred Financing Costs

During 2015, the Company adopted ASU No. 2015-03, "Interest-Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs." Previously, debt issuance costs were recorded as assets on the balance sheet. This

update requires that debt issuance costs related to a debt liability be presented on the balance sheet as a direct deduction from

the carrying amount of the debt liability, consistent with debt discounts. This update does not change the recognition and

measurement of debt issuance costs. The update has been adopted retrospectively for all periods presented in the

accompanying consolidated balance sheets. The reclassification of debt issuance costs resulted in reductions in "Other assets,

net" and "Long-term debt, net, excluding current portion" of $74.3 million as of January 31, 2015.

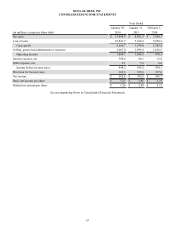

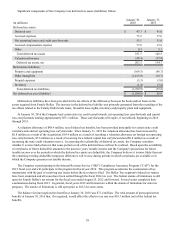

Impairment of Long-Lived Assets and Long-Lived Assets to Be Disposed Of

The Company reviews its long-lived assets and certain identifiable intangible assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be

held and used is measured by comparing the carrying amount of an asset to future net undiscounted cash flows expected to be

generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured as the

amount by which the carrying amount of the assets exceeds the fair value of the assets based on discounted cash flows or other

readily available evidence of fair value, if any. Assets to be disposed of are reported at the lower of the carrying amount or fair

value less costs to sell. In fiscal 2015, 2014 and 2013, the Company recorded charges of $1.6 million, $1.5 million and $0.5

million, respectively, to write down certain assets. These charges are recorded as a component of "Selling, general and

administrative expenses" in the accompanying consolidated income statements.

Financial Instruments

The Company utilizes derivative financial instruments to reduce its exposure to market risks from changes in interest rates

and diesel fuel costs. By entering into receive-variable, pay-fixed interest rate and diesel fuel swaps, the Company limits its

exposure to changes in variable interest rates and diesel fuel prices. The Company is exposed to credit-related losses in the

event of non-performance by the counterparty to these instruments but minimizes this risk by entering into transactions with

high quality counterparties. Interest rate or diesel fuel cost differentials paid or received on the swaps are recognized as

adjustments to interest in the period earned or incurred. The Company formally documents all hedging relationships, if

applicable, and assesses hedge effectiveness both at inception and on an ongoing basis.

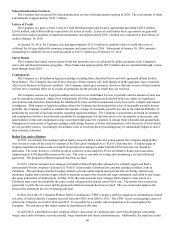

Fair Value Measurements

Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should

be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for

considering such assumptions, a fair value hierarchy has been established that prioritizes the inputs used to measure fair

value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of the fair value

hierarchy are as follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in

markets that are not active; and

Level 3 - Unobservable inputs in which there is little or no market data which require the reporting entity to develop its

own assumptions.

As required, financial assets and liabilities are classified in their entirety based on the lowest level of input that is

significant to the fair value measurement. The Company's assessment of the significance of a particular input to the fair value

measurement requires judgment, and may affect the valuation of fair value assets and liabilities and their placement within the

fair value hierarchy levels.