ComEd 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

nection with the closing of the sale in the third quarter of

2003, Enterprises recorded a gain of $44 million (before in-

come taxes), primarily due to the book value of InfraSource

at the date of closing being lower than estimated in the sec-

ond quarter of 2003. The net impact of the goodwill

impairment in the second quarter and the gain recorded in

the third quarter was a loss before income taxes and minor-

ity interest of $4 million for the year ended December 31,

2003. The net impact was recorded as an operating and

maintenance expense within the Consolidated Statements

of Income.

Exelon Thermal Holdings, Inc.

In December 2003, Exelon signed an agreement to sell its

Chicago thermal business of Exelon Thermal Holdings, Inc.

(Thermal) for approximately $135 million, subject to working

capital adjustments. The agreement to sell the Chicago

thermal operations is subject to customary closing con-

ditions and approval from the City of Chicago (Chicago) and

is expected to close during the first half of 2004. The debt of

the Chicago thermal operations is required to be repaid by

Enterprises prior to closing. The total debt outstanding of the

Chicago thermal operations as of December 31, 2003 was $38

million, which may result in prepayment penalties. Exelon

also reached agreement to sell Exelon’s 75% share in the

Aladdin thermal facility (located in Las Vegas, Nevada) for

$24 million, which is contingent upon the exit of the Aladdin

Hotel, the primary customer, from bankruptcy. The sale is

expected to close during the second half of 2004. In 2003,

Enterprises recorded an impairment charge of $8 million

(before income taxes) related to its investment in the Alad-

din thermal facility based on the terms of the sales agree-

ment. See Assets and Liabilities Held for Sale below for dis-

cussion of the classification of the Thermal assets and li-

abilities as of December 31, 2003.

Sale of AT&T Wireless

On April 1, 2002, Enterprises sold its 49% interest in

AT&T Wireless PCS of Philadelphia, LLC to a subsidiary of

AT&T Wireless Services for $285 million in cash. Exelon re-

corded a gain of $116 million (net of income taxes) on the $84

million investment in other income and deductions on its

Consolidated Statements of Income.

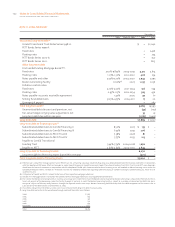

Assets and Liabilities Held for Sale

As of December 31, 2003, the assets and liabilities of certain

entities of Thermal and Exelon Services, Inc. (Exelon Services)

were classified as held for sale within the Consolidated Bal-

ance Sheet pursuant to SFAS No. 144. Enterprises recognized

impairment charges totaling $14 million (before income tax-

es) under SFAS No. 144 related to the assets of Exelon Services

that were classified as held for sale as of December 31, 2003.

These assets and liabilities are reported under the Enter-

prises segment in Note 21—Segment Information and are

expected to be sold in 2004. See Note 8—Goodwill for in-

formation regarding the goodwill impairment charge re-

corded in 2003 related to Exelon Services.

Generation classified three gas turbines with a book

value of $36 million as held for sale as of December 31, 2003

in anticipation of their sale in 2004. These turbines had been

classified as other long-term assets as they were not placed

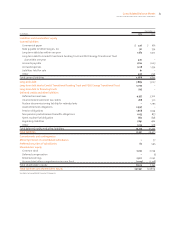

into service. The major classes of assets and liabilities classi-

fied as held for sale as of December 31, 2003 consist of the

following (in millions):

Generation Thermal Exelon Services Total

Cash $– $ 9 $2 $ 11

Accounts receivable, net – 13 46 59

Other current assets – 1 23 24

Property, plant and equipment, net – 85 1 86

Other long-term assets 36 12 14 62

Total assets classified as held for sale $36 $120 $86 $242

Thermal Exelon Services Total

Accounts payable, accrued expenses and other current liabilities $ 4 $40 $44

Debt 1– 1

Asset retirement obligation 3 – 3

Other long-term liabilities 10 3 13

Total liabilities classified as held for sale $18 $ 43 $ 61

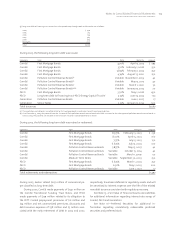

Synthetic Fuel-Producing Facilities

In November 2003, Exelon purchased interests in two syn-

thetic fuel-producing facilities. Exelon’s purchase price for

these facilities included a combination of cash, notes pay-

able and contingent consideration dependent upon the pro-

duction level of the facilities. These facilities are not con-

solidated within Exelon’s financial statements as Exelon

does not have the ability to exert a significant influence on

93