ComEd 2003 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

related to Enterprises’ mark-to-market contracts. Enter-

prises’ counterparties in these contracts are all investment

grade.

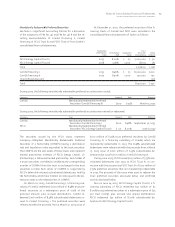

As of December 31, 2003, $176 million of deferred net

losses on derivative instruments in accumulated other com-

prehensive income are expected to be reclassified to earn-

ings during the next twelve months. Amounts in

accumulated other comprehensive income related to

changes in interest-rate cash-flow hedges are reclassified

into earnings when the forecasted interest payment occurs.

Amounts in accumulated other comprehensive income re-

lated to changes in energy commodity cash-flow hedges are

reclassified into earnings when the forecasted purchase or

sale of the energy commodity occurs. The majority of Ex-

elon’s cash-flow hedges are expected to settle within the

next 4 years.

Exelon would be exposed to credit-related losses in the

event of non-performance by the counterparties that issued

the derivative instruments. The credit exposure of de-

rivatives contracts is represented by the fair value of con-

tracts at the reporting date. Exelon’s interest-rate swaps are

documented under master agreements. Among other

things, these agreements provide for a maximum credit

exposure for both parties. Payments are required by the ap-

propriate party when the maximum limit is reached. Gen-

eration has entered into payment netting agreements or

enabling agreements that allow for payment netting with

the majority of its large counterparties, which reduce Gen-

eration’s exposure to counterparty risk by providing for the

offset of amounts payable to the counterparty against

amounts receivable from the counterparty.

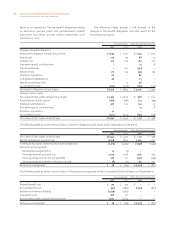

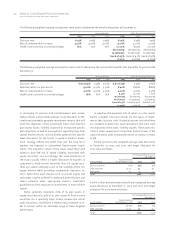

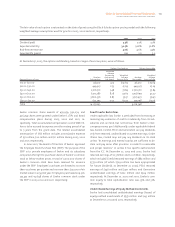

Available-for-Sale Securities

Exelon classifies investments in the trust accounts for

decommissioning nuclear plants as available-for-sale. The

following tables show the fair values, gross unrealized gains

and losses and amortized cost bases for the securities held in

these trust accounts as of December 31, 2003 and 2002.

December 31, 2003

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Cash and cash equivalents(1) $72 $– $– $72

Equity securities 2,402 300 (294) 2,408

Debt securities

Government obligations 1,574 65 (4) 1,635

Other debt securities 579 29 (2) 606

Total debt securities 2,153 94 (6) 2,241

Total available-for-sale securities $4,627 $394 $(300) $ 4,721

(1) Cash and cash equivalents does not include $12 million related to AmerGen nuclear decommissioning trust. AmerGen’s nuclear decommissioning trust cash and cash equiv-

alents are classified elsewhere in the table.

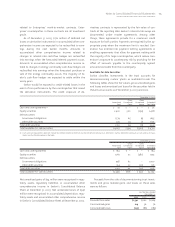

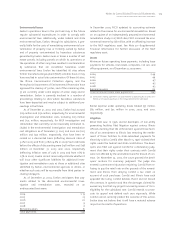

December 31, 2002

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Cash and cash equivalents $ 184 $ – $ – $ 184

Equity securities 1,763 72 (482) 1,353

Debt securities

Government obligations 938 62 – 1,000

Other debt securities 514 32 (30) 516

Total debt securities 1,452 94 (30) 1,516

Total available-for-sale securities $3,399 $166 $ (512) $ 3,053

Net unrealized gains of $94 million were recognized in regu-

latory assets, regulatory liabilities or accumulated other

comprehensive income in Exelon’s Consolidated Balance

Sheet at December 31, 2003. Net unrealized losses of $346

million were recognized in accumulated depreciation, regu-

latory assets and accumulated other comprehensive income

in Exelon’s Consolidated Balance Sheet at December 31, 2002.

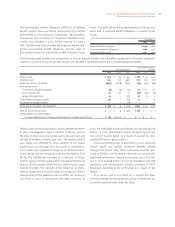

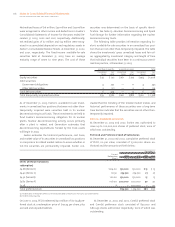

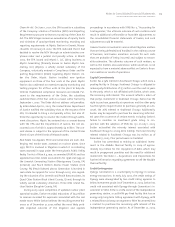

Proceeds from the sale of decommissioning trust invest-

ments and gross realized gains and losses on those sales

were as follows:

For the Years Ended

December 31,

2003 2002 2001

Proceeds from sales $2,341 $1,612 $1,624

Gross realized gains 219 56 76

Gross realized losses (235) (86) (189)