ComEd 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

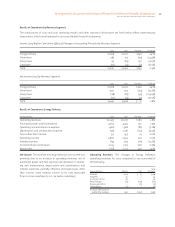

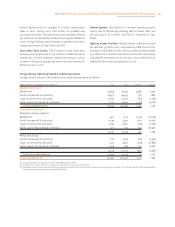

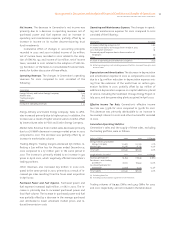

58 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

Financing activities exclude the non-cash issuance of a

$534 million note to Sithe for the November 1, 2002 acqui-

sition of Exelon New England, which was subsequently in-

creased to $536 million.

Credit Issues

Exelon Credit Facility

Exelon meets its short-term liquidity requirements primarily

through the issuance of commercial paper by Exelon corpo-

rate holding company (Exelon Corporate) and by ComEd,

PECO and Generation. In October 2003, Exelon, ComEd, PECO

and Generation replaced their $1.5 billion bank unsecured

revolving credit facility with a $750 million 364-day un-

secured revolving credit agreement and a $750 million three-

year unsecured revolving credit agreement with a group of

banks. Both revolving credit agreements are used principally

to support the commercial paper programs at Exelon,

ComEd, PECO and Generation and to issue letters of credit.

The 364-day agreement includes a term-out option provision

that allows a borrower to extend the maturity of revolving

credit borrowings outstanding at the end of the 364-day

period for one year.

At December 31, 2003, aggregate sublimits under the

credit agreements were $1.0 billion, $100 million, $150 mil-

lion and $250 million for Exelon Corporate, ComEd, PECO,

and Generation, respectively. Sublimits under the credit

agreements can change upon written notification to the

bank group. Exelon Corporate, ComEd, PECO and Generation

had approximately $955 million, $80 million, $148 million

and $170 million of unused bank commitments under the

credit agreements, respectively, at December 31, 2003. At

December 31, 2003, commercial paper outstanding was $280

million and $46 million at Exelon Corporate and PECO, re-

spectively. ComEd and Generation did not have any

commercial paper outstanding at December 31, 2003. Inter-

est rates on the advances under the credit facility are based

on either the London Interbank Offering Rate (LIBOR) or

prime plus an adder based on the credit rating of the bor-

rower as well as the total outstanding amounts under the

agreement at the time of borrowing. The maximum adder

would be 175 basis points.

The credit agreements require Exelon Corporate, ComEd,

PECO and Generation to maintain a minimum cash from

operations to interest expense ratio for the twelve-month

period ended on the last day of any quarter. The ratios ex-

clude revenues and interest expenses attributable to

securitization debt, certain changes in working capital, dis-

tributions on preferred securities of subsidiaries and, in the

case of Exelon Corporate and Generation, revenues from Ex-

elon New England and interest on the debt of Exelon New

England’s project subsidiaries. Exelon Corporate is measured

at the Exelon consolidated level. At December 31, 2003,

Exelon Corporate, ComEd, PECO and Generation were in

compliance with the credit agreement thresholds. The

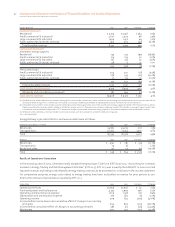

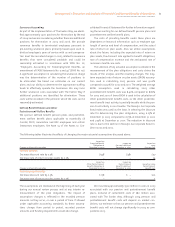

following table summarizes the minimum thresholds re-

flected in the credit agreement for the twelve-month period

ended December 31, 2003:

Exelon

Corporate ComEd PECO Generation

Credit agreement

threshold 2.65 to 1 2.25 to 1 2.25 to 1 3.25 to 1

At December 31, 2003, our capital structure consisted of 62%

of long-term debt, including long-term debt to financing

trusts, 35% common equity, 3% notes payable and less than

1% preferred securities of subsidiaries. Total debt included

$6.2 billion owed to unconsolidated affiliates of ComEd and

PECO that qualify as special purpose entities under FIN No.

46-R. These special purpose entities were created for the sole

purpose of issuing debt obligations to securitize intangible

transition property and CTCs of Energy Delivery or manda-

torily redeemable preferred securities. See Note 1 of the

Notes to Consolidated Financial Statements for further in-

formation regarding FIN No. 46-R.

Boston Generating Project Debt

Boston Generating has a $1.25 billion credit facility (Boston

Generating Facility), which was entered into primarily to fi-

nance the development and construction of the Mystic 8 and

9 and Fore River generating facilities. Approximately $1.0 bil-

lion of debt was outstanding under the credit facility at De-

cember 31, 2003, all of which was reflected in our

Consolidated Balance Sheet as a current liability due to cer-

tain events of default described below. The Boston Generat-

ing Facility is non-recourse to us and an event of default

under the Boston Generating Facility does not constitute an

event of default under any other of our debt instruments or

the debt instruments of our subsidiaries.

The Boston Generating Facility required that all of the

projects achieve “Project Completion,” as defined in the

Boston Generating Facility (Project Completion) by July 12,

2003. Project Completion was not achieved by July 12, 2003,

resulting in an event of default under the Boston Generating

Facility. Mystic 8 and 9 and Fore River have begun commer-

cial operation, although they have not yet achieved Project

Completion.

We have commenced the process of an orderly transition

out of the ownership of Boston Generating and the Mystic 8

and 9 and Fore River generating projects. Our decision to

transition out of the projects was made as a result of our

evaluation of the projects and discussions with the lenders