ComEd 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

standards to safeguard the electric grid system control.

These standards are expected to be effective in 2004 and

fully implemented by January 2005. The gas industry,

through the American Gas Association, developed physical

security guidelines that were accepted by the U.S. Depart-

ment of Transportation. We participated in the development

of these guidelines and are using them as a model for our

security program.

Insurance. In addition to nuclear liability insurance, we also

carry property damage and liability insurance for our

properties and operations. As a result of significant changes

in the insurance marketplace, due in part to terrorist acts,

the available coverage and limits may be less than the

amount of insurance obtained in the past, and the recovery

for losses due to terrorist acts may be limited. We are self-

insured for deductibles and to the extent that any losses may

exceed the amount of insurance maintained.

A claim that exceeds the amounts available under our

property damage and liability insurance, together with the

deductible, would negatively affect our results of operations.

Nuclear Electric Insurance Limited (NEIL), a mutual insurance

company to which we belong, provides property and busi-

ness interruption insurance for our nuclear operations. In

recent years, NEIL has made distributions to its members.

Our distribution for 2003 was $32 million, which was re-

corded as a reduction to operating and maintenance ex-

penses in our Consolidated Statement of Income. We cannot

predict the level of future distributions or if they will con-

tinue at all.

We may incur substantial costs to fulfill our obligations re-

lated to environmental matters.

Our businesses are subject to extensive environmental regu-

lation by local, state and Federal authorities. These laws and

regulations affect the manner in which we conduct our

operations and make our capital expenditures. These regu-

lations affect how we handle air and water emissions and

solid waste disposal and are an important aspect of our

operations. In addition, we are subject to liability under

these laws for the costs of remediating environmental con-

tamination of property now or formerly owned by us and of

property contaminated by hazardous substances we gen-

erate. We believe that we have a responsible environmental

management and compliance program; however, we have

incurred and expect to incur significant costs related to

environmental compliance, site remediation and clean-up.

Remediation activities associated with manufactured gas

plant operations conducted by predecessor companies will

be one component of such costs. Also, we are currently in-

volved in a number of proceedings relating to sites where

hazardous substances have been deposited and may be sub-

ject to additional proceedings in the future.

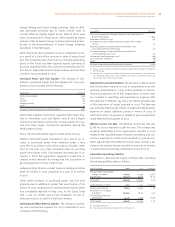

As of December 31, 2003, our reserve for environmental

investigation and remediation costs was $129 million, ex-

clusive of decommissioning liabilities. We have accrued and

will continue to accrue amounts that we believe are prudent

to cover these environmental liabilities, but we cannot pre-

dict with any certainty whether these amounts will be suffi-

cient to cover our environmental liabilities. We cannot

predict whether we will incur other significant liabilities for

any additional investigation and remediation costs at addi-

tional sites not currently identified by us, environmental

agencies or others, or whether such costs will be recoverable

from third parties.

Taxation has a significant impact on our results of operations.

Tax reserves and the recoverability of our deferred tax assets.

We are required to make judgments regarding the potential

tax effects of various financial transactions and our ongoing

operations to estimate our obligations to taxing authorities.

These tax obligations include income, real estate, use and

employment-related taxes and ongoing appeals related to

these tax matters. These judgments include reserves for po-

tential adverse outcomes regarding tax positions that we

have taken. We must also assess our ability to generate capi-

tal gains in future periods to realize tax benefits associated

with capital losses expected to be generated in future peri-

ods. Capital losses may be deducted only to the extent of

capital gains realized during the year of the loss or during

the three prior or five succeeding years. As of December 31,

2003, we have not recorded an allowance against our de-

ferred tax assets associated with impairment losses which

will become capital losses when realized for income tax pur-

poses. We believe these deferred tax assets will be realized in

future periods. The ultimate outcome of such matters could

result in adjustments to our consolidated financial state-

ments and such adjustments could be material.

Increases in state income taxes. Due to the revenue needs of

the states in which we operate, various state income tax and

fee increases have been proposed or are being contemplated.

We cannot predict whether legislation or regulation will be

introduced, the form of any legislation or regulation,

whether any such legislation or regulation will be passed by

the state legislatures or regulatory bodies, and, if enacted,

whether any such legislation or regulation would be effec-

tive retroactively or prospectively. If enacted, these changes

could increase our state income tax expense and could have

a negative impact on our results of operations and cash

flows.

The introduction of new technologies could increase competi-

tion within our markets.

While demand for electricity is generally increasing through-

out the United States, the rate of construction and develop-