ComEd 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

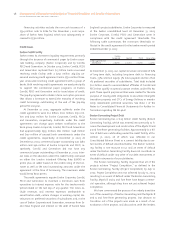

solidated affiliates of $16 million resulting from the dis-

continuance of losses on its investment in AT&T Wireless as a

result of its sale and $9 million resulting from the recovery of

trade receivables previously considered uncollectible from a

communications joint venture. The adoption of SFAS No. 142

reduced 2002 net income by $243 million, net of income tax-

es. See Note 1 of the Notes to Consolidated Financial State-

ments for further discussion of the adoption of SFAS No. 142.

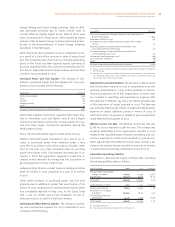

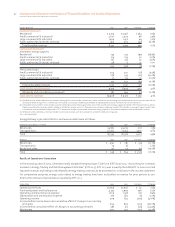

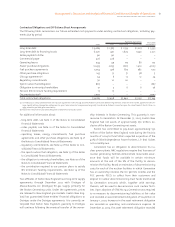

Operating Revenues. The changes in Enterprises’ operat-

ing revenues for 2002 compared to 2001 consisted of

the following:

Enterprises Variance

Exelon Energy Company $ (172)

Exelon Services (65)

InfraSource (20)

Other (2)

Decrease in operating revenues $(259)

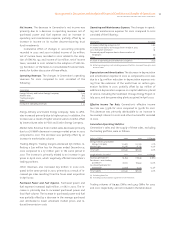

Exelon Energy Company. Operating revenues decreased $168

million at Exelon Energy Company due to the discontinuance

of retail sales in the PJM region and lower gas prices of $112

million in 2002. These decreases were partially offset by

higher electric sales of $74 million and increased customer

growth in the gas market of $33 million.

Exelon Services. Operating revenues decreased primarily as a

result of reduced construction projects.

InfraSource. Operating revenues decreased $117 million at

InfraSource as a result of the continued decline in the tele-

communications industry, partially offset by higher infra-

structure and construction services of $97 million from an

increase in the electric line of business.

Purchased Power and Fuel Expense. Purchased power and

fuel expense at Exelon Energy Company decreased due to

reduced costs from the discontinuance of retail sales in the

PJM region of $174 million, decreased fuel costs due to lower

gas prices of $115 million and $16 million from favorable im-

pacts of mark-to-market accounting relating to Northeast

operations. These decreases were partially offset by in-

creased electric costs of $72 million and increased gas costs

from customer growth of $32 million.

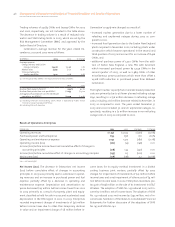

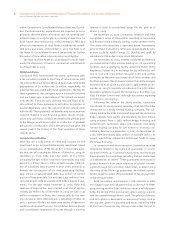

Operating and Maintenance Expense. The changes in Enter-

prises’ operating and maintenance expense for 2002 com-

pared to 2001 consisted of the following:

Enterprises Variance

Exelon Services $ (57)

InfraSource (43)

Exelon Energy Company (11)

Other 2

Decrease in operating and maintenance expense $(109)

Exelon Services. Operating and maintenance expense de-

creased $51 million at Exelon Services due to lower con-

struction costs and $2 million from general and

administrative cost reduction initiatives.

InfraSource. Operating and maintenance expense decreased

at InfraSource primarily due to lower construction costs as a

result of the decline of the telecommunications industry of

$80 million and $16 million from general and administrative

cost reduction initiatives, partially offset by higher infra-

structure and construction costs of $53 million.

Exelon Energy Company. Operating and maintenance ex-

pense decreased at Exelon Energy Company primarily due to

lower general and administrative costs from the dis-

continuance of retail sales in the PJM region.

Effective Income Tax Rate. The effective income tax rate was

50.4% for 2002 compared to 33.3% for 2001. This increase in

the effective tax rate was primarily attributable to the AT&T

Wireless sale and tax adjustments resulting from various

income tax related items of $21 million, partially offset by the

discontinuation of goodwill amortization as of January 1,

2002, which was not deductible for income tax purposes

in 2001.

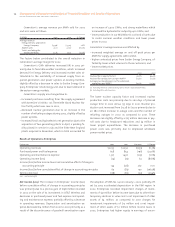

LIQUIDITY AND CAPITAL RESOURCES

Our businesses are capital intensive and require consid-

erable capital resources. These capital resources are primar-

ily provided by internally generated cash flows from Energy

Delivery and Generation’s operations. Our working capital

deficit is expected to be cured with our anticipated con-

tinuance of positive operating cash flows and the eventual

elimination of our Boston Generating debt balance upon the

transfer of our ownership of Boston Generating. We antici-

pate that the transfer of Boston Generating will be accom-

plished on a non-cash basis. When necessary, we obtain

funds from external sources in the capital markets and

through bank borrowings. Our access to external financing

at reasonable terms depends on our and our subsidiaries’

credit ratings and general business conditions, as well as

that of the utility industry in general. If these conditions

deteriorate to where we no longer have access to external

financing sources at reasonable terms, we have access to $1.5

billion through revolving credit facilities that we currently

utilize to support our commercial paper programs. See the

Credit Issues section of Liquidity and Capital Resources for

further discussion. We primarily use our capital resources to

fund capital requirements, including construction, to invest

in new and existing ventures, to repay maturing debt, to pay

common stock dividends and to fund our pension obliga-

tions. Future acquisitions that we may undertake may re-

quire external financing, which might include issuing our

common stock.