ComEd 2003 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

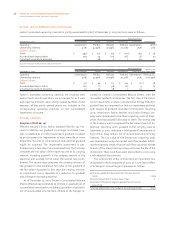

106 Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

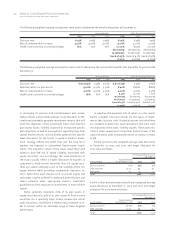

recorded income of $112 million (net of income taxes) as a

cumulative effect of a change in accounting principle in

connection with its adoption of this standard in the first

quarter of 2003. The components of the cumulative effect of

a change in accounting principle, net of income taxes, were

as follows:

Generation (net of income taxes of $52) $80

Generation’s investments in AmerGen and Sithe (net of

income taxes of $18) 28

ComEd (net of income taxes of $0) 5

Enterprises (net of income taxes of $(1)) (1)

Total $112

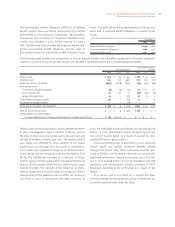

See Note 1—Significant Accounting Policies for net income

and earnings per common share for 2002 and 2001, adjusted

as if SFAS No. 143 had been applied effective January 1, 2001.

The cumulative effect of the change in accounting principle

in adopting SFAS No. 143 had no impact on PECO’s Con-

solidated Statements of Income.

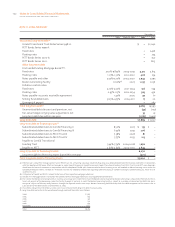

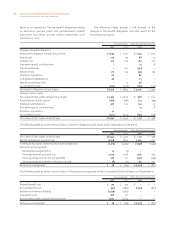

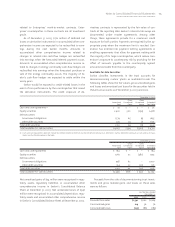

The asset retirement obligation (ARO) as of January 1,

2003 was determined under SFAS No. 143 to be $2,366 mil-

lion. The following table provides a reconciliation of the pre-

viously recorded liabilities for nuclear decommissioning to

the ARO reflected on the Consolidated Balance Sheets at

December 31, 2003 and 2002:

Accumulated depreciation $2,845

Nuclear decommissioning liability for retired units 1,293

Decommissioning obligation at December 31, 2002 4,138

Net reduction due to adoption of SFAS No. 143 1,772

Asset retirement obligation at January 1, 2003 2,366

Consolidation of AmerGen 487

Accretion expense 161

Expenditures to decommission retired plants (14)

Classification of Thermal ARO as held for sale (3)

Asset retirement obligation at December 31, 2003 $2,997

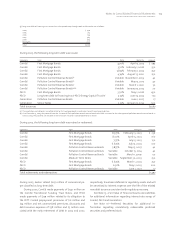

Determination of Asset Retirement Obligation

In accordance with SFAS No. 143, a probability-weighted, dis-

counted cash flow model with multiple scenarios was used

to determine the “fair value” of the decommissioning

obligation. SFAS No. 143 also stipulates that fair value repre-

sents the amount a third party would receive for assuming

an entity’s entire obligation.

The present value of future estimated cash flows was

calculated using credit-adjusted, risk-free rates applicable to

the various businesses in order to determine the fair value of

the decommissioning obligation at the time of adoption of

SFAS No. 143.

Significant changes in the assumptions underlying the

items discussed above could materially affect the balance

sheet amounts and future costs related to decommissioning

recorded in the consolidated financial statements.

Effect of Adopting SFAS No. 143

Exelon was required to re-measure the decommissioning

liabilities at fair value using the methodology prescribed by

SFAS No. 143. The transition provisions of SFAS No. 143 re-

quired Exelon to apply this re-measurement back to the his-

torical periods in which AROs were incurred, resulting in a

re-measurement of these obligations at the date the related

assets were acquired. Since the nuclear plants previously

owned by ComEd were acquired by Exelon on October 20,

2000 as a result of the Merger, Exelon’s historical accounting

for its ARO associated with those plants has been revised as

if SFAS No. 143 had been in effect at the Merger date.

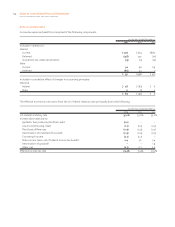

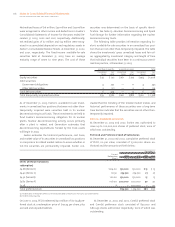

In the case of the former ComEd plants, the calculation of

the SFAS No. 143 ARO yielded decommissioning obligations

lower than the value of the corresponding trust assets at

January 1, 2003. ComEd has previously collected amounts

from customers (which were subsequently transferred to

Generation) in advance of Generation’s recognition of

decommissioning expense under SFAS No. 143. While it is

expected that the trust assets will ultimately be used en-

tirely for the decommissioning of the plants, the current

measurement required by SFAS No. 143 results in an excess

of assets over related ARO liabilities. As such, in accordance

with regulatory accounting practices and a December 2000

ICC Order, a regulatory liability of $948 million and a corre-

sponding receivable from Generation were recorded at

ComEd upon the adoption of SFAS No. 143. At December 31,

2003, the regulatory liability and corresponding receivable

from Generation was $1,183 million. Exelon believes that all

of the decommissioning assets, prospective earnings

thereon and up to $73 million of annual collections from

ComEd ratepayers through 2006 will be required to decom-

mission the former ComEd plants. Subsequent to 2006,

there will be no further recoveries of decommissioning costs

from customers of ComEd. Additionally, any surplus funds

after the nuclear stations are decommissioned must be re-

funded to customers. Exelon expects the regulatory liability

and ComEd’s corresponding receivable from Generation will

be reduced to zero at or before the conclusion of the

decommissioning of the former ComEd plants.

In the case of the former PECO plants, the SFAS No. 143

ARO calculation yielded decommissioning obligations

greater than the corresponding trust assets at January 1,

2003. As such, a regulatory asset of $20 million and a corre-

sponding payable to Generation were recorded upon adop-

tion of SFAS No. 143 at PECO. As a result of increases in the

trust funds due to market conditions and contributions col-

lected from PECO customers, at December 31, 2003, the trust

funds exceeded the ARO for the former PECO plants and thus

a regulatory liability of $12 million was recorded. Exelon be-

lieves that all of the decommissioning assets, prospective