ComEd 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

Severance Accounting

As part of the implementation of The Exelon Way, we identi-

fied approximately 1,500 positions for elimination by the end

of 2004 and we are considering whether there are additional

positions for elimination in 2005 and 2006. We provide

severance benefits to terminated employees pursuant to

pre-existing severance plans primarily based upon each in-

dividual employee’s years of service with us and compensa-

tion level. We recorded charges in 2003 related to severance

benefits that were considered probable and could be

reasonably estimated in accordance with SFAS No. 112,

“Employer’s Accounting for Postemployment Benefits, an

amendment of FASB Statements No. 5 and 43” (SFAS No. 112).

A significant assumption in calculating the severance charge

was the determination of the number of positions to

be eliminated. We based our estimates on our current

plans and our ability to determine the appropriate staffing

levels to effectively operate the businesses. We may incur

further severance costs associated with The Exelon Way if

additional positions are identified for elimination. These

costs will be recorded in the period in which the costs can be

reasonably estimated.

Defined Benefit Pension and Other

Postretirement Welfare Benefits

We sponsor defined benefit pension plans and postretire-

ment welfare benefit plans applicable to essentially all

ComEd, PECO, Generation and BSC employees and certain

Enterprises employees. See Note 14 of the Notes to Con-

solidated Financial Statement for further information regard-

ing the accounting for our defined benefit pension plans and

postretirement welfare benefit plans.

The costs of providing benefits under these plans are

dependent on historical information such as employee age,

length of service and level of compensation, and the actual

rate of return on plan assets. Also, we utilize assumptions

about the future, including the expected rate of return on

plan assets, the discount rate applied to benefit obligations,

rate of compensation increase and the anticipated rate of

increase in health care costs.

The selection of key actuarial assumptions utilized in the

measurement of the plan obligations and costs drives the

results of the analysis and the resulting charges. The long-

term expected rate of return on plan assets (EROA) assump-

tion used in calculating 2003 pension cost was 9.00%

compared to 9.50% for 2002 and 2001. The weighted average

EROA assumption used in calculating 2003 other

postretirement benefit costs was 8.40% compared to 8.80%

for 2002 and 2001. A lower EROA is used in the calculation of

other postretirement benefit costs, as the other postretire-

ment benefit trust activity is partially taxable while the pen-

sion trust activity is non-taxable. The Moody’s Aa Corporate

Bond Index was used as the basis in selecting the discount

rate for determining the plan obligations, using 6.25% at

December 31, 2003 compared to 6.75% at December 31, 2002

and 7.35% at December 31, 2001. The reduction in discount

rate is due to the decline in Moody’s Aa Corporate Bond In-

dex in 2003 and 2002.

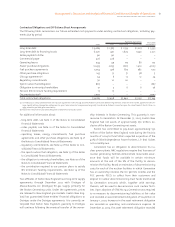

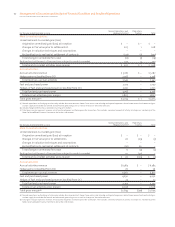

The following tables illustrate the effects of changing the major actuarial assumptions discussed above:

Change in Actuarial Assumption

Impact on

Projected Benefit

Obligation at

December 31, 2003

Impact on

Pension Liability at

December 31, 2003

Impact on

2004

Pension Cost

Pension benefits

Decrease discount rate by 0.5% $548 $481 $ 37

Decrease rate of return on plan assets by 0.5% – – 34

Change in Actuarial Assumption

Impact on

Other Postretirement

Benefit Obligation at

December 31, 2003

Impact on

Postretirement

Benefit Liability at

December 31, 2003

Impact on 2004

Postretirement

Benefit Cost

Postretirement benefits

Decrease discount rate by 0.5% $ 178 $ – $20

Decrease rate of return on plan assets by 0.5% – – 5

The assumptions are reviewed at the beginning of each year

during our annual review process and at any interim re-

measurement of the plan obligations. The impact of

assumption changes is reflected in the recorded pension

amounts as they occur, or over a period of time if allowed

under applicable accounting standards. As these assump-

tions change from period to period, recorded pension

amounts and funding requirements could also change.

We incurred approximately $320 million in costs in 2003

associated with our pension and postretirement benefit

plans, inclusive of curtailment costs of $80 million asso-

ciated with The Exelon Way. Although 2004 pension and

postretirement benefit costs will depend on market con-

ditions, our estimate is that our pension and postretirement

benefit costs will not change significantly in 2004 as com-

pared to 2003.