ComEd 2003 Annual Report Download - page 32

Download and view the complete annual report

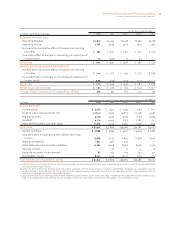

Please find page 32 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

service to customers in their service territories at fixed rates,

or in some instances, market-derived rates. In addition, cus-

tomers who take service from an alternative generation

supplier may later return to ComEd or PECO, provided, how-

ever, that under Illinois law, ComEd’s obligation to provide

generation may be eliminated over time if the ICC finds that

competitive supply options are available to certain classes of

customers. ComEd and PECO remain obligated to provide

transmission and distribution service to all customers

regardless of their generation suppliers. The number of

customers taking service from alternative generation

suppliers depends in part on the prices being offered by

those suppliers relative to the fixed prices that ComEd and

PECO are authorized to charge by their state regulatory

commissions. To the extent that customers leave traditional

bundled tariffs and select a different generation supplier,

Energy Delivery’s revenues are likely to decline, and our rev-

enues and gross margins could vary from period to period.

Energy Delivery continues to serve as the POLR for energy for

all customers in its service territories. Since ComEd and PECO

customers can “switch,” that is, within limits they can choose

an alternative generation supplier and then return to us and

then go back to an alternative supplier, and so on, planning

for Energy Delivery has a higher level of uncertainty than

that traditionally experienced due to weather and the

economy. Energy Delivery has no obligation to purchase

power reserves to cover the load served by others. We man-

age our POLR obligation through full-requirements contracts

with Generation, under which Generation supplies the

power requirements of ComEd and PECO.

ComEd has received ICC approval to phase out its obliga-

tion to provide fixed-price energy under bundled rates to

approximately 350 of its largest energy customers, which

ComEd believes partially mitigates its risk. These are

commercial and industrial customers, including heavy in-

dustrial plants, large office buildings, government facilities

and a variety of other businesses with demands of at least

three MWs representing an aggregate of approximately

2,500 MWs of load. These customers accounted for 10% of

ComEd’s 2003 MWh deliveries.

Weather affects electricity and gas usage and, consequently,

Energy Delivery’s results of operations.

Temperatures above normal levels in the summer tend to

further increase summer cooling electricity demand and

revenues, and temperatures below normal levels in the win-

ter tend to further increase winter heating electricity and

gas demand and revenues. Because of seasonal pricing

differentials, coupled with higher consumption levels, we

typically report higher revenues in the third quarter of our

fiscal year. However, extreme summer conditions or storms

may stress our transmission and distribution systems,

resulting in increased maintenance costs and limiting our

ability to meet peak customer demand. These extreme con-

ditions may have detrimental effects on our operations.

Economic conditions and activity in Energy Delivery’s service

territories directly affect the demand for electricity.

Higher levels of development and business activity generally

increase the number of customers and their average use of

energy. Periods of recessionary economic conditions may

adversely affect our results of operations. In the near term,

retail sales growth on an annual basis is expected to be 1.2%

and 1.3% in the service territories of ComEd and PECO,

respectively. Long-term retail sales growth for electricity is

expected to be 1.5% and 1.0% per year for ComEd and

PECO, respectively.

Energy Delivery’s business is affected by the restructuring of

the energy industry.

The electric utility industry in the United States is in tran-

sition. As a result of both legislative initiatives as well as

competitive pressures, the industry has been moving from a

fully regulated industry, consisting primarily of vertically in-

tegrated companies that combine generation, transmission

and distribution, to a partially restructured industry, consist-

ing of competitive wholesale generation markets and con-

tinued regulation of transmission and distribution. These

developments have been somewhat uneven across the states

as a result of the reaction to the problems experienced in Cal-

ifornia in 2000, the August Blackout and the publicized prob-

lems of some energy companies. Both Illinois and

Pennsylvania have adopted restructuring legislation de-

signed to foster competition in the retail sale of electricity. A

large number of states have not changed their regulatory

structures.

Regional Transmission Organizations and Standard Market

Platform. The FERC has required jurisdictional utilities to

provide open access to their transmission systems. It has also

sought the voluntary development of RTOs and the elimi-

nation of trade barriers between regions. The FERC also pro-

posed rulemakings to implement protocols to create a

standard wholesale market platform for the wholesale mar-

kets for energy and capacity. The RTO would become the

provider of the transmission service, and the transmission

owners would recover their revenue requirements through

it. The transmission owners would remain responsible for

maintaining and physically operating their transmission fa-

cilities. The wholesale market platform proposal would also

require RTOs to operate an organized bid-based wholesale

market for those who wish to sell their generation through

the market and to manage congestion on transmission lines

preferably by means of a financially based system known as

“locational marginal pricing.” FERC is likely to finalize its

wholesale market platform rule during 2004.