ComEd 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

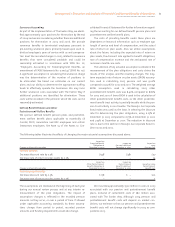

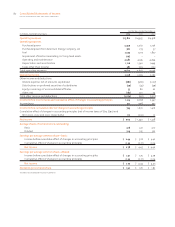

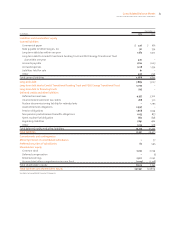

The table below provides details of effective cash-flow

hedges under SFAS No. 133 included in the balance sheet as

of December 31, 2003. The data in the table gives an in-

dication of the magnitude of SFAS No. 133 hedges Generation

has in place; however, since under SFAS No. 133 not all hedges

are recorded in OCI, the table does not provide an all-

encompassing picture of Generation’s hedges. The table also

includes a roll-forward of Accumulated Other Compre-

hensive Income related to cash-flow hedges for the years

ended December 31, 2003 and December 31, 2002, providing

insight into the drivers of the changes (new hedges entered

into during the period and changes in the value of existing

hedges). Information related to energy merchant activities is

presented separately from interest-rate hedging activities.

Total Cash-Flow Hedge Other Comprehensive Income Activity,

Net of Income Tax

Power Team

Normal Operations and

Hedging Activities

Interest-Rate and

Other Hedges(1)

Total Cash-

Flow Hedges

Accumulated OCI, January 1, 2002 $ 47 $ (2) $ 45

Changes in fair value (128) (3) (131)

Reclassifications from OCI to net income (33) – (33)

Accumulated OCI, December 31, 2002 (114) (5) (119)

Changes in fair value (186) (8) (194)

Reclassifications from OCI to net loss 167 – 167

Accumulated OCI derivative loss at December 31, 2003 $(133) $(13) $(146)

(1) Includes interest-rate hedges at Generation.

We use a Value-at-Risk (VaR) model to assess the market risk

associated with financial derivative instruments entered

into for proprietary trading purposes. The measured VaR

represents an estimate of the potential change in value of

our proprietary trading portfolio.

The VaR estimate includes a number of assumptions

about current market prices, estimates of volatility and

correlations between market factors. These estimates, how-

ever, are not necessarily indicative of actual results, which

may differ because actual market rate fluctuations may dif-

fer from forecasted fluctuations and because the portfolio

may change over the holding period.

We estimate VaR using a model based on the Monte

Carlo simulation of commodity prices that captures the

change in value of forward purchases and sales as well as

option values. Parameters and values are backtested daily

against daily changes in mark-to-market value for propri-

etary trading activity. Value-at-Risk assumes that normal

market conditions prevail and that there are no changes in

positions. We use a 95% confidence interval, one-day holding

period, one-tailed statistical measure in calculating our VaR.

This means that we may state that there is a one in 20

chance that, if prices move against our portfolio positions,

our pre-tax loss in liquidating our portfolio in a one-day

holding period would exceed the calculated VaR. To account

for unusual events and loss of liquidity, we use stress tests

and scenario analysis.

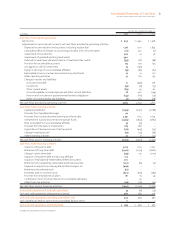

For financial reporting purposes only, we calculate sev-

eral other VaR estimates. The higher the confidence interval,

the less likely the chance that the VaR estimate would be

exceeded. A longer holding period considers the effect of

liquidity in being able to actually liquidate the portfolio. A

two-tailed test considers potential upside in the portfolio in

addition to the potential downside in the portfolio consid-

ered in the one-tailed test. The following table provides the

VaR for all proprietary trading positions of Generation as of

December 31, 2003.

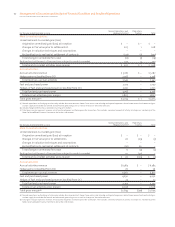

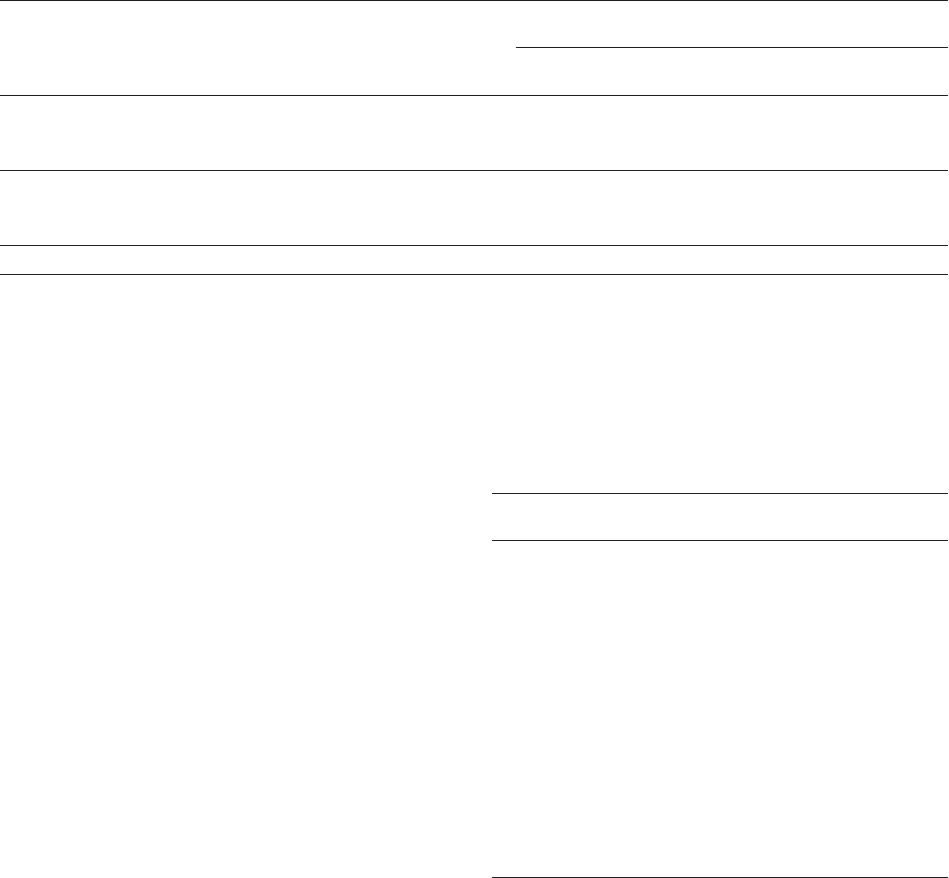

Proprietary Trading VaR

2003

95% Confidence level, one-day holding period, one-tailed

Period end $ –

Average for the period (0.1)

High (0.2)

Low –

95% Confidence level, ten-day holding period, two-tailed

Period end $ (0.1)

Average for the period (0.5)

High (0.9)

Low (0.1)

99% Confidence level, one-day holding period, two-tailed

Period end $ –

Average for the period (0.2)

High (0.3)

Low –

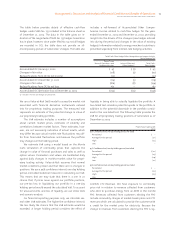

ComEd’s CTC Revenues. We have exposure to commodity

price risk in relation to revenue collected from customers

who elect to purchase energy from an ARES or the ComEd

PPO. Revenues collected from customers electing the PPO

include commodity charges at market-based prices and CTC

revenues which are calculated to provide the customer with

a credit for the market price for electricity. Because the

change in revenues from customers electing the PPO is sig-