ComEd 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

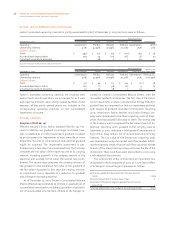

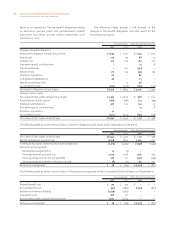

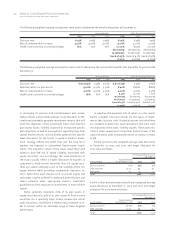

The tax effects of temporary differences giving rise to

significant portions of Exelon’s deferred tax assets

and liabilities as of December 31, 2003 and 2002 are pre-

sented below:

2003 2002

Deferred tax liabilities:

Plant basis difference $ 3,932 $ 3,647

Stranded cost recovery 1,784 1,923

Deferred investment tax credits 288 301

Deferred debt refinancing costs 69 96

Total deferred tax liabilities 6,073 5,967

Deferred tax assets:

Deferred pension and postretirement obligations (901) (911)

Excess of tax value over book value of impaired assets(a) (501) –

Decommissioning and decontamination obligations (97) (607)

Unrealized loss on derivative financial instruments (70) (60)

Goodwill (29) (95)

Other, net (304) (297)

Total deferred tax assets (1,902) (1,970)

Deferred income tax liabilities (net) on the Consolidated Balance Sheets $ 4,171 $ 3,997

(a) Includes impairments related to Exelon’s investments in Sithe and Boston Generating and write-downs of certain Enterprises investments.

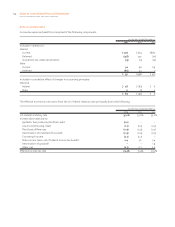

In accordance with regulatory treatment of certain tempo-

rary differences, Exelon has recorded a net regulatory asset

associated with deferred income taxes, pursuant to SFAS No.

71 and SFAS No. 109, “Accounting for Income Taxes,” (SFAS

No. 109) of $701 million and $661 million at December 31,

2003 and 2002, respectively. See Note 20 - Supplemental

Financial Information for further discussion of Exelon’s regu-

latory asset associated with deferred income taxes.

ComEd and PECO have certain tax returns that are under

review at the audit or appeals level of the IRS and certain

state authorities. These reviews by the governmental taxing

authorities are not expected to have an adverse impact on

the financial condition or result of operations of Exelon.

ComEd has taken certain tax positions, which have been

disclosed to the IRS, to defer the tax gain on the 1999 sale of

its fossil generating assets. As of December 31, 2003 and

2002, a deferred tax liability of approximately $848 million

and $860 million, respectively, related to the fossil plant sale

is reflected in deferred income taxes on Exelon’s Con-

solidated Balance Sheets. ComEd’s management believes an

adequate reserve for interest has been established in the

event that such positions are not sustained. Changes in IRS

interpretations of existing tax authority or challenges to

ComEd’s positions could have the impact of accelerating

future income tax payments and increasing interest expense

above amounts reserved related to the deferred tax gain that

becomes current. The Federal tax returns covering the period

of the 1999 fossil plant sale are expected to be under IRS au-

dit beginning in 2004. Final resolution of this matter is not

anticipated for several years.

As of December 31, 2003 and 2002, Exelon had recorded

valuation allowances of $22 million and $13 million, re-

spectively, with respect to deferred taxes associated with

separate company state taxes.

NOTE 13 ‰NUCLEAR DECOMMISSIONING

AND SPENT FUEL STORAGE

Nuclear Decommissioning

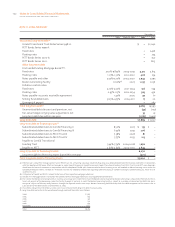

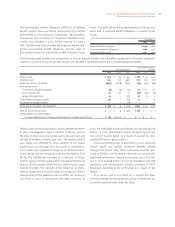

Exelon has an obligation to decommission its nuclear power

plants. Based on the extended license lives of the nuclear

plants, expenditures are expected to occur primarily during

the period 2029 through 2056. Exelon currently recovers

costs for decommissioning its nuclear generating stations,

excluding the AmerGen stations, through regulated rates.

See further discussion of AmerGen below. The amounts re-

covered from customers are deposited in trust accounts and

invested for funding of future decommissioning costs of

nuclear generating stations.

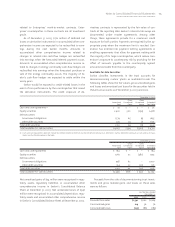

Exelon had decommissioning assets in trust accounts of

$4,721 million and $3,053 million as of December 31, 2003 and

2002, respectively, which are included as nuclear decom-

missioning trust funds on Exelon’s Consolidated Balance

Sheets. Exelon anticipates that all trust fund assets will

ultimately be used to decommission Exelon’s nuclear plants.

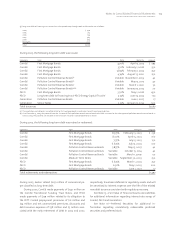

SFAS No. 143 provides accounting requirements for

retirement obligations (whether statutory, contractual or as

a result of principles of promissory estoppel) associated with

tangible long-lived assets. Exelon adopted SFAS No. 143 as of

January 1, 2003. After considering interpretations of the

transitional guidance included in SFAS No. 143, Exelon

105