ComEd 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

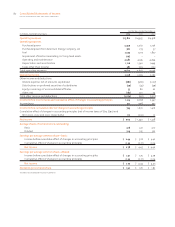

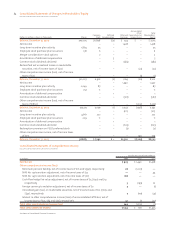

cussion of Exelon’s stock-compensation plans. The table be-

low shows the effect on net income and earnings per share

had Exelon elected to account for its stock-based compensa-

tion plans using the fair-value method under SFAS No. 123 for

the years ended December 31, 2003, 2002 and 2001:

2003 2002 2001

Net income–as reported $ 905 $1,440 $1,428

Deduct: Total stock-based

compensation expense determined

under fair-value method for all

awards, net of income taxes 20 33 26

Pro forma net income $ 885 $1,407 $1,402

Earnings per share:

Basic–as reported $2.78 $ 4.47 $ 4.46

Basic–pro forma $2.72 $4.36 $4.38

Diluted–as reported $2.75 $ 4.44 $ 4.43

Diluted–pro forma $2.69 $4.33 $4.35

Income Taxes

Deferred Federal and state income taxes are provided on all

significant temporary differences between the book basis

and the tax basis of assets and liabilities and for tax benefits

carried forward. Investment tax credits previously utilized

for income tax purposes have been deferred on the Con-

solidated Balance Sheets and are recognized in book income

over the life of the related property. Pursuant to the Internal

Revenue Code, Exelon files a consolidated Federal income tax

return that includes its subsidiaries in which it owns at least

80% of the outstanding stock. Income taxes are allocated to

each of Exelon’s subsidiaries included in the filing of the

consolidated Federal income tax return based on the sepa-

rate return method and records its income tax valuation al-

lowance by assessing which deferred tax assets are more

likely than not to be realized in the future (see Note 12 – In-

come Taxes).

Gains and Losses on Reacquired Debt

Recoverable gains and losses on reacquired debt related to

regulated operations are deferred and amortized to interest

expense over the life of new debt issued to finance the debt

redemption consistent with rate recovery for ratemaking

purposes. Gains and losses on other debt are recognized in

Exelon’s Consolidated Statements of Income as incurred (see

Note 20 – Supplemental Financial Information).

Comprehensive Income

Comprehensive income includes all changes in equity during

a period except those resulting from investments by and dis-

tributions to shareholders. Comprehensive income is re-

flected in the Consolidated Statements of Changes in

Shareholders’ Equity and the Consolidated Statements of

Comprehensive Income.

Cash and Cash Equivalents

Exelon considers all temporary cash investments purchased

with an original maturity of three months or less to be cash

equivalents.

Restricted Cash

As of December 31, 2003, restricted cash primarily represents

liquidated damages receipts at Generation and proceeds

from a ComEd pollution control bond offering in December

2003 which were applied to redeem pollution control bonds

that matured in January 2004. Prior to the adoption of FIN

No. 46-R, the restricted cash of ComEd Transitional Funding

Trust and PETT was included in Exelon’s Consolidated Bal-

ance Sheets. This restricted cash reflected escrowed cash to

be applied to the principal and interest payments on the

debt issued by the financing trusts.

Allowance for Doubtful Accounts

The allowance for doubtful accounts reflects Exelon’s best

estimate of probable losses inherent in the accounts receiv-

able balance. The allowance is based on known troubled ac-

counts, historical experience, and other currently available

evidence.

Inventories

Fossil Fuel. Fossil fuel inventory includes the weighted aver-

age cost of stored natural gas, coal, and oil. Fossil fuel also

includes propane at cost. PECO has several long-term storage

contracts as well as a liquefied natural gas facility.

Materials and Supplies. Materials and supplies inventory

generally includes the average costs of transmission, dis-

tribution and generating plant materials. Materials are gen-

erally charged to inventory when purchased and then

expensed or capitalized to plant, as appropriate, when in-

stalled.

Inventory is recorded at the lower of cost or market, and

provisions are made for obsolete inventory.

Emission Allowances

Emission allowances are included in inventories and de-

ferred debits and other assets and are carried at the lower of

cost or market and charged to fuel expense as they are used

in operations. Emission allowances can be used from the

years 2004 to 2028. As of December 31, 2003 and 2002, emis-

sion allowance balances were $105 million and $107 million,

respectively.

Marketable Securities

Marketable securities are classified as available-for-sale

securities and are reported at fair value. Unrealized gains

and losses, net of tax, on nuclear decommissioning trust

funds transferred to Generation from PECO and ComEd are

reflected in regulatory assets and liabilities on Exelon’s Con-

solidated Balance Sheets. Unrealized gains and losses on