ComEd 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

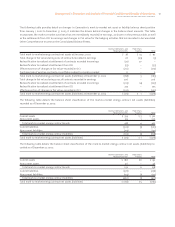

nificantly offset by the change in CTC revenues, we do not

believe that our exposure to such a market price decrease

would be material.

ComEd’s CTC revenues are also collected from customers

who elect to purchase energy from an ARES. ComEd’s CTC

rates are reset once a year in the spring, and customers can

elect to lock in their CTC rates for a one-, two- or three-year

term. Based on the current customers who have elected the

one-year CTC rates, we have performed a sensitivity analysis

to determine the net impact of a 10% increase in the average

market price of electricity which would result in a $14 million

decrease in CTC revenues. A 10% decrease in market prices

would result in a $14 million increase in CTC revenues. The

result may be significantly affected if additional customers

elect to purchase energy from an ARES or if customers elect

to purchase their energy from us.

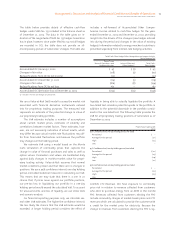

Credit Risk

Credit risk for Energy Delivery is managed by the credit

and collection policies of ComEd and PECO, which are con-

sistent with state regulatory requirements. ComEd and

PECO are each currently obligated to provide service to all

electric customers within their respective franchised terri-

tories. For the year ended December 31, 2003, ComEd’s ten

largest customers represented approximately 2% of its retail

electric revenues and PECO’s ten largest customers repre-

sented approximately 7% of its retail electric and gas rev-

enues. We record a provision for uncollectible accounts,

based upon historical experience and third-party studies,

to provide for the potential loss from nonpayment by these

customers.

Generation has credit risk associated with counterparty

performance on energy contracts which includes, but is not

limited to, the risk of financial default or slow payment.

Generation manages counterparty credit risk through estab-

lished policies, including counterparty credit limits, and in

some cases, requiring deposits and letters of credit to be

posted by certain counterparties. Generation’s counterparty

credit limits are based on a scoring model that considers a

variety of factors, including leverage, liquidity, profitability,

credit ratings and risk management capabilities. Generation

has entered into payment netting agreements or enabling

agreements that allow for payment netting with the ma-

jority of its large counterparties, which reduce Generation’s

exposure to counterparty risk by providing for the offset of

amounts payable to the counterparty against amounts

receivable from the counterparty.The credit department

monitors current and forward credit exposure to counter-

parties and their affiliates, both on an individual and an

aggregate basis.

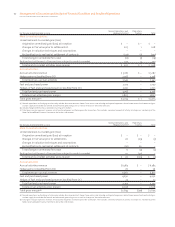

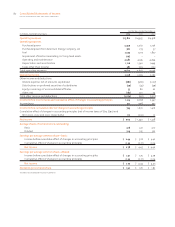

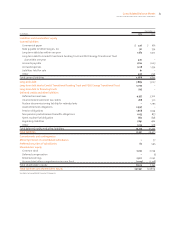

The following tables provide information on Gen-

eration’s credit exposure, net of collateral, as of December 31,

2003 and 2002. They further delineate that exposure by the

credit rating of the counterparties and provide guidance on

the concentration of credit risk to individual counterparties

and an indication of the maturity of a company’s credit risk

by credit rating of the counterparties. The figures in the ta-

bles below do not include sales to Generation’s affiliates or

exposure through ISOs which are discussed below.

Rating as of December 31, 2003

Total

Exposure

Before Credit

Collateral

Credit

Collateral

Net

Exposure

Number Of

Counterparties

Greater than 10%

of Net Exposure

Net Exposure Of

Counterparties

Greater than 10%

of Net Exposure

Investment grade $116 $– $116 1 $20

Non-investment grade 22 7 15 – –

No external ratings

Internally rated–investment grade 13 – 13 – –

Internally rated–non-investment grade 1 – 1 – –

Total $152 $7 $145 1 $20

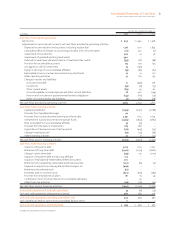

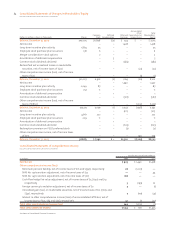

Rating as of December 31, 2002

Total

Exposure

Before Credit

Collateral

Credit

Collateral

Net

Exposure

Number Of

Counterparties

Greater th an 10%

of Net Exposure

Net Exposure Of

Counterparties

Greater than 10%

of Net Exposure

Investment grade $ 156 $ – $156 2 $ 71

Non-investment grade 17 11 6 – –

No external ratings

Internally rated–investment grade 27 4 23 4 16

Internally rated–non-investment grade 4 2 2 – –

Total $204 $17 $187 6 $87