ComEd 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

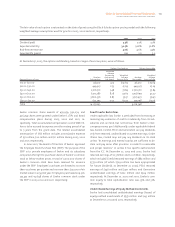

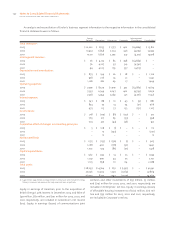

Supplemental Balance Sheet Information

December 31,

2003 2002

Investments

Direct financing leases $465 $ 445

Energy services and other ventures 170 177

Affordable housing projects 77 88

Investment in subsidiaries and joint ventures (a) 73 16

Investment in EXRES SHC, Inc. (b) 47 –

Investment in Sithe (b) –478

Investment in AmerGen (c) –160

Communication ventures 539

Total $ 837 $1,403

(a) Includes investments in financing trusts which were not consolidated within the

financial statements of Exelon at December 31, 2003 pursuant to the provisions of

FIN No. 46-R. See Note 1—Significant Accounting Policies for further discussion of

the effects of FIN No. 46-R.

(b) On November 25, 2003, Generation, Reservoir and Sithe completed a series of

transactions that restructured the ownership of Sithe, with Generation continuing

to own a 50% interest in Sithe through EXRES SHC, Inc. See Note 3—Sithe for fur-

ther information on these transactions.

(c) On December 22, 2003, Generation purchased British Energy’s 50% interest in

AmerGen. See Note 2—Acquisitions and Dispositions for further information.

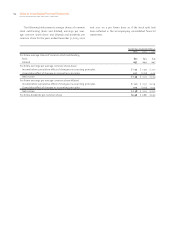

Prior to the Merger, Unicom entered into a like-kind ex-

change transaction pursuant to which approximately $1.6

billion was invested in passive generating station leases with

two separate entities unrelated to Exelon. The generating

stations were leased back to such entities as part of the

transaction. For financial accounting purposes, the invest-

ments are accounted for as direct financing lease invest-

ments. Unicom Investments, Inc. holds the leasehold

interests in the generating stations in several separate

bankruptcy remote, special purpose companies it directly or

indirectly wholly owns. Under the terms of the lease agree-

ments, Exelon received a prepayment of $1.2 billion in the

fourth quarter of 2000, which reduced the investment in the

lease. The remaining payments are payable at the end of the

thirty-year lease and there are no minimum scheduled lease

payments to be received over the next five years. The

components of the net investment in the direct financing

leases were as follows:

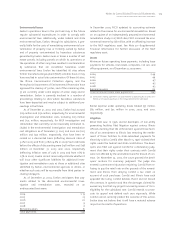

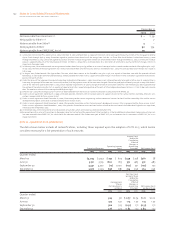

December 31,

2003 2002

Total minimum lease payments $1,492 $1,492

Less: unearned income 1,027 1,047

Net investment in direct financing leases $ 465 $ 445

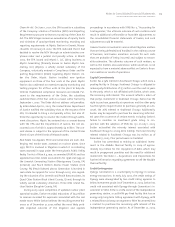

The following tables provide information about the regu-

latory assets and liabilities of ComEd and PECO as of De-

cember 31, 2003 and 2002.

December 31,

ComEd 2003 2002

Regulatory assets (liabilities)

Nuclear decommissioning $(1,183) $–

Removal costs (973) (933)

Reacquired debt costs and interest-rate swap

settlements 172 84

Recoverable transition costs 131 175

Deferred income taxes (61) (68)

Nuclear decommissioning costs for retired plants –248

Other 23 8

Total $(1,891) $(486)

December 31,

PECO 2003 2002

Regulatory assets

Competitive transition charges $4,303 $4,639

Deferred income taxes 762 729

Non-pension postretirement benefits 58 64

Reacquired debt costs 49 53

MGP regulatory asset 34 20

DOE facility decommissioning 26 32

Nuclear decommissioning (12) –

Other 69

Long-term regulatory assets 5,226 5,546

Deferred energy costs (current asset) 81 31

Total $5,307 $5,577

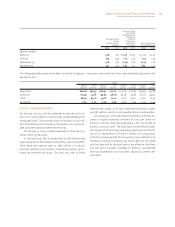

Nuclear Decommissioning Costs. These costs represent the

amount of future nuclear decommissioning costs that ex-

ceed (regulatory asset) or are less than (regulatory liability)

the associated decommissioning trust fund assets. ComEd

and PECO believe the trust fund assets including any future

collections from ratepayers will equal the associated future

decommissioning costs. See Note 13—Nuclear Decom-

missioning and Spent Fuel Storage.

Removal Costs. These amounts represent funds received

from ratepayers to cover the future removal of property,

plant and equipment. See Note 6—Property, Plant and

Equipment for further information.

Reacquired Debt Costs and Interest-Rate Swaps. The re-

acquired debt costs represent premiums paid for the early

extinguishment and refinancing of long-term debt, which is

amortized over the life of the new debt issued to finance the

debt redemption. Interest-rate swap settlements are de-

ferred and amortized over the period that the related debt is

outstanding.

Recoverable Transition Costs. These charges, related to the

recovery of ComEd’s former generating plants, are amortized