ComEd 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

subject to change at the time the impairment charge was

recorded. We utilized a discount rate based upon valuations

of the business developed at the purchase date. A change in

our assumptions, including estimated cash flows and the

discount rate, could have had a significant impact on the

amount of the impairment charge recorded.

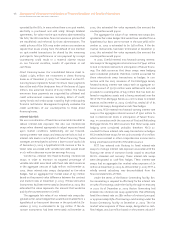

In 2003, we recorded impairment charges totaling $255

million (before income taxes) associated with a decline in

the fair value of Generation’s investment in Sithe. In reach-

ing that decision, we considered various factors, including

negotiations to sell our investment in Sithe, which indicated

an other-than-temporary decline in fair value.

In 2003, we recorded impairment charges related to in-

vestments held by Enterprises of approximately $54 million

(before income taxes). We had determined that an other-

than-temporary decline in the fair value of these invest-

ments had occurred and considered various factors in our

decision to record an impairment of the investments, includ-

ing recent third-party valuations of the investments. The

other-than-temporary determination was significant be-

cause any increase in fair value of these investments will not

be recoverable until they are sold. Had we determined that

the impairment was temporary, no impairment charge

would have been recorded. The valuations of these invest-

ments, which formed the basis for the impairment charge,

required assumptions regarding the future earnings poten-

tial of these investments. Actual results from these invest-

ments have fluctuated in the past and are expected

to continue.

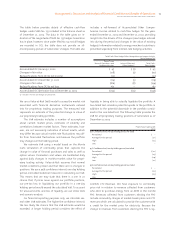

Goodwill. We have approximately $4.7 billion of goodwill

recorded at December 31, 2003, which relates entirely to the

ComEd goodwill within the Energy Delivery reporting unit.

As described below, we recorded charges of $72 million

(before income taxes) during 2003 to fully impair the good-

will that had been recorded within the Exelon Services and

InfraSource reporting units of our Enterprises segment. We

perform an assessment for impairment of our goodwill at

least annually, or more frequently, if events or circumstances

indicate that goodwill might be impaired. Application of the

goodwill impairment test requires judgment, including the

identification of reporting units, assigning assets and li-

abilities to reporting units, assigning goodwill to reporting

units, and determining the fair value of each reporting unit.

Energy Delivery. Our annual assessment of goodwill impair-

ment at the Energy Delivery reporting unit was performed as

of November 1, 2003 and this assessment determined that

goodwill was not impaired. In our assessment, to estimate

the fair value of the Energy Delivery reporting unit, we used

a probability-weighted, discounted cash flow model with

multiple scenarios. The determination of the fair value is

dependent on many sensitive, interrelated and uncertain

variables including changing interest rates, utility sector

market performance, ComEd’s capital structure, market

power prices, post-2006 rate regulatory structures, operat-

ing and capital expenditure requirements and other factors.

Changes in these variables or in how they interrelate could

result in a future impairment of goodwill at Energy Delivery,

which could be material. Based on Energy Delivery’s ex-

pected cash flows, we do not anticipate a goodwill impair-

ment at Exelon through the end of ComEd’s transition

period in 2006. However, a hypothetical decrease of approx-

imately 15% in Energy Delivery’s expected discounted cash

flows could trigger an impairment of goodwill.

Exelon Services and InfraSource. Our annual assessment of

goodwill impairment at the Exelon Services reporting unit

(within our Enterprises segment) was also performed as of

November 1, 2003. As we are actively negotiating to sell enti-

ties within the Exelon Services reporting unit, we used these

negotiations as the basis for the fair value of the Exelon Serv-

ices reporting unit used in Step I of the analysis. Our

assumptions regarding estimated sales prices are subject to

change as we continue to negotiate these transactions.

The first step of the annual impairment analysis, compar-

ing the fair value of a reporting unit to its carrying value, in-

cluding goodwill, indicated an impairment of the Exelon

Services goodwill. The second step of the analysis, which

compared the implied fair value of Exelon Services’ goodwill

to the carrying value, indicated that the total goodwill of

$24 million recorded at the Exelon Services reporting unit

was impaired.

Due to the sale of certain of our InfraSource businesses,

we performed an interim assessment of the goodwill re-

corded at the InfraSource reporting unit during the second

quarter of 2003 and in advance of the annual assessment,

which would have been performed as of November 1. Based

upon this interim assessment, we recorded an impairment

charge of approximately $48 million (before minority inter-

est and income taxes) to fully impair this goodwill. We pri-

marily considered the negotiated sales price of InfraSource

in determining the need for an interim assessment and the

amount of the goodwill impairment charge.

We recorded our 2003 goodwill impairment charges re-

lated to the Exelon Services and InfraSource reporting units

as operating and maintenance expense within our Con-

solidated Statements of Income. As of December 31, 2003,

there was no goodwill recorded within our Consolidated

Balance Sheets related to the reporting units of the Enter-

prises segment.