ComEd 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

Taxation

We are required to make judgments regarding the potential

tax effects of various financial transactions and our ongoing

operations to estimate our obligations to taxing authorities.

These tax obligations include income, real estate, use and

employment-related taxes and ongoing appeals related to

these tax matters. These judgments include reserves for po-

tential adverse outcomes regarding tax positions that we

have taken. We must also assess our ability to generate capi-

tal gains in future periods to realize tax benefits associated

with capital losses expected to be generated in future peri-

ods. Capital losses may be deducted only to the extent of

capital gains realized during the year of the loss or during

the three prior or five succeeding years. As of December 31,

2003, we have not recorded an allowance against our de-

ferred tax assets associated with impairment losses which

will become capital losses when realized for income tax pur-

poses. We believe these deferred tax assets will be realized in

future periods. While we believe the resulting tax reserve

balances as of December 31, 2003 reflect the most likely

probable expected outcome of these tax matters in accord-

ance with SFAS No. 5, “Accounting for Contingencies,” and

SFAS No. 109, “Accounting for Income Taxes,” the ultimate

outcome of such matters could result in additional adjust-

ments to our consolidated financial statements and such

adjustments could be material.

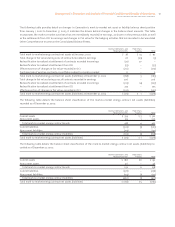

Unbilled Energy Revenues

Revenues related to the sale of energy are generally recorded

when service is rendered or energy is delivered to customers.

The determination of Energy Delivery and Exelon Energy

Company’s energy sales to individual customers, however, is

based on systematic readings of customer meters generally

on a monthly basis. At the end of each month, amounts of

energy delivered to customers during the month since the

date of the last meter reading are estimated, and

corresponding unbilled revenue is recorded. This unbilled

revenue is estimated each month based on daily customer

demand measured by generation or gas throughput volume,

estimated customer usage by class, estimated losses of en-

ergy during delivery to customers and applicable customer

rates. Customer accounts receivable as of December 31, 2003

included an estimate of $452 million for unbilled revenue as

a result of unread meters at Energy Delivery and Exelon En-

ergy Company. Increases in volumes delivered to the utilities’

customers in the period would increase unbilled revenue.

Changes in the timing of meter reading schedules and the

number and type of customers scheduled for each meter

reading date would also have an effect on the estimated

unbilled revenue; however, total operating revenues would

remain unchanged.

The determination of Generation’s energy sales is based

on estimated amounts delivered as well as fixed quantity

sales. At the end of each month, amounts of energy delivered

to customers during the month and corresponding unbilled

revenue are recorded.

Customer accounts receivable as of

December 31, 2003 include unbilled energy revenues of $366

million at Generation. Increases in volumes delivered to the

wholesale customers in the period would increase unbilled

revenue.

Environmental Costs

As of December 31, 2003, we had accrued liabilities of $129

million for environmental investigation and remediation

costs. These liabilities are based upon estimates with respect

to the number of sites for which we will be responsible, the

scope and cost of work to be performed at each site, the por-

tion of costs that will be shared with other parties and the

timing of the remediation work. Where timing and costs of

expenditures can be reliably estimated, amounts are dis-

counted. These amounts represent $105 million of the ac-

crued liabilities total above. Where timing and amounts

cannot be reliably estimated, amounts are recognized on an

undiscounted basis. Such amounts represent $24 million of

the accrued liabilities total above. Estimates can be affected

by the factors noted above as well as by changes in technol-

ogy, regulations or the requirements of local governmental

authorities.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK

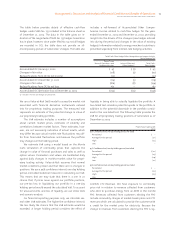

We are exposed to market risks associated with commodity

prices, credit, interest rates and equity prices. The inherent risk

in market-sensitive instruments and positions is the potential

loss arising from adverse changes in commodity prices,

counterparty credit, interest rates and equity security prices.

Our RMC sets forth risk management policy and objectives and

establishes procedures for risk assessment, control and valu-

ation, counterparty credit approval, and the monitoring and

reporting of derivative activity and risk exposures. The RMC is

chaired by the chief risk officer and includes the chief financial

officer, general counsel, treasurer, vice president of corporate

planning, vice president of strategy, vice president of audit

services and officers from each of the business units. The RMC

reports to the Exelon Board of Directors on the scope of our de-

rivative and risk management activities.

Commodity Price Risk

Commodity price risk is associated with market price move-

ments resulting from excess or insufficient generation,

changes in fuel costs, market liquidity and other factors.

Trading activities and non-trading marketing activities in-

clude the purchase and sale of electric capacity, energy and

fossil fuels, including oil, gas, coal and emission allowances.

The availability and prices of energy and energy-related

commodities are subject to fluctuations due to factors such