ComEd 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

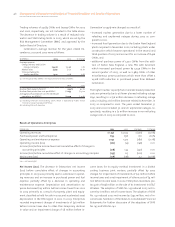

56 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

We are in the process of implementing its new business

model referred to as The Exelon Way. This business model is

focused on improving operating cash flows while meeting

service and financial commitments through integration

of operations and consolidation of support functions.

We have targeted approximately $300 million of annual

cash savings beginning in 2004 and increasing the annual

cash savings to $600 million in 2006.

As part of the implementation of The Exelon Way, we

identified approximately 1,500 positions for elimination by

the end of 2004 and recorded a charge for salary con-

tinuance severance of $130 million before income taxes dur-

ing 2003, which we anticipate that the majority will be paid

in 2004 and 2005. We are considering whether there are

additional positions to be eliminated in 2005 and 2006. We

may incur further severance costs associated with The Ex-

elon Way if additional positions are identified to be elimi-

nated. These costs will be recorded in the period in which the

costs can be reasonably estimated.

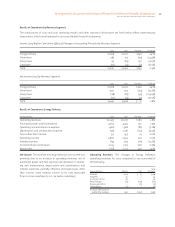

Cash Flows from Operating Activities

Energy Delivery’s cash flows from operating activities primar-

ily result from sales of electricity and gas to a stable and

diverse base of retail customers at fixed prices and are

weighted toward the third quarter. Energy Delivery’s future

cash flows will depend upon the ability to achieve cost sav-

ings in operations and the impact of the economy, weather,

customer choice and future regulatory proceedings on its

revenues. Generation’s cash flows from operating activities

primarily result from the sale of electric energy to wholesale

customers, including Energy Delivery and Enterprises. Gen-

eration’s future cash flows from operating activities will

depend upon future demand and market prices for energy

and the ability to continue to produce and supply power at

competitive costs.

Cash flows from operations have been and are expected

to continue to provide a reliable, steady source of cash flow,

sufficient to meet operating and capital expenditures re-

quirements for the foreseeable future. Operating cash flows

after 2006 could be negatively affected by changes in the

rate regulatory environments of ComEd and PECO, although

any effects are not expected to hinder our ability to fund our

business requirements. See Business Outlook and the Chal-

lenges in Managing our Business for further information

regarding the regulatory transition periods.

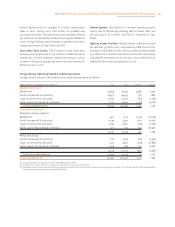

Cash flows provided by operations in 2003 and 2002

were $3.4 billion and $3.6 billion, respectively. Changes in our

cash flows provided by operations are generally consistent

with changes in our results of operations, and further ad-

justed by changes in working capital in the normal course of

business.

In addition to the items mentioned in Results of Oper-

ations, the following items affected our operating cash flows

in 2003 and 2002:

– Purchases of natural gas at higher prices as well as slightly

increased volumes during 2003 resulted in an increase in

natural gas inventories of $54 million at Generation and

PECO and an increase in deferred natural gas costs of $50

million at PECO, resulting in a reduction to operating cash

flows of $104 million. During 2002, changes in deferred

natural gas costs of $25 million and a decrease in natural

gas inventories during the year of $37 million, resulted in a

$62 million increase in operating cash flows.

– Discretionary tax-deductible pension plan payments of

$367 million in 2003 compared to $202 million in 2002.

Additionally, we contributed $134 million and $73 million

to the postretirement welfare benefit plans in 2003 and

2002, respectively.

We expect to contribute up to approximately $419 million to

our pension plans in 2004. These contributions exclude

benefit payments expected to be made directly from corpo-

rate assets. Of the $419 million expected to be contributed to

the pension plans during 2004, $17 million is estimated to be

needed to satisfy IRS minimum funding requirements.

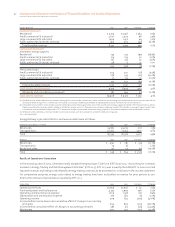

Cash Flows from Investing Activities

Cash flows used in investing activities in 2003 and 2002

were $2.1 billion and $2.6 billion, respectively. Cash used in

investing activities decreased from 2002 due to lower capital

expenditures of $288 million, net of liquidated damages re-

ceived during 2003 of $92 million, a reduction in cash used

to acquire businesses of $173 million, a net increase over

2002 in amounts contributed into the nuclear decom-

missioning trust funds of $11 million and a decrease from

2002 in the proceeds from the sale of businesses in the cur-

rent year of $24 million.

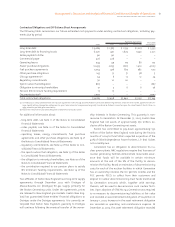

Capital expenditures by business segment for 2003 and

projected amounts for 2004 are as follows:

2003 2004

Energy Delivery $ 962 $ 855

Generation 953 972

Enterprises 14 1

Corporate and other 25 35

Total capital expenditures 1,954 1,863

Acquisition of businesses, net of cash

acquired 272 –

Total capital expenditures and acquisition of

businesses $2,226 $1,863