ComEd 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

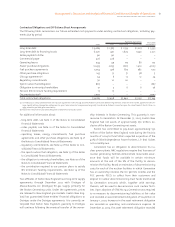

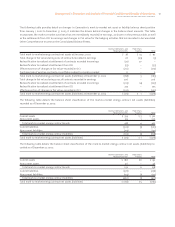

For the year ended December 31, 2003

Normal Operations and

Hedging Activities(a)

Proprietary

Trading Total

Mark-to-market activities:

Unrealized mark-to-market gain/(loss)

Origination unrealized gain/(loss) at inception $ – $ – $ –

Changes in fair value prior to settlements(b) 207 1 208

Changes in valuation techniques and assumptions – – –

Reclassification to realized at settlement of contracts (223) (4) (227)

Total change in unrealized fair value (16) (3) (19)

Realized net settlement of transactions subject to mark-to-market 223 4 227

Total mark-to-market activities gross margin $ 207 $ 1 $ 208

Accrual activities:

Accrual activities revenue $ 5,187 $ – $ 5,187

Hedge gains reclassified from OCI 2,358 – 2,358

Total revenue—accrual activities 7,545 – 7,545

Fuel and purchased power 2,107 – 2,107

Hedges of fuel and purchased power reclassified from OCI 2,631 – 2,631

Total fuel and purchased power 4,738 – 4,738

Total accrual activities gross margin 2,807 – 2,807

Total gross margin(c) $ 3,014 $ 1 $ 3,015

(a) Normal operations and hedging activities only include derivative contracts Power Team enters into to hedge anticipated exposures related to our owned and contracted gen-

eration supply, but excludes our owned and contracted generating assets as well as Enterprises’ derivative contracts.

(b) Includes hedge ineffectiveness, recorded in earnings of $1 million.

(c) Total gross margin represents revenue, net of purchased power and fuel expense for Generation. This excludes a minimal amount of activity at Enterprises. See Note 15 of the

Notes to Consolidated Financial Statements for further information.

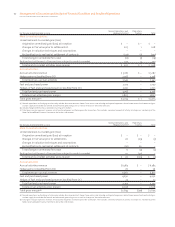

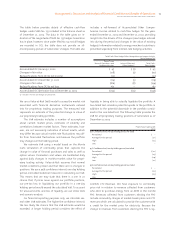

For the year ended December 31, 2002

Normal Operations and

Hedging Activities(a)

Proprietary

Trading Total

Mark-to-market activities:

Unrealized mark-to-market gain/(loss)

Origination unrealized gain/(loss) at inception $ – $ – $ –

Changes in fair value prior to settlements 26 (29) (3)

Changes in valuation techniques and assumptions – – –

Reclassification to realized at settlement of contracts (20) 20 –

Total change in unrealized fair value 6 (9) (3)

Realized net settlement of transactions subject to mark-to-market 20 (20) –

Total mark-to-market activities gross margin $ 26 $(29) $ (3)

Accrual activities:

Accrual activities revenue $ 6,785 $ – $ 6,785

Hedge gains reclassified from OCI 76 – 76

Total revenue—accrual activities 6,861 – 6,861

Fuel and purchased power 4,230 – 4,230

Hedges of fuel and purchased power reclassified from OCI 23 – 23

Total fuel and purchased power 4,253 – 4,253

Total accrual activities gross margin 2,608 – 2,608

Total gross margin(b) $ 2,634 $(29) $2,605

(a) Normal operations and hedging activities only include derivative contracts Power Team enters into to hedge anticipated exposures related to our owned and contracted gen-

eration supply, but excludes our owned and contracted generating assets as well as Enterprises’ derivative contracts.

(b) Total gross margin represents revenue, net of purchased power and fuel expense for Generation. This excludes a minimal amount of activity at Enterprises. See Note 15 of the

Notes to Consolidated Financial Statements for further information.