ComEd 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.109Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

of the agreement violates the NWPA and therefore is null

and void. The Court did not hold that the Amendment as a

whole is invalid. Article XVI(I) of the Amendment provides

that if any portion of the Amendment is found to be void, the

DOE and Generation agree to negotiate in good faith and

attempt to reach an enforceable agreement consistent with

the spirit and purpose of the Amendment. That provision

further provides that should a major term be declared void,

and the DOE and Generation cannot reach a subsequent

agreement, the entire Amendment would be rendered null

and void, the original Peach Bottom Standard Contract

would remain in effect and the parties would return to pre-

Amendment status. Pursuant to Article XVI(I), Generation

has begun negotiations with the DOE and those negotia-

tions are ongoing. Under the agreement, Generation has

received approximately $40 million in credits against con-

tributions to the nuclear waste fund.

On August 14, 2003, Generation received a letter from the

DOE demanding repayment of $40 million of previously re-

ceived credits from the Nuclear Waste Fund. The letter also

demanded $1.5 million of interest that was accrued as of that

date, and Exelon has continued to accrue interest expense

each subsequent month. Although a new settlement would

offset Generation’s payments, Generation nonetheless has

reserved its 50% ownership share of these amounts. Because

Generation expenses the dry storage casks and capitalizes

the permanent components of its spent fuel storage facili-

ties, these reserves increased Generation’s operating and

maintenance expense approximately $11 million and its

capital base approximately $9 million during 2003. The re-

mainder of the recorded obligation to the DOE will be recov-

ered from the co-owner of the facility.

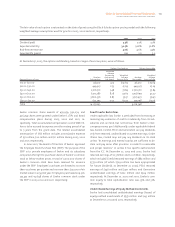

The Standard Contract with the DOE also required that

PECO and ComEd pay the DOE a one-time fee applicable to

nuclear generation through April 6, 1983. PECO’s fee has

been paid. Pursuant to the Standard Contract, ComEd

elected to pay the one-time fee of $277 million, with interest

to the date of payment, just prior to the first delivery of SNF

to the DOE. As of December 31, 2003, the unfunded liability

for the one-time fee with interest was $867 million. The li-

abilities for spent nuclear fuel disposal costs, including the

one-time fee, were transferred to Generation as part of the

corporate restructuring.

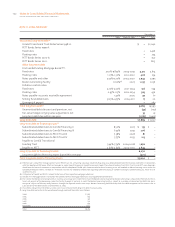

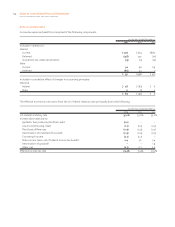

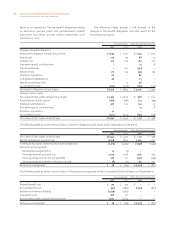

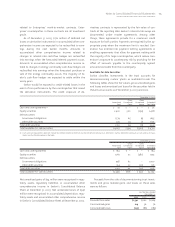

NOTE 14 ‰RETIREMENT BENEFITS

Exelon sponsors defined benefit pension plans and post-

retirement welfare benefit plans applicable to essentially all

ComEd, PECO, Generation and Exelon Business Services

Company (BSC) employees and certain employees of Enter-

prises. Essentially all management employees, and electing

union employees, hired on or after January 1, 2001 partic-

ipate in Exelon sponsored cash balance pension plans.

The defined benefit pension plans and postretirement

welfare benefit plans are accounted for in accordance with

SFAS No. 87, “Employer’s Accounting for Pensions” (SFAS No.

87) and SFAS No. 106, “Employers’ Accounting for

Postretirement Benefits Other than Pensions” (SFAS No. 106).

The costs of providing benefits under these plans are

dependent on historical information, such as employee age,

length of service and level of compensation, and the actual

rate of return on plan assets, in addition to assumptions

about the future, including the expected rate of return on

plan assets, the discount rate applied to benefit obligations,

rate of compensation increase and the anticipated rate of

increase in health care costs. The impact of changes in these

factors on pension and other postretirement welfare benefit

obligations is generally recognized over the expected

remaining service life of the employees rather than immedi-

ately recognized in the income statement. Exelon uses a

December 31 measurement date for the majority of its plans.

Funding is based upon actuarially determined con-

tributions that take into account the amount deductible for

income tax purposes and the minimum contribution re-

quired under the Employee Retirement Income Security Act

of 1974, as amended.

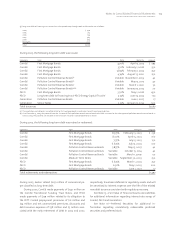

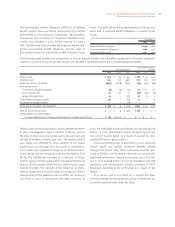

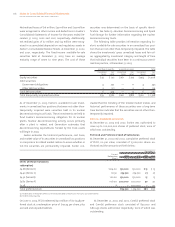

During 2003, Exelon announced an amendment related

to the benefit provisions of its postretirement welfare bene-

fit plans. The amendment was effective August 1, 2003 and

reduced the benefits attributable to prior service through

increased retiree cost-sharing for medical coverage. The

changes in the postretirement welfare plan design due to

the amendment were incorporated into the August 1, 2003

remeasurement of the plan obligation discussed below.

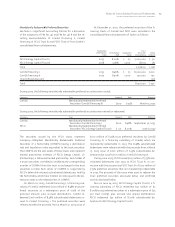

Due to The Exelon Way and an overall reduction in active

employees during 2003, certain defined benefit pension

plans and postretirement welfare benefit plans were subject

to curtailment accounting that resulted in a remeasurement

of the plan obligations as of August 1, 2003. The threshold

basis for curtailment remeasurement was a reduction in

future service greater than 5%. The net benefit obligations of

the pension plans and the postretirement welfare benefit

plans increased by $48 million and $27 million, respectively,

due to the curtailment.

The remeasurements of the plan obligations resulted in

accelerated recognition of a portion of the prior service cost

generated by the pension and postretirement benefit plans,

resulting in the recognition of curtailment charges in

operating and maintenance expense related to the pension

plans and other postretirement plans during 2003 of $59

million and $21 million, respectively.

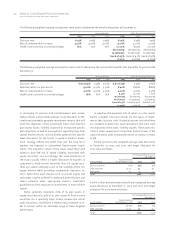

On December 22, 2003, Generation purchased British

Energy’s 50% interest in AmerGen, and as a result, the

obligations associated with AmerGen’s pension and post-

retirement welfare plans are reflected in the disclosures