ComEd 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

conditions, which may not have been fully anticipated, may

have an adverse effect by causing Generation to seek addi-

tional capacity at a time when wholesale markets are tight

or to seek to sell excess capacity at a time when those mar-

kets are weak. Generation incorporates contingencies into its

planning for extreme weather conditions, including poten-

tially reserving capacity to meet summer loads at levels rep-

resentative of warmer-than-normal weather conditions.

Excess capacity. Energy prices are also affected by the amount

of supply available in a region. In the markets where Gen-

eration sells power, there has been a significant increase in

the number of new power plants commencing commercial

operations which has driven down power prices over the last

few years. In fact, an excess supply situation currently exists

in many parts of the country which has reduced prices in the

wholesale markets and adversely affected Generation’s

profitability. We cannot predict when these regions will re-

turn to more normal levels in the supply-demand balance.

Generation’s business is also affected by the restructuring of

the energy industry.

Regional Transmission Organizations and Standard Market

Platform. Generation is dependent on wholesale energy

markets and open transmission access and rights by which

Generation delivers power to its wholesale customers,

including ComEd and PECO. Generation uses the wholesale

regional energy markets to sell power that Generation does

not need to satisfy its long-term contractual obligations, to

meet long-term obligations not provided by its own re-

sources and to take advantage of price opportunities.

Wholesale markets have only been implemented in cer-

tain areas of the country and each market has unique fea-

tures which may create trading barriers among the markets.

The FERC has proposed initiatives, including FERC Order No.

2000 and the proposed wholesale market platform rule, to

encourage the development of large regional, uniform mar-

kets and to eliminate trade barriers. These initiatives, how-

ever, have not yet led to the development of such markets in

all areas of the country. PJM’s and the New England markets

strongly resemble the FERC’s proposal, and the New York

Independent System Operator (ISO) is implementing market

reforms. We support the development of standardized en-

ergy markets and the FERC’s standardization efforts as being

essential to wholesale competition in the energy industry

and to Generation’s ability to compete on a national basis

and to meet its long-term contractual commitments

efficiently.

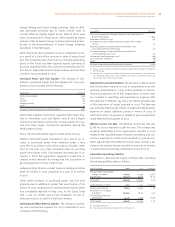

Approximately 27% of Generation’s generating re-

sources, which include directly owned assets and capacity

obtained through long-term contracts, are located in the re-

gion encompassed by PJM. If the PJM market is expanded to

the Midwest, 79% of Generation’s generating resources

would be located within that market. The PJM market has

been the most successful and liquid regional market. Our

future results of operations may be affected by the success-

ful expansion of that market to the Midwest and the im-

plementation of any market changes mandated by the FERC.

Provider of Last Resort. As discussed above, ComEd and PECO

each have POLR obligations that they have effectively trans-

ferred to Generation through full-requirements contracts.

Because the choice of electricity generation supplier lies

with the customer, planning to meet these obligations has a

higher level of uncertainty than that traditionally experi-

enced due to weather and the economy. It is difficult for

Generation to plan the energy demand of ComEd and PECO

customers. The uncertainty regarding the amount of ComEd

and PECO load for which Generation must prepare increases

our costs and may limit our sales opportunities. A significant

under-estimation of the electric-load requirements of

ComEd and PECO could result in Generation not having

enough power to cover its supply obligation, in which case

Generation would be required to buy power from third par-

ties or in the spot markets at prevailing market prices. Those

prices may not be as favorable or as manageable as Gen-

eration’s long-term supply expenses and thus could increase

our total costs.

Effective management of capital projects is important to

Generation’s business.

Generation’s business is capital intensive and requires sig-

nificant investments in energy generation and in other in-

ternal infrastructure projects. The inability of Generation to

effectively manage its capital projects could adversely affect

our results from operations.

In 2002, Generation purchased the assets of Sithe New

England Holdings, LLC (now known as Exelon New England),

a subsidiary of Sithe, and related power marketing oper-

ations. Due to the reduction in power prices and delays in

construction completion, in July 2003, we commenced the

process of an orderly transition out of the ownership of the

Boston Generating assets.

We recorded an impairment charge of $945 million be-

fore income taxes related to the long-lived assets of Boston

Generating as a result of our decision to exit these facilities.

Charges could result from decisions to exit other invest-

ments or projects in the future. These charges could have a

significant impact on our results of operations.

The interaction between our energy delivery and generation

businesses provides us a partial hedge of wholesale energy

market prices.

The price of power purchased and sold in the open wholesale

energy markets can vary significantly in response to market

conditions. The amounts of power that Generation provides