ComEd 2003 Annual Report Download - page 64

Download and view the complete annual report

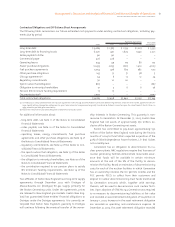

Please find page 64 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62 Management’s Discussion and Analysis of Financial Condition and Results of Operations

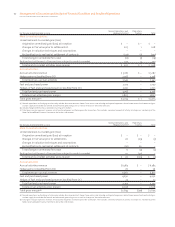

EXELON CORPORATION AND SUBSIDIARY COMPANIES

within Generation’s Consolidated Balance Sheet was $3.0 bil-

lion. Decommissioning expenditures are expected to occur

primarily after the plants are retired and are currently esti-

mated to begin in 2029 for plants currently in operation. To

fund future decommissioning costs, Generation held $4.7

billion of investments in trust funds, including net unreal-

ized gains and losses, at December 31, 2003. See Note 13 of

the Notes to Consolidated Financial Statements for further

discussion of Generation’s decommissioning obligation.

See Note 19 of the Notes to Consolidated Financial State-

ments for discussion of Exelon’s commercial commitments

as of December 31, 2003.

IRS Refund Claims

ComEd and PECO have entered into several agreements with

a tax consultant related to the filing of refund claims with

the Internal Revenue Service (IRS) and have made refundable

prepayments of $11 million and $5 million, respectively, for

potential fees associated with these agreements. The fees for

these agreements are contingent upon a successful outcome

and are based upon a percentage of the refunds recovered

from the IRS, if any. As such, ultimate net cash flows to Ex-

elon related to these agreements will either be positive or

neutral depending upon the outcome of the refund claim

with the IRS. These potential tax benefits and associated fees

could be material to our financial position, results of oper-

ations and cash flows. ComEd’s tax benefits for periods prior

to the Merger would be recorded as a reduction of goodwill

pursuant to a reallocation of the Merger purchase price. We

cannot predict the timing of the final resolution of these

refund claims.

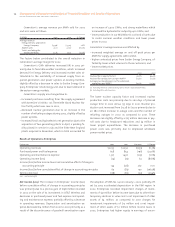

Variable Interest Entities

Sithe. We are a 50% owner of Sithe and account for the

investment as an unconsolidated equity investment. Based

on our interpretation of FIN No. 46-R, it is reasonably possi-

ble that we will consolidate Sithe as of March 31, 2004. At

December 31, 2003, Sithe had total assets of $1.5 billion

(including the $90 million note from Generation) and total

debt of $1.0 billion. The $1.0 billion of debt includes $588 mil-

lion of subsidiary debt incurred in prior years primarily to

finance the construction of six new generating facilities,

$419 million of subordinated debt, $43 million of current

portion of long-term debt, but excludes $469 million of non-

recourse project debt associated with Sithe’s equity invest-

ments. For the year ended December 31, 2003, Sithe had

revenues of $690 million and incurred a net loss of approx-

imately $72 million. As of December 31, 2003, we had a $47

million investment in Sithe. We contractually do not own

any interest in Sithe International, a subsidiary of Sithe. As

such, a portion of Sithe’s net assets and results of operations

would be eliminated from our Consolidated Balance Sheets

and Consolidated Statements of Income through a minority

interest if Sithe is consolidated under FIN No. 46-R as of

March 31, 2004.

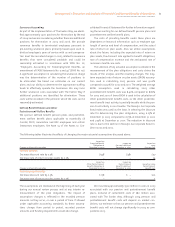

On November 25, 2003, Generation, Reservoir and Sithe

completed a series of transactions resulting in Generation

and Reservoir each indirectly owning a 50% interest in Sithe.

This series of transactions is described below. Immediately

prior to these transactions, Sithe was owned 49.9% by Gen-

eration, 35.2% by Apollo Energy, LLC (Apollo), and 14.9% by

subsidiaries of Marubeni Corporation (Marubeni).

On November 25, 2003, entities controlled by Reservoir

purchased certain Sithe entities holding six U.S. generating

facilities, each a qualifying facility under the Public Utility

Regulatory Policies Act, in exchange for $37 million ($21 mil-

lion in cash and a $16 million two-year note); and entities

controlled by Marubeni purchased all of Sithe’s entities and

facilities outside of North America (other than Sithe Energies

Australia (SEA) of which it purchased a 49% interest on No-

vember 24, 2003 for separate consideration) for $178 million.

Marubeni agreed to acquire the remaining 51 % of SEA in 90

days if a buyer is not found, although discussions regarding

an extension are ongoing.

Following the sales of the above entities, Generation

transferred its wholly owned subsidiary that held the Sithe

investment to a newly formed holding company. The sub-

sidiary holding the Sithe investment acquired the remaining

Sithe interests from Apollo and Marubeni for $612 million

using proceeds from a $580 million bridge financing and

available cash. Generation sold a 50% interest in the newly

formed holding company for $76 million to an entity con-

trolled by Reservoir on November 25, 2003. On November 26,

2003, Sithe distributed $580 million of available cash to its

parent, which then utilized the distributed funds to repay

the bridge financing.

In connection with this transaction, Generation recorded

obligations related to $39 million of guarantees in accord-

ance with FIN No. 45 “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees

of Indebtedness to Others”. These guarantees were issued to

protect Reservoir from credit exposure of certain counter-

parties through 2015 and other indemnities. In determining

the value of the FIN No. 45 guarantees, we utilized a proba-

bilistic model to assess the possibilities of future payments

under the guarantees.

Both Generation and Reservoir’s 50% interests in Sithe

are subject to put and call options that could result in either

party owning 100% of Sithe. While our intent is to fully divest

Sithe, the timing of the put and call options vary by acquirer

and can extend through March 2006. The pricing of the put

and call options is dependent on numerous factors, such as

the acquirer, date of acquisition and assets owned by Sithe

at the time of exercise. Any closing under either the put or