ComEd 2003 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

Environmental Issues

Exelon’s operations have in the past and may in the future

require substantial expenditures in order to comply with

environmental laws. Additionally, under Federal and state

environmental laws, Exelon, through its subsidiaries, is gen-

erally liable for the costs of remediating environmental con-

tamination of property now or formerly owned by Exelon

and of property contaminated by hazardous substances

generated by Exelon. Exelon owns or leases a number of real

estate parcels, including parcels on which its operations or

the operations of others may have resulted in contamination

by substances that are considered hazardous under

environmental laws. Exelon has identified 66 sites where

former manufactured gas plant (MGP) activities have or may

have resulted in actual site contamination. Of these 66 sites,

the Illinois Environmental Protection Agency and the

Pennsylvania Department of Environmental Protection have

approved the cleanup of 9 sites, and of the remaining sites,

57 are currently under some degree of active study and/or

remediation. Exelon is currently involved in a number of

proceedings relating to sites where hazardous substances

have been deposited and may be subject to additional pro-

ceedings in the future.

As of December 31, 2003 and 2002, Exelon had accrued

$129 million and $156 million, respectively, for environmental

investigation and remediation costs, including $105 million

and $125 million, respectively, for MGP investigation and

remediation that currently can be reasonably estimated. In-

cluded in the environmental investigation and remediation

cost obligations as of December 31, 2003 and 2002 are $105

million and $97 million, respectively, that have been re-

corded on a discounted basis (reflecting discount rates of

5.0% in 2003 and from 5.0% to 4.6% in 2002). Such estimates

before the effects of discounting were $138 million and $138

million at December 31, 2003 and 2002, respectively

(reflecting inflation rates of 2.5% in 2003 and from 1.6% to

2.5% in 2002). Exelon cannot reasonably estimate whether it

will incur other significant liabilities for additional inves-

tigation and remediation costs at these or additional sites

identified by Exelon, environmental agencies or others, or

whether such costs will be recoverable from third parties in-

cluding ratepayers.

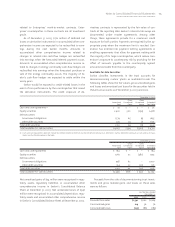

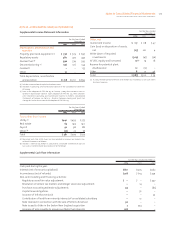

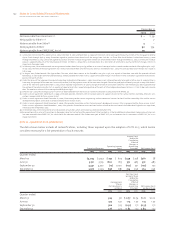

As of December 31, 2003, Exelon anticipates that pay-

ments related to the discounted environmental inves-

tigation and remediation costs, recorded on an

undiscounted basis were:

2004 $ 19

2005 23

2006 20

2007 9

2008 6

Remaining years 61

Total payments $138

In December 2003, PECO updated its accounting estimate

related to the reserve for environmental remediation. Based

on an update of an independently prepared environmental

remediation study on 27 MGP sites, PECO increased the envi-

ronmental reserve by $18 million, with an offsetting increase

to the MGP regulatory asset. See Note 20—Supplemental

Financial Information for further discussion of the MGP

regulatory asset.

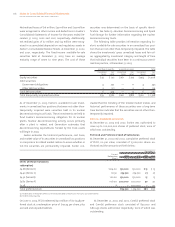

Leases

Minimum future operating lease payments, including lease

payments for vehicles, real estate, computers, rail cars and

office equipment, as of December 31, 2003 were:

2004 $ 49

2005 49

2006 47

2007 43

2008 43

Remaining years 512

Total minimum future lease payments(a) $743

(a) Generation’s tolling agreements are accounted for as operating leases and are re-

flected as net capacity purchases in the energy commitments table above.

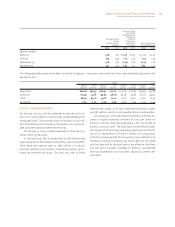

Rental expense under operating leases totaled $57 million,

$85 million, and $75 million in 2003, 2002, and 2001,

respectively.

Litigation

Retail Rate Law. In 1996, several developers of non-utility

generating facilities filed litigation against various Illinois

officials claiming that the enforcement against those facili-

ties of an amendment to Illinois law removing the entitle-

ment of those facilities to state-subsidized payments for

electricity sold to ComEd after March 15, 1996 violated their

rights under the Federal and state constitutions. The devel-

opers also filed suit against ComEd for a declaratory judg-

ment that their rights under their contracts with ComEd

were not affected by the amendment and for breach of con-

tract. On November 25, 2002, the court granted the devel-

opers’ motions for summary judgment. The judge also

entered a permanent injunction enjoining ComEd from re-

fusing to pay the retail rate on the grounds of the amend-

ment and Illinois from denying ComEd a tax credit on

account of such purchases. ComEd and Illinois have each

appealed the ruling. ComEd believes that it did not breach

the contracts in question and that the damages claimed far

exceed any loss that any project incurred by reason of its in-

eligibility for the subsidized rate. ComEd intends to prose-

cute its appeal and defend each case vigorously. While

ComEd cannot currently predict the outcome of this action,

Exelon does not believe that it will have a material adverse

impact on its results of operations.