ComEd 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

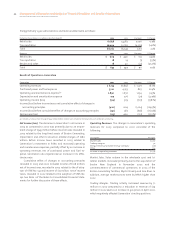

51Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

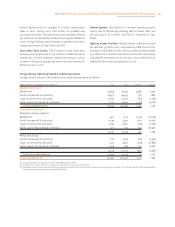

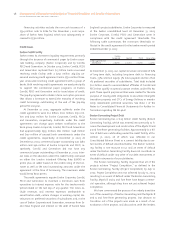

million decrease due to changes in ComEd’s depreciation

rates in 2002. During 2001, $126 million of goodwill was

amortized at ComEd. These decreases were partially offset by

$34 million of increased depreciation due to capital additions

across Energy Delivery and increased competitive transition

charge amortization of $37 million at PECO.

Taxes Other Than Income. The increase in taxes other than

income was primarily due to $72 million of additional gross

receipts tax at PECO related to additional revenues and an

increase in the gross receipts tax rate on electric revenue ef-

fective January 1, 2002.

Interest Expense. The reduction in interest expense was pri-

marily due to refinancing existing debt at lower rates and

the pay down of ComEd’s and PECO’s Transitional Trust

Notes.

Effective Income Tax Rate. Energy Delivery’s effective income

tax rate was 37.6% for 2002, compared to 40.8% for 2001. The

decrease in the effective tax rate was primarily attributable

to a reduction in state income taxes and the discontinuation

of goodwill amortization as of January 1, 2002, which was not

deductible for income tax purposes in 2001.

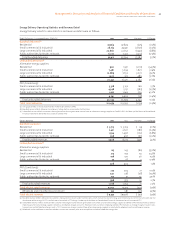

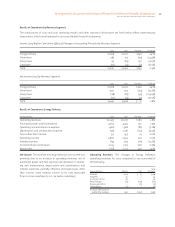

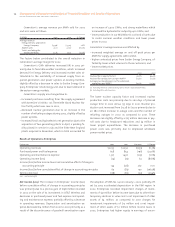

Energy Delivery Operating Statistics and Revenue Detail

Energy Delivery’s electric sales statistics and revenue detail were as follows:

Retail Deliveries—(in gigawatthours (GWhs))(a) 2002 2001 Variance % Change

Bundled deliveries(b)

Residential 37,839 33,355 4,484 13.4%

Small commercial & industrial 29,971 29,433 538 1.8%

Large commercial & industrial 22,652 23,265 (613) (2.6%)

Public authorities & electric railroads 7,332 8,645 (1,313) (15.2%)

Total bundled deliveries 97,794 94,698 3,096 3.3%

Unbundled deliveries(c)

Alternative energy suppliers

Residential 1,971 3,105 (1,134) (36.5%)

Small commercial & industrial 5,634 4,471 1,163 26.0%

Large commercial & industrial 7,652 7,810 (158) (2.0%)

Public authorities & electric railroads 913 372 541 145.4%

16,170 15,758 412 2.6%

PPO (ComEd only)

Small commercial & industrial 3,152 3,279 (127) (3.9%)

Large commercial & industrial 5,131 5,750 (619) (10.8%)

Public authorities & electric railroads 1,346 987 359 36.4%

9,629 10,016 (387) (3.9%)

Total unbundled deliveries 25,799 25,774 25 0.1%

Total retail deliveries 123,593 120,472 3,121 2.6%

(a) One gigawatthour is the equivalent of one million kilowatthours (kWh).

(b) Bundled service reflects deliveries to customers taking electric service under tariffed rates.

(c) Unbundled service reflects customers electing to receive electric generation service from an alternative energy supplier or ComEd’s PPO. See Note 4 of the Notes to Consolidated

Financial Statements for further discussion of ComEd’s PPO.