ComEd 2003 Annual Report Download - page 39

Download and view the complete annual report

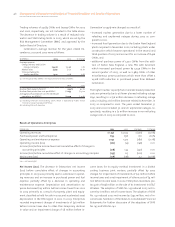

Please find page 39 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

we estimate the total costs and profits of the contract; if the

actual costs vary significantly from the estimates, our results

of operations will be adversely affected. Along with our abil-

ity to manage our projects, results may also be affected by

economic conditions, weather conditions, the inability to

attract and retain qualified management due to planned

divestiture of these businesses and the regulatory environ-

ment. In connection with the sale or wind down of certain

businesses of Enterprises in 2003, Enterprises has retained

risk of loss for certain long-term fixed-price contracts that

have been subcontracted to third parties. If unanticipated

losses are incurred on these contracts in future periods, our

results of operations may be adversely affected.

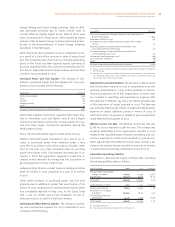

General Business

Our financial performance will be affected by our ability to

achieve the targeted cash savings under The Exelon Way

business model.

We have begun to implement The Exelon Way business

model, which is focused on improving operating cash flows

while meeting service and financial commitments through

improved integration of operations and consolidation of

support functions. Our targeted annual cash savings range

from approximately $300 million in 2004 to approximately

$600 million in 2006. We have incurred and are considering

whether there are additional expenses, including employee

severance costs, associated with reaching these annual cash

savings levels. Our targeted annual cash savings do not re-

flect any expenses that may be incurred in future periods.

Our inability to realize these annual cash savings levels in

the targeted timeframes could adversely affect our future

financial performance.

Our results of operations are affected by inflation.

Inflation affects us through increased operating costs and

increased capital costs for plant and equipment. As a result

of the rate freezes and caps under which our Energy Delivery

businesses operate and price pressures due to competition,

we may not be able to pass the costs of inflation through to

our customers.

Market performance affects our decommissioning trust funds

and benefit plan asset values.

The performance of the capital markets affects the values of

the assets that are held in trust to satisfy our future obliga-

tions under our pension and postretirement benefit plans

and to decommission our nuclear generation plants. We

have significant obligations in these areas and hold sig-

nificant assets in these trusts. A decline in the market value

of those assets, as was experienced from 2000 to 2002, may

increase our funding requirements of these obligations.

Regulations imposed by the Securities and Exchange Commis-

sion under the Public Utility Holding Company Act of 1935

affect our business operations.

We are subject to regulation by the Securities and Exchange

Commission (SEC) under PUHCA as a result of our ownership

of ComEd and PECO. That regulation affects our ability to:

– diversify, by generally restricting our investments to tradi-

tional electric and gas utility businesses and related

businesses;

– issue securities, by requiring the prior approval of the SEC

and for ComEd and PECO, requiring the approval of state

regulatory commissions;

– engage in transactions among our affiliates without the

SEC’s prior approval and, then, only at cost, since the

PUHCA regulates business between affiliates in a utility

holding company system; and

– make dividend payments in specified situations.

Our financial performance is affected by increasing costs asso-

ciated with additional security measures and obtaining ad-

equate liability insurance.

Security. We do not know the impact that future terrorist

attacks or threats of terrorism may have on our industry in

general and on us in particular. We have initiated security

measures to safeguard our employees and critical oper-

ations from threats of terrorism and are actively participat-

ing in industry initiatives to identify methods to maintain

the reliability of our energy production and delivery systems.

We fully expect to meet or exceed all NRC-mandated meas-

ures on or before the dates specified by requirements pro-

mulgated in 2003. These requirements will necessitate

additional security expenditures in 2004. Additionally, we

are in full compliance with all pre-2003 NRC security meas-

ures. On a continuing basis, we are evaluating enhanced

security measures at certain critical locations, enhanced re-

sponse and recovery plans and assessing long-term design

changes and redundancy measures. Additionally, the energy

industry is working with governmental authorities to ensure

that emergency plans are in place and critical infrastructure

vulnerabilities are addressed in order to maintain the reli-

ability of the country’s energy systems. These measures will

involve additional expense to develop and implement but

will provide increased assurances as to our ability to con-

tinue to operate under difficult times.

The electric and gas industries have also developed addi-

tional security guidelines as the result of various terrorist

attacks or threats of terrorism. The electric industry, through

the North American Electric Reliability Council, developed

physical security guidelines, which were accepted by the U.S.

Department of Energy. In 2003, the FERC issued minimum