ComEd 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36 Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

to ComEd and PECO vary from month to month; however,

delivery requirements are generally highest in the summer

when wholesale power prices are also generally highest.

Therefore, energy committed by Generation to serve ComEd

and PECO customers is not exposed to the price uncertainty

of the open wholesale energy market. Generally, between

60% and 70% of our generation supply serves ComEd and

PECO customers. Consequently, we have limited our earn-

ings exposure from the volatility of the wholesale energy

market to the energy generated in excess of the ComEd and

PECO requirements, as well as any other contracted longer

term obligations.

Our financial performance depends on our ability to respond

to competition in the energy industry.

As a result of industry restructuring, numerous generation

companies created by the disaggregation of vertically in-

tegrated utilities have become active in the wholesale power

generation business. In addition, independent power pro-

ducers (IPP) have become prevalent in the wholesale power

industry. In recent years, IPPs and the generation companies

of disaggregated utilities have installed new generating

capacity at a pace greater than the growth of elec-

tricity demand. These new generating facilities may be more

efficient than our facilities. The introduction of new tech-

nologies could increase competition, which could lower

prices and have an adverse effect on our results of oper-

ations or financial condition. Our financial performance

depends on our ability to respond to competition in the en-

ergy industry.

Power Team’s risk management policies cannot fully elimi-

nate the risk associated with its power trading activities.

Power Team’s power trading (including fuel procurement

and power marketing) activities expose us to risks of com-

modity price movements. We attempt to manage our ex-

posure through enforcement of established risk limits and

risk management procedures. These risk limits and risk

management procedures may not always be followed or

may not work as planned and cannot eliminate the risks

associated with these activities. Even when our policies and

procedures are followed, and decisions are made based on

projections and estimates of future performance, results of

operations may be diminished if the judgments and

assumptions underlying those decisions prove to be wrong

or inaccurate. Factors, such as future prices and demand for

power and other energy-related commodities, become more

difficult to predict and the calculations become less reliable

the further into the future estimates are made. As a result,

we cannot predict the impact that our power trading and

risk management decisions may have on our business, oper-

ating results or financial position.

Our results of operations may be affected by our ability to

strategically divest certain businesses.

We are actively pursuing opportunities to dispose of busi-

nesses, such as our investment in Sithe, which are either

unprofitable or do not advance our strategic goals. We may

incur significant costs in divesting these businesses. We also

may be unable to successfully implement our divestiture

strategy of certain businesses for a number of reasons, in-

cluding an inability to locate appropriate buyers or to nego-

tiate acceptable terms for the transactions. The inability to

divest certain businesses could negatively affect our results

of operations. In addition, the amounts that we may realize

from a divestiture are subject to fluctuating market con-

ditions that may contribute to pricing and other terms that

may be materially different than expected and could result

in losses on sales.

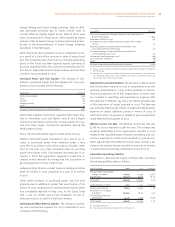

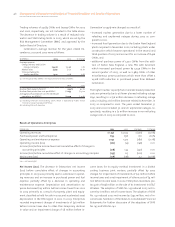

Enterprises

Enterprises is focused on maximizing the earnings and cash

flows of its investments and is not currently contemplating

any acquisitions. Enterprises expects to continue to divest

businesses that are not consistent with our strategic direc-

tion. This does not necessarily mean an immediate exit from

all Enterprises’ businesses, but rather, we may retain busi-

nesses for a period of time if we believe that this course of

action will increase their value.

Enterprises’ results of operations may be affected by its abil-

ity to strategically divest certain businesses.

Enterprises may be unable to successfully implement its di-

vestiture strategy of certain businesses for a number of rea-

sons, including an inability to locate appropriate buyers or to

negotiate acceptable terms for transactions. In addition, the

amount that Enterprises may realize from a divestiture is

subject to fluctuating market conditions that may contribute

to pricing and other terms that may be materially different

than expected and could result in losses on sales. Enterprises

also faces risks in managing these businesses prior to their

divestitures due to potential turnover of key employees and

operating the businesses through their transition.

Enterprises may incur further impairment charges.

Enterprises recorded impairment charges totaling $140 mil-

lion during 2003 associated with investments, goodwill and

other assets.

At December 31, 2003, Enterprises had total assets of $831

million, of which $214 million are under contract to be sold in

2004. Enterprises may incur further impairment charges in

connection with the ultimate disposition of these assets.

Enterprises’ results of operations may be affected by its abil-

ity to manage its projects.

Enterprises includes certain businesses that utilize long-

term fixed-price contracts. At the beginning of the contract,