ComEd 2003 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

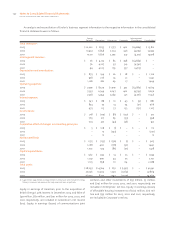

130 Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

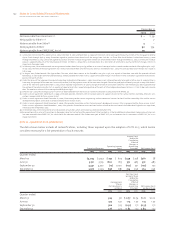

An analysis and reconciliation of Exelon’s business segment information to the respective information in the consolidated

financial statements were as follows:

Energy

Delivery Generation Enterprises Corporate

Intersegment

Eliminations Consolidated

Total revenues(1):

2003 $ 10,202 $ 8,135 $ 1,757 $ 402 $(4,684) $ 15,812

2002 10,457 6,858 2,033 346 (4,739) 14,955

2001 10,171 6,826 2,292 341 (4,712) 14,918

Intersegment revenues:

2003 $ 76 $ 4,125 $ 85 $ 398 $(4,684) $ –

2002 76 4,227 97 341 (4,741) –

2001 94 4,103 179 337 (4,713) –

Depreciation and amortization:

2003 $ 873 $ 199 $ 26 $ 28 $ – $ 1,126

2002 978 276 55 31 – 1,340

2001 1,081 282 69 17 – 1,449

Operating expenses:

2003 $ 7,579 $ 8,329 $ 1,919 $ 472 $(4,685) $ 13,614

2002 7,597 6,349 2,047 402 (4,739) 11,656

2001 7,578 5,954 2,369 371 (4,716) 11,556

Interest expense:

2003 $ 747 $ 88 $ 10 $ 45 $ (9) $ 881

2002 854 75 14 74 (51) 966

2001 973 115 37 133 (151) 1,107

Income taxes:

2003 $ 718 $ (179) $ (81) $ (127) $ – $ 331

2002 765 217 69 (53) – 998

2001 703 327 (43) (56) – 931

Cumulative effect of changes in accounting principles:

2003 $ 5 $ 108 $ (1) $ – $ – $ 112

2002 – 13 (243) – – (230)

2001 – 12 – – – 12

Net income/(loss):

2003 $ 1,175 $ (133) $ (136) $ (1) $ – $ 905

2002 1,268 400 (178) (50) – 1,440

2001 1,022 524 (85) (33) – 1,428

Capital expenditures:

2003 $ 962 $ 953 $ 14 $ 25 $ – $ 1,954

2002 1,041 990 44 75 – 2,150

2001 1,105 858 61 64 – 2,088

Total assets:

2003 $ 28,297 $ 14,764 $ 831 $ (1,951) $ – $ 41,941

2002 27,036 10,905 1,297 (1,369) – 37,869

2001 26,590 8,145 1,743 (1,509) – 34,969

(1) $439 million, $439 million and $373 million in utility taxes were included in Energy

Delivery’s revenues and expenses for 2003, 2002 and 2001, respectively.

Equity in earnings of AmerGen, prior to the acquisition of

British Energy’s 50% interest in December 2003, and Sithe of

$49 million, $87 million, and $90 million for 2003, 2002, and

2001, respectively, are included in Generation’s net income

(loss). Equity in earnings (losses) of communications joint

ventures and other investments of $(5) million, $3 million,

and $(19) million for 2003, 2002, and 2001, respectively, are

included in Enterprises’ net loss. Equity in earnings (losses)

of affordable housing investments of $(10) million, $(11) mil-

lion and $(9) million for 2003, 2002 and 2001, respectively,

are included in Corporate’s net loss.