ComEd 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXELON CORPORATION AND SUBSIDIARY COMPANIES

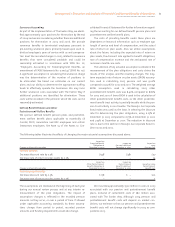

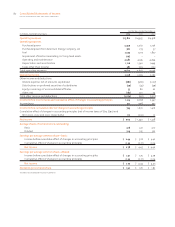

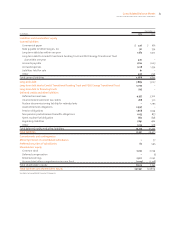

Maturity of Credit Risk Exposure

Rating as of December 31, 2003

Less than

2 Years 2-5 Years

Exposure

Greater than

5 Years

Total Exposure

Before Credit

Collateral

Investment grade $101 $15 $– $116

Non-investment grade 22 – – 22

No external ratings

Internally rated–investment grade 13 – – 13

Internally rated–non-investment grade 1 – – 1

Total $137 $15 $– $152

Dynegy. Generation is a counterparty to Dynegy in various

energy transactions. In early July 2002, the credit ratings of

Dynegy were downgraded to below investment grade by two

credit rating agencies. Generation has credit risk associated

with Dynegy through Generation’s equity investment in

Sithe. Sithe is a 60% owner of the Independence generating

station, a 1,028-MW gas-fired facility that has an energy-only

long-term tolling agreement with Dynegy, with a related

financial swap arrangement. Sithe has entered into a con-

tract to purchase the remaining 40% interest of the In-

dependence generating station. As of December 31, 2003,

Sithe had recognized an asset on its balance sheet related to

the fair market value of the financial swap agreement with

Dynegy that is marked-to-market under the terms of SFAS

No. 133. If Dynegy is unable to fulfill the terms of this agree-

ment, Sithe would be required to impair this financial swap

asset. We estimate, as a 50% owner of Sithe, that the

impairment would result in an after-tax reduction of our

equity earnings of approximately $5 million.

In addition to the impairment of the financial swap as-

set, if Dynegy were unable to fulfill its obligations under the

financial swap agreement and the tolling agreement, Sithe

would likely incur a further impairment associated with the

Independence plant. Depending upon the timing of Dyne-

gy’s failure to fulfill its obligations and the outcome of any

restructuring initiatives, Exelon could realize an after-tax

charge of up to $30 million, net of a FIN No. 45 guarantee

recorded in connection with Generation’s sale of 50% of

Sithe to Reservoir. In the event of a sale of Exelon’s invest-

ment in Sithe to a third party, proceeds from the sale could

be negatively affected by up to $74 million, which would rep-

resent an after-tax loss of up to $43 million. Additionally, the

future economic value of AmerGen’s purchased power ar-

rangement with Illinois Power Company, a subsidiary of

Dynegy, could be affected by events related to Dynegy’s

financial condition. On February 3, 2004, Dynergy announced

an agreement to sell its subsidiary Illinois Power Company to

a third party, which, upon closing of the transaction, would

reduce Generation’s credit risk associated with Dynergy.

Midwest Generation. ComEd and Generation are parties to

various transactions with Midwest Generation, a subsidiary

of Edison Mission Energy (EME) and Edison Mission Midwest

Holdings (EMMH). Although earlier public filings in 2003 by

EME indicated credit issues, a filing in December 2003 in-

dicated that EMMH has secured financing and re-paid its

significant current debts. Thus, Exelon’s credit contingency

risk associated with Midwest Generation has decreased dur-

ing the fourth quarter of 2003.

Collateral. As part of the normal course of business, we rou-

tinely enter into physical or financially settled contracts for

the purchase and sale of capacity, energy, fuels and emis-

sions allowances. These contracts either contain express

provisions or otherwise permit our counterparties and us to

demand adequate assurance of future performance when

there are reasonable grounds for doing so. In accordance

with the contracts and applicable law, if we are downgraded

by a credit rating agency, especially if such downgrade is to a

level below investment grade, it is possible that a counter-

party would attempt to rely on such a downgrade as a basis

for making a demand for adequate assurance of future per-

formance. Depending on our net position with a counter-

party, the demand could be for the posting of collateral. In

the absence of expressly agreed to provisions that specify the

collateral that must be provided, the obligation to supply the

collateral requested will be a function of the facts and cir-

cumstances of our situation at the time of the demand. If we

can reasonably claim that we are willing and financially able

to perform our obligations, it may be possible to successfully

argue that no collateral should be posted or that only an

amount equal to two or three months of future payments

should be sufficient.

ISOs. Generation participates in the following established,

real-time energy markets, which are administered by ISOs:

PJM, ISO New England, New York ISO, California ISO, Midwest

ISO, Inc., Southwest Power Pool, Inc. and Texas, which is ad-

ministered by the Electric Reliability Council of Texas. In

these areas, power is traded through bilateral agreements

between buyers and sellers and on the spot markets that are