ComEd 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

EXELON CORPORATION AND SUBSIDIARY COMPANIES

NOTE 09 ‰SEVERANCE ACCOUNTING

Exelon provides severance and health and welfare benefits

to terminated employees pursuant to pre-existing severance

plans primarily based upon each individual employee’s years

of service with Exelon and compensation level. Exelon ac-

counts for its ongoing severance plans in accordance with

SFAS No. 112, “Employer’s Accounting for Postemployment

Benefits, an amendment of FASB Statements No. 5 and 43”

(SFAS No. 112) and SFAS No. 88, “Employers’ Accounting for

Settlements and Curtailments of Defined Benefit Pension

Plans and for Termination Benefits” and accrues amounts

associated with severance benefits that are considered

probable and that can be reasonably estimated.

As part of the implementation of Exelon’s new business

model referred to as The Exelon Way during 2003, Exelon

identified approximately 1,500 positions for elimination by

the end of 2004. The majority of the headcount reductions

are professional and managerial employees. Exelon recorded

a charge for salary continuance severance of $130 million

(before income taxes) associated with The Exelon Way dur-

ing 2003, which represented salary continuance costs that

were probable and could be reasonably estimated as of

December 31, 2003. During 2003, Exelon recorded a charge of

$48 million (before income taxes) associated with special

health and welfare severance benefits offered through The

Exelon Way. In addition to salary continuance and health

and welfare severance benefits, Exelon incurred curtailment

costs associated with its pension and postretirement benefit

plans of $80 million as a result of personnel reductions due

to The Exelon Way. In total, Exelon recorded charges of $258

million (before income taxes) in 2003 associated with The

Exelon Way. See Note 14 – Retirement Benefits for a descrip-

tion of the curtailment charges related to the pension and

postretirement benefit plans.

Exelon based its estimate of the number of positions to be

eliminated on management’s current plans and its ability to

determine the appropriate staffing levels to effectively oper-

ate the businesses. Exelon may incur further severance costs

associated with The Exelon Way if additional positions are

identified for elimination. These costs will be recorded in the

period in which the costs can be first reasonably estimated.

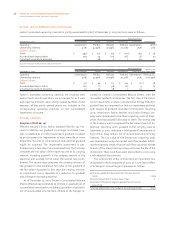

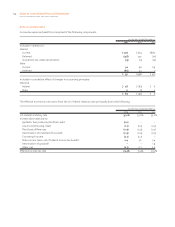

The following table details, by segment, Exelon’s total

salary continuance severance costs for the years ended

December 31, 2003, 2002 and 2001:

Salary continuance severance charges

Energy

Delivery Generation Enterprises

Corporate

and

Intersegment

Eliminations Consolidated

Costs recorded–2003(a) $77 $38 $9 $ 11 $135

Costs recorded–2002(b) – 2 (1) 7 8

Costs recorded–2001(b) –49 (6) 7

(a) Severance expense in 2003 reflects severance costs associated with The Exelon Way and other severance costs incurred in the normal course of business.

(b) Severance expense in 2002 and 2001 generally represents severance activity associated with the Merger and in the normal course of business.

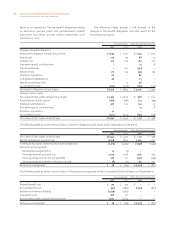

The following table provides a roll forward of Exelon’s salary

continuance severance obligation from January 1, 2002

through December 31, 2003. The salary continuance sev-

erance obligation as of January 1, 2002 and amounts paid in

2002 relate to severance associated with the Merger.

Salary continuance severance obligation

Balance as of January 1, 2002 $124

Severance charges recorded 8

Cash payments (78)

Other adjustments (15)

Balance as of January 1, 2003 39

Severance charges recorded 135

Cash payments (39)

Other adjustments 4

Balance as of December 31, 2003 $139

100