Clearwire 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

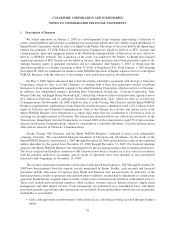

u

b

sequent Events —

W

eeva

l

uate

d

su

b

sequent events occurr

i

ng t

h

roug

h

t

h

e

d

ate t

h

e

fi

nanc

i

a

l

statements

w

ere

i

ssue

d.

C

as

h

an

d

Cas

h

Equiva

l

ent

s

—

Cas

h

equ

i

va

l

ents cons

i

st o

f

money mar

k

et mutua

lf

un

d

san

dhi

g

hl

y

li

qu

id

s

hort-term investments with ori

g

inal maturities of three months or less. Cash equivalents are stated at cost, whic

h

approximates market value. Cash and cash equivalents exclude cash that is contractually restricted for operationa

l

purposes. We ma

i

nta

i

n cas

h

an

d

cas

h

equ

i

va

l

ent

b

a

l

ances w

i

t

hfi

nanc

i

a

li

nst

i

tut

i

ons t

h

at excee

df

e

d

era

ll

y

i

nsure

d

li

m

i

ts. We

h

ave not exper

i

ence

d

an

yl

osses re

l

ate

d

to t

h

ese

b

a

l

ances, an

d

mana

g

ement

b

e

li

eves t

h

e cre

di

tr

i

s

k

related to these balances to be minimal.

Restricted

C

ash — Restricted cash consists primaril

y

of amounts we have set aside to satisf

y

certai

n

c

ontractual obligations and is classified as a current or noncurrent asset based on its designated purpose. The

m

a

j

or

i

t

y

o

f

t

hi

s restr

i

cte

d

cas

h

re

l

ates to outstan

di

n

gl

etters o

f

cre

di

t

.

I

nvestments

—

We

h

ave an

i

nvestment port

f

o

li

o compr

i

se

d

o

f

U.S. Treasur

i

es an

d

ot

h

er

d

e

b

t secur

i

t

i

es. T

he

value of these securities is sub

j

ect to market and credit volatilit

y

durin

g

the period the investments are held and until

their sale or maturit

y

. We classif

y

marketable debt securities as available-for-sale investments and these securities

are state

d

at t

h

e

i

r est

i

mate

df

a

i

rva

l

ue. Our

i

nvestments t

h

at are ava

il

a

bl

e

f

or current operat

i

ons are recor

d

e

d

a

s

s

hort-term investments when the ori

g

inal maturities are

g

reater than three months but remainin

g

maturities are less

than one

y

ear. Our investments with maturities of more than one

y

ear are recorded as lon

g

-term investments.

U

nrea

li

ze

d

ga

i

ns an

dl

osses are recor

d

e

d

w

i

t

hi

n accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome (

l

oss). Rea

li

ze

d

ga

i

n

s

an

dl

osses are measure

d

an

d

rec

l

ass

ifi

e

df

rom accumu

l

ate

d

ot

h

er com

p

re

h

ens

i

ve

i

ncome (

l

oss) on t

h

e

b

as

i

so

f

t

he

sp

ecific identification method

.

We reco

g

n

i

ze rea

li

ze

dl

osses w

h

en

d

ec

li

nes

i

nt

h

e

f

a

i

rva

l

ue o

f

our

i

nvestments

b

e

l

ow t

h

e

i

r cost

b

as

i

s are

judged to be other-than-temporary. In determining whether a decline in fair value is other-than-temporary, we

c

ons

id

er var

i

ous

f

actors

i

nc

l

u

di

ng mar

k

et pr

i

ce (w

h

en ava

il

a

bl

e),

i

nvestment rat

i

ngs, t

h

e

fi

nanc

i

a

l

con

di

t

i

on an

d

n

ear-term prospects o

f

t

h

e

i

ssuer, t

h

e

l

en

g

t

h

o

f

t

i

me an

d

t

h

e extent to w

hi

c

h

t

h

e

f

a

i

rva

l

ue

h

as

b

een

l

ess t

h

an t

h

e cost

basis, and our intent and abilit

y

to hold the investment until maturit

y

or for a period of time sufficient to allow fo

r

any ant

i

c

i

pate

d

recovery

i

n mar

k

et va

l

ue. We ma

k

es

i

gn

ifi

cant

j

u

d

gments

i

n cons

id

er

i

ng t

h

ese

f

actors. I

fi

t

i

s

j

u

d

ge

d

t

h

at a

d

ec

li

ne

i

n

f

a

i

rva

l

ue

i

sot

h

er-t

h

an-temporary, a rea

li

ze

dl

oss equa

l

to t

h

e

d

ec

li

ne

i

sre

fl

ecte

di

nt

h

e

c

onsolidated statement of o

p

erations, and a new cost basis in the investment is established.

We account for certain of our investments usin

g

the equit

y

method based on our ownership interest and ou

r

abilit

y

to exercise si

g

nificant influence. Accordin

g

l

y

, we record our investment initiall

y

at cost and we ad

j

ust the

c

arry

i

ng amount o

f

t

h

e

i

nvestment to recogn

i

ze our s

h

are o

f

t

h

e earn

i

ngs or

l

osses o

f

t

h

e

i

nvestee eac

h

report

i

n

g

p

er

i

o

d

. We cease to reco

g

n

i

ze

i

nvestee

l

osses w

h

en our

i

nvestment

b

as

i

s

i

s zero.

Fair Va

l

ue Measurement

s

—

Fa

i

rva

l

ue

i

st

h

e

p

r

i

ce t

h

at wou

ld b

e rece

i

ve

d

to se

ll

an asset or

p

a

id

to trans

f

er

a

liabilit

y

in an orderl

y

transaction between market participants at the measurement date. In determinin

g

fair value

,

we use various methods including market, cost and income approaches. Based on these approaches, we utilize

c

erta

i

n assumpt

i

ons t

h

at mar

k

et part

i

c

i

pants wou

ld

use

i

npr

i

c

i

n

g

t

h

e asset or

li

a

bili

t

y

,

i

nc

l

u

di

n

g

assumpt

i

ons a

b

out

ri

s

k

. Base

d

on t

h

eo

b

serva

bili

t

y

o

f

t

h

e

i

nputs use

di

nt

h

eva

l

uat

i

on tec

h

n

i

ques, we are requ

i

re

d

to prov

id

et

he

followin

g

information accordin

g

to the fair value hierarch

y

. The fair value hierarch

y

ranks the qualit

y

and reliabilit

y

o

f

t

h

e

i

n

f

ormat

i

on use

d

to

d

eterm

i

ne

f

a

i

r

v

a

l

ues. F

i

nanc

i

a

l

assets an

dfi

nanc

i

a

lli

a

bili

t

i

es carr

i

e

d

at

f

a

i

r

v

a

l

ue

will b

e

cl

ass

ifi

e

d

an

ddi

sc

l

ose

di

n one o

f

t

h

e

f

o

ll

ow

i

n

g

t

h

ree cate

g

or

i

es

:

L

eve

l

1: Quote

d

mar

k

et pr

i

ces

i

n act

i

ve mar

k

ets

f

or

id

ent

i

ca

l

assets or

li

a

bili

t

i

es

L

eve

l

2: O

b

serva

bl

e mar

k

et

b

ase

di

nputs or uno

b

serva

bl

e

i

nputs t

h

at are corro

b

orate

db

y mar

k

et

d

at

a

L

eve

l

3: Uno

b

serva

bl

e

i

nputs t

h

at are not corro

b

orate

db

y mar

k

et

d

at

a

84

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)