Clearwire 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

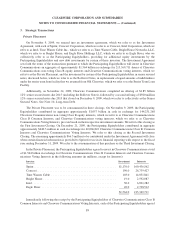

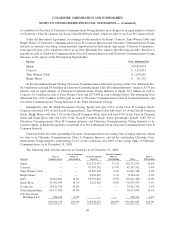

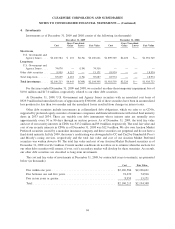

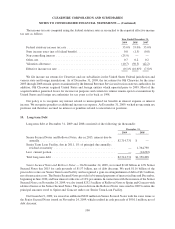

P

urc

h

ase cons

id

erat

i

on

w

as

b

ase

d

on t

h

e

f

a

i

r

v

a

l

ue o

f

t

h

e

Old Cl

ear

wi

re

Cl

ass A common stoc

k

as o

f

t

he

Closing, which had a closing price of

$

6.62 on November 28, 2008

.

T

he total purchase consideration to acquire Old Clearwire is approximatel

y$

1.12 billion, calculated as follows

(

in thousands, exce

p

t

p

er share amount):

N

umber of shares of Old Clearwire Class A common stock exchan

g

ed in the Transaction

s

......

1

6

4,48

4

C

l

os

i

ng pr

i

ce per s

h

are o

f

O

ld

C

l

earw

i

re C

l

ass A common stoc

k

.

........................

$

6

.

62

F

air value of Old Clearwire Class A common stock exchanged .......................... 1

,

088

,

88

4

F

air value adjustment for Old Clearwire stock options exchange

d

........................

3

8

,

01

4

F

air value ad

j

ustment for restricted stock units exchan

g

ed

..............................

1,39

8

F

air value ad

j

ustment for warrants exchan

g

e

d

.......................................

18

,

490

T

r

a

n

sactio

n

costs

............................................................

51,546

P

urc

h

ase cons

id

erat

i

on

f

or

Old Cl

ear

wi

re

b

e

f

ore sett

l

ement

l

oss

.........................

1,198,332

Less: net

l

oss

f

rom sett

l

ement o

f

pre-ex

i

st

i

ng re

l

at

i

ons

hi

p

s

.............................

(

80,573

)

P

urchase consideration for Old Clearwire ..........................................

$

1

,

117

,

75

9

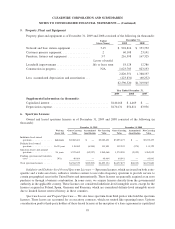

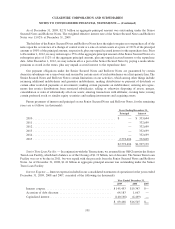

Purc

ha

se Price A

ll

oc

a

tio

n

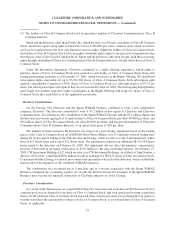

Th

e tota

l

purc

h

ase cons

id

erat

i

on was a

ll

ocate

d

to t

h

e respect

i

ve assets an

dli

a

bili

t

i

es

b

ase

d

upon t

h

e

ir

e

st

i

mate

df

a

i

rva

l

ues on t

h

e

d

ate o

f

t

h

eac

q

u

i

s

i

t

i

on. At t

h

e

d

ate o

f

ac

q

u

i

s

i

t

i

on, t

h

e est

i

mate

df

a

i

rva

l

ue o

f

t

h

ene

t

assets acquired exceeded the purchase price; therefore, no

g

oodwill is reflected in the purchase price allocation. Th

e

e

xcess of estimated fair value of net assets acquired over the purchase price was allocated to eligible non-curren

t

assets, spec

ifi

ca

lly

propert

y

,p

l

ant an

d

equ

i

pment, ot

h

er non-current assets an

di

ntan

gibl

e assets,

b

ase

d

upon t

h

e

ir

r

elative fair values

.

D

urin

g

2009, we finalized the allocation of the purchase consideration to the identifiable tan

g

ible an

d

i

ntangible assets acquired and liabilities assumed of Old Clearwire. In connection therewith, there was a reduction

i

n the amount allocated to consolidated property, plant and equipment of approximately

$

11.3 million, and a

c

orrespon

di

n

gi

ncrease

i

nt

h

e amount a

ll

ocate

d

to spectrum, pr

i

mar

ily b

ase

d

on t

h

e rece

i

pt o

f

a

ddi

t

i

ona

li

n

f

or

-

m

ation and final appraisal valuations. The followin

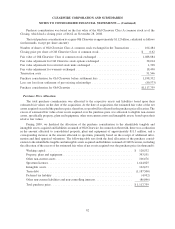

g

table sets forth the final allocation of the purchase consid-

e

ration to the identifiable tangible and intangible assets acquired and liabilities assumed of Old Clearwire, including

th

ea

ll

ocat

i

on o

f

t

h

e excess o

f

t

h

e est

i

mate

df

a

i

rva

l

ue o

f

net assets acqu

i

re

d

over t

h

e purc

h

ase pr

i

ce (

i

nt

h

ousan

d

s):

Wor

ki

ng cap

i

ta

l

.

....................................................

$

128

,

53

2

P

roperty, plant and equipmen

t

.

..........................................

3

93

,551

O

ther non-current assets

...............................................

106

,

676

Sp

ectrum license

s

....................................................

1,644,82

5

I

ntan

g

ible assets

.....................................................

122,

6

73

T

erm

d

e

bt

.........................................................

(1,187,500

)

D

e

f

erre

d

tax

li

a

bili

t

y

.................................................

(

4,952

)

O

t

h

er non-current

li

a

bili

t

i

es an

d

non-contro

lli

ng

i

nterest

s

.......................

(

8

6

,04

6)

T

otal purchase pric

e

.

.................................................

$

1

,

117

,

7

59

9

2

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)