Clearwire 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• prov

id

e reasona

bl

e assurance t

h

at transact

i

ons are recor

d

e

d

as necessary to perm

i

t preparat

i

on o

ffi

nanc

i

a

l

s

tatements in accordance with

g

enerall

y

accepted accountin

g

principles, and that receipts and expenditures

are being made only in accordance with authorization of our management and directors; and

• prov

id

e reasona

bl

e assurance re

g

ar

di

n

g

prevent

i

on or t

i

me

ly d

etect

i

on o

f

unaut

h

or

i

ze

d

acqu

i

s

i

t

i

on, use o

r

d

is

p

osition of our assets that could have a material effect on the financial statements

.

D

ue to

i

ts

i

n

h

erent

li

m

i

tat

i

ons,

i

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

ng may not prevent or

d

etect m

i

sstate-

m

ents. In addition, pro

j

ections of an

y

evaluation of effectiveness to future periods are sub

j

ect to the risk tha

t

c

ontrols ma

y

become inadequate because of chan

g

es in conditions or that the de

g

ree of compliance with the policies

or proce

d

ures may

d

eter

i

orate.

O

ur mana

g

ement, un

d

er t

h

e superv

i

s

i

on an

d

w

i

t

h

t

h

e part

i

c

i

pat

i

on o

f

our CEO an

d

CFO, assesse

d

t

he

e

ffectiveness of our internal control over financial reportin

g

as of December 31, 2009. In makin

g

this assessment,

our management use

d

t

h

ecr

i

ter

i

a

d

escr

ib

e

di

nt

h

e Interna

l

Contro

l

-Integrate

d

Framewor

ki

ssue

db

yt

h

e Comm

i

tte

e

o

f

Sponsor

i

n

g

Or

g

an

i

zat

i

ons o

f

t

h

e Trea

d

wa

y

Comm

i

ss

i

on

.

B

ase

d

on t

hi

s assessment, our management conc

l

u

d

e

d

t

h

at our

i

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

ng was

i

ne

ff

ect

i

ve as o

f

Decem

b

er 31

,

2009

,d

ue to a mater

i

a

l

wea

k

ness

d

escr

ib

e

db

e

l

ow. A mater

i

a

l

wea

k

ness

i

sa

d

e

fi

c

i

enc

y

, or com

bi

nat

i

on o

fd

e

fi

c

i

enc

i

es,

i

n

i

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

n

g

, suc

h

t

h

at t

h

ere

i

s

a

r

easonable possibility that a material misstatement of our annual or interim financial statements will not b

e

p

revented or detected on a timely basis.

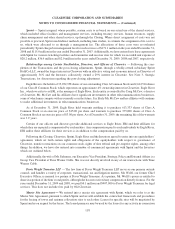

Mana

g

ement identified a material weakness durin

g

its assessment of internal control over financial reportin

g

r

elated to control deficiencies in procedures we implemented for recordin

g

and monitorin

g

the movement o

f

n

etwor

ki

n

f

rastructure equ

i

pment. Dur

i

ng t

h

et

hi

r

d

quarter o

f

2009, we

i

mp

l

emente

d

new proce

d

ures re

l

ate

d

to t

h

e

assembl

y

, shipment, and stora

g

e of network infrastructure equipment to improve flexibilit

y

in deplo

y

in

g

network

i

nfrastructure e

q

ui

p

ment in markets under develo

p

ment. We believed that these new

p

rocedures would im

p

rove ou

r

a

bili

ty to manage t

h

esu

b

stant

i

a

li

ncreases

i

nt

h

evo

l

ume o

f

networ

ki

n

f

rastructure equ

i

pment s

hi

pments necessary

t

o meet our networ

kd

ep

l

o

y

ment tar

g

ets. T

h

ese new proce

d

ures

i

nc

l

u

d

e

di

ncreas

i

n

g

t

h

e num

b

er o

f

ware

h

ouses

utilized for receivin

g

, storin

g

and shippin

g

equipment and outsourcin

g

the mana

g

ement of equipment inventor

y

m

ovements to third party vendors. However, the new procedures implemented did not adequately provide for th

e

ti

me

ly

up

d

at

i

n

g

an

d

ma

i

nta

i

n

i

n

g

o

f

account

i

n

g

recor

d

s

f

or t

h

e networ

ki

n

f

rastructure equ

i

pment. As a resu

l

t

,

m

ovements o

f

t

hi

s equ

i

pment were not proper

ly

recor

d

e

di

n our account

i

n

g

s

y

stem. Accor

di

n

gly

,

i

t

i

s reasona

bly

p

ossible that a material misstatement of our interim or annual financial statements may not be prevented or detecte

d

on a t

i

me

ly b

as

i

s

d

ue to t

h

ese contro

ld

e

fi

c

i

enc

i

es.

T

o provide reasonable assurance re

g

ardin

g

the reliabilit

y

of the financial statements included in this Annual

Report on Form 10-K, our management per

f

orme

d

ap

h

ys

i

ca

l

count o

f

our networ

ki

n

f

rastructure equ

i

pment near

th

een

d

o

f

t

h

e per

i

o

d

a

l

ong w

i

t

h

a

ddi

t

i

ona

l

ana

l

ys

i

san

d

ot

h

er proce

d

ures. To reme

d

yt

h

e mater

i

a

l

wea

k

ness, w

e

e

xpect to modif

y

our procedures for recordin

g

and monitorin

g

the movement of network infrastructure equipment.

These changes may include adding resources focused on transaction processing and enhancing transaction

p

rocess

i

ng systems. F

i

na

ll

y, our management p

l

ans to per

f

orm a

ddi

t

i

ona

l

p

h

ys

i

ca

l

counts o

f

equ

i

pment

d

ur

i

n

g

th

e

fi

rst

q

uarter o

f

2010.

T

he assessment of the effectiveness of our internal control over financial reportin

g

as of December 31, 200

9

h

as

b

een au

di

te

db

yDe

l

o

i

tte & Touc

h

e LLP, an

i

n

d

epen

d

ent reg

i

stere

d

pu

bli

c account

i

ng

fi

rm, as state

di

nt

h

e

ir

attestation re

p

ort, which is included in this Annual Re

p

ort on Form 10-K

.

C

hanges

i

n Internal

C

ontrol over F

i

nanc

i

al Report

i

n

g

O

ther than that described above under “Mana

g

ement’s Report on Internal Control over Financial Reportin

g

”

,

th

ere

h

ave

b

een no s

i

gn

ifi

cant c

h

anges

i

n our

i

nterna

l

contro

l

sover

fi

nanc

i

a

l

report

i

ng

d

ur

i

ng t

h

e year en

d

e

d

D

ecem

b

er 31, 2009 t

h

at

h

ave mater

i

a

ll

ya

ff

ecte

d

, or are reasona

bl

y

lik

e

l

y to mater

i

a

ll

ye

ff

ect, our

i

nterna

l

contro

l

over financial reportin

g

.

12

6