Clearwire 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

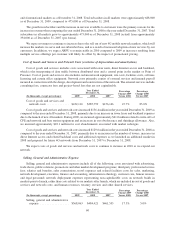

contractua

l

matur

i

ty o

f

30 mont

h

san

d

t

h

eun

d

er

l

y

i

ng

i

nterest rate was t

h

e LIBOR

l

oan

b

ase rate o

f

2

.7

5

percent, as the 3 month LIBOR rate in effect at the Closin

g

was less than the base rate, plus th

e

applicable margin. The calculation assumed an applicable margin of 6.00 percent and additional rate

i

ncreases as spec

ifi

e

di

nt

h

e Amen

d

e

d

Cre

di

t Agreement over t

h

e term o

f

t

h

e

l

oan. A one-e

i

g

h

t

h

p

ercenta

g

e chan

g

e in the interest rate would increase or decrease interest expense b

y

$1.6 million an

d

$

1.7 million for the years ended December 31, 2008 and 2007, respectively. Total interest expense on a

p

ro

f

orma

b

as

i

s

d

oes not

i

nc

l

u

d

eana

dj

ustment

f

or cap

i

ta

li

ze

di

nterest

.

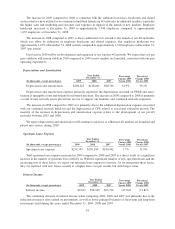

(i) Represents the ad

j

ustment to reflect the pro forma income tax expense for the

y

ears ended December 31,

2

008 an

d

2007, w

hi

c

h

was

d

eterm

i

ne

db

y comput

i

ng t

h

e pro

f

orma e

ff

ect

i

ve tax rates

f

or t

h

e years en

d

e

d

Decem

b

er 31, 2008 an

d

2007, g

i

v

i

ng e

ff

ect to t

h

e Transact

i

ons. C

l

earw

i

re expects to generate ne

t

o

peratin

g

losses into the foreseeable future and thus has recorded a valuation allowance for the deferre

d

t

ax assets not expected to be realized. Therefore, for years ended December 31, 2008 and 2007, no tax

b

ene

fi

t was recogn

i

ze

d

.

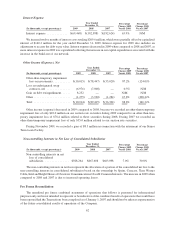

(

j

) Represents the allocation of a portion of the pro forma combined net loss to the non-controllin

g

interests

i

n conso

lid

ate

d

su

b

s

idi

ar

i

es

b

ase

d

on Spr

i

nt’s an

d

t

h

e Investors’ (ot

h

er t

h

an Goog

l

e) owners

hi

po

f

t

he

Cl

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests upon C

l

os

i

ng o

f

t

h

e Transact

i

ons an

d

re

fl

ects t

he

contributions b

y

CW Investment Holdin

g

s LLC and the Investors at $17.00 per share followin

g

th

e

post-closing adjustment. This adjustment is based on pre-tax loss since income tax consequences

a

ssoc

i

ate

d

w

i

t

h

any

l

oss a

ll

ocate

d

to t

h

eC

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests w

ill

b

e

i

ncurre

ddi

rect

ly by

Spr

i

nt an

d

t

h

e Investors (ot

h

er t

h

an Goo

gl

e) an

d

CW Investment Ho

ldi

n

g

s LLC.

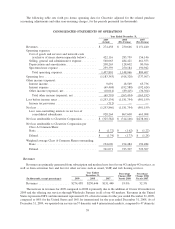

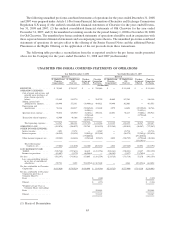

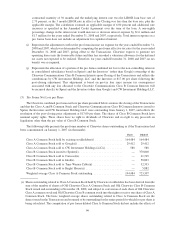

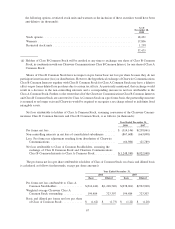

(3) Pro Forma Net Loss per Shar

e

T

he Clearwire combined pro forma net loss per share presented below assumes the closin

g

of the Transactions

and that the

C

lass A and B

C

ommon

S

tock and

C

lear

w

ire

C

ommunications

C

lass B

C

ommon Interests issued to

S

pr

i

nt, t

h

e Investors an

d

CW Investment Ho

ldi

ngs LLC were outstan

di

ng

f

rom January 1, 2007, an

d

re

fl

ects t

h

e

r

esolution of the post-closin

g

price ad

j

ustment at $17.00 per share. The shares of Class B Common Stock hav

e

n

ominal equity rights. These shares have no right to dividends of Clearwire and no right to any proceeds o

n

li

q

uidation other than the

p

ar value of Class B Common Stock.

T

he followin

g

table presents the pro forma number of Clearwire shares outstandin

g

as if the Transactions ha

d

been consummated on January 1, 2007 (in thousands):

B

asic Diluted

C

lass A Common Stock held b

y

existin

g

stockholders(i)

.................

1

6

4,484 1

6

4,484

Cl

ass A Common Stoc

k

so

ld

to Goo

gl

e(

i

)

............................

29

,

412 29

,

412

Cl

ass A Common Stoc

k

so

ld

to CW Investment Ho

ldi

n

g

s LLC(

i)

.

..........

588 588

Cl

ass B Common Stoc

ki

ssue

d

to Spr

i

nt(

ii)

...........................

—

3

70

,

000

Cl

ass B Common Stoc

k

so

ld

to Comcast

(ii)

...........................

—

61

,

76

5

C

lass B Common Stock sold to Intel

(

ii

)

..............................

—

5

8

,

82

3

C

lass B Common Stock sold to Time Warner Cable(ii

)

.................. —

32,3

53

C

lass B Common Stock sold to Bri

g

ht House(ii)

....................... —

5

,882

We

igh

te

d

avera

g

eC

l

ass A Common Stoc

k

outstan

di

n

g

..................

194

,

484

7

23

,

307

(i) Shares outstanding related to Class A Common Stock held by Clearwire stockholders has been derived from th

e

sum o

f

t

h

e num

b

er o

f

s

h

ares o

f Old Cl

ear

wi

re

Cl

ass A

C

ommon

S

toc

k

an

d Old Cl

ear

wi

re

Cl

ass B

C

ommo

n

Stoc

ki

ssue

d

an

d

outstan

di

n

g

at Novem

b

er 28, 2008, an

d

su

bj

ect to convers

i

on o

f

eac

h

s

h

are o

f

O

ld

C

l

earw

i

r

e

C

lass A common stock and Old Clearwire Class B common stock into the right to receive one share of Class

A

C

ommon Stoc

k

.T

h

e

b

as

i

cwe

igh

te

d

avera

g

es

h

ares outstan

di

n

g

re

l

ate

d

to C

l

ass A Common Stoc

k

are t

he

s

h

ares

i

ssue

di

nt

h

e Transact

i

ons an

d

assume

d

to

b

e outstan

di

n

gf

or t

h

e ent

i

re per

i

o

df

or w

hi

c

hl

oss per s

h

are

i

s

b

ein

g

calculated. The computation of pro forma diluted Class A Common Stock did not include the effects o

f

66