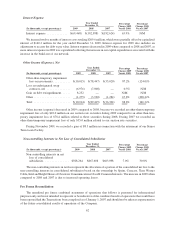

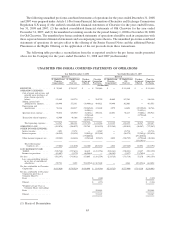

Clearwire 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Spr

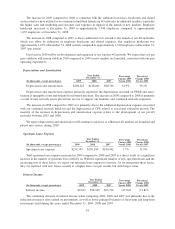

i

nt Nexte

l

Corporat

i

on entere

di

nto an agreement w

i

t

h

O

ld

C

l

earw

i

re to com

bi

ne

b

ot

h

o

f

t

h

e

i

rnext

g

eneration wireless broadband businesses to form a new independent compan

y

. On Closin

g

, Old Clearwire and th

e

S

print WiMAX Business completed the combination to form Clearwire. The Transactions were accounted for as a

r

everse acqu

i

s

i

t

i

on w

i

t

h

t

h

e Spr

i

nt W

i

MAX Bus

i

ness

d

eeme

d

to

b

et

h

e account

i

ng acqu

i

rer

.

At the Closin

g

, the Investors made an a

gg

re

g

ate $3.2 billion capital contribution to Clearwire and it

s

s

u

b

s

idi

ary, C

l

earw

i

re Commun

i

cat

i

ons. In exc

h

ange

f

or t

h

e contr

ib

ut

i

on o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness an

d

t

h

e

i

r

i

nvestments, as applicable, Goo

g

le initiall

y

received 25,000,000 shares of Class A Common Stock and Sprint an

d

t

he other Investors received in aggregate

5

0

5

,000,000 shares of Class B Common Stock and an equivalent amount of

Cl

ear

wi

re

C

ommun

i

cat

i

ons

Cl

ass B

C

ommon Interests. T

h

e num

b

er o

f

s

h

ares o

fCl

ass A an

d

B

C

ommon

S

toc

k

an

d

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests, as a

ppli

ca

bl

e, t

h

at t

h

e Investors were ent

i

t

l

e

d

to rece

i

v

e

under the Transaction Agreement was subject to a post-closing adjustment based on the trading price of Class A

Common Stock on NASDAQ over 1

5

randomly-selected trading days during the 30-day period ending on th

e

9

0th da

y

after the Closin

g

, or Februar

y

26, 2009, which we refer to as the Ad

j

ustment Date, with a floor of $17.0

0

p

er share and a cap of $23.00 per share. Durin

g

the measurement period, Class A Common Stock traded below

$

17.00 per share on NASDAQ, so on the Adjustment Date, we issued to the Investors an additional 4,411,765 shares

of Class A Common Stock and 23

,

823

,

529 shares of Class B Common Stock and Clearwire Communication

s

Class B Common Interests to reflect the $17.00 final price per share. Additionall

y

, in accordance with th

e

s

ubscription a

g

reement, on Februar

y

27, 2009, CW Investment Holdin

g

s LLC purchased

5

88,23

5

shares of Class A

Common Stock at

$

17.00 per share for a total investment of

$

10.0 million. For the purpose of determining th

e

n

umber of shares outstandin

g

within the unaudited pro forma condensed combined statements of operations, we

assumed that the additional shares and common interests issued to the Investors and CW Investment Holdin

g

s LLC

on t

h

eA

dj

ustment Date an

d

Fe

b

ruary 27, 2009, respect

i

ve

l

y, were

i

ssue

d

as o

f

t

h

eC

l

os

i

ng an

d

t

h

at t

h

eC

l

os

i

ng was

c

onsummated on Januar

y

1, 2007.

I

n connect

i

on w

i

t

h

t

h

e

i

ntegrat

i

on o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness an

d

O

ld

C

l

earw

i

re operat

i

ons, we expec

t

t

hat certain non-recurrin

g

char

g

es will be incurred. We also expect that certain s

y

ner

g

ies mi

g

ht be realized due to

operatin

g

efficiencies or future revenue s

y

ner

g

ies expected to result from the Transactions. However, in preparin

g

th

e unau

di

te

d

pro

f

orma con

d

ense

d

com

bi

ne

d

statements o

f

operat

i

ons, w

hi

c

h

g

i

ve e

ff

ect to t

h

e Transact

i

ons as

if

th

e

y

were consummate

d

on Januar

y

1, 2007, no pro

f

orma a

dj

ustments

h

ave

b

een re

fl

ecte

d

to cons

id

er an

y

suc

h

c

osts or

b

ene

fi

ts

.

(

2) Pro Forma A

dj

ustments Re

l

ate

d

to Purc

h

ase Account

i

ng an

d

Ot

h

er Non-recurr

i

ng C

h

arges

f

or t

h

e Years En

d

e

d

D

ecem

b

er 31, 2008 an

d

200

7

Th

e pro

f

orma a

dj

ustments re

l

ate

d

to purc

h

ase account

i

ng

h

ave

b

een

d

er

i

ve

df

rom t

h

ea

ll

ocat

i

on o

f

t

he

p

urc

h

ase cons

id

erat

i

on to t

h

e

id

ent

ifi

a

bl

e tan

gibl

ean

di

ntan

gibl

e assets acqu

i

re

d

an

dli

a

bili

t

i

es assume

d

o

f

O

ld

Clearwire, including the allocation of the excess of the estimated fair value of net assets acquired over the purchas

e

p

rice.

Art

i

c

l

e11o

f

Re

g

u

l

at

i

on S-X requ

i

res t

h

at pro

f

orma a

dj

ustments re

fl

ecte

di

nt

h

e unau

di

te

d

pro

f

orm

a

c

ondensed combined statements of operations are directly related to the transaction for which pro forma financial

i

n

f

ormat

i

on

i

s presente

d

an

dh

ave a cont

i

nu

i

ng

i

mpact on t

h

e resu

l

ts o

f

operat

i

ons. Certa

i

nc

h

arges

h

ave

b

een

e

xc

l

u

d

e

di

nt

h

e unau

di

te

d

pro

f

orma con

d

ense

d

com

bi

ne

d

statements o

f

operat

i

ons as suc

h

c

h

ar

g

es were

i

ncurre

di

n

direct connection with or at the time of the Transactions and are not expected to have an on

g

oin

g

impact on th

e

r

esu

l

ts o

f

operat

i

ons a

f

ter t

h

eC

l

os

i

ng

.

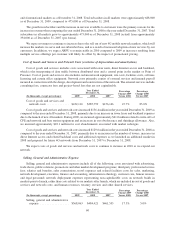

(a) Represents the accelerated vestin

g

of stock options for certain members of mana

g

ement upon the Closin

g,

w

hich resulted in a one-time charge of approximately

$

38.9 million recorded by Old Clearwire in its

hi

stor

i

ca

lfi

nanc

i

a

l

statements

f

or t

h

e 11 mont

h

sen

d

e

d

Novem

b

er 28, 2008. As t

h

ese are non-recurr

i

n

g

char

g

es directl

y

attributable to the Transactions, the

y

are excluded from the unaudited pro forma

com

bi

ne

d

statement o

f

operat

i

ons

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008.

(b) Represents ad

j

ustments in the depreciation expense on a pro forma basis related to items of Old Clearwir

e

PP&E that are bein

g

depreciated over their estimated remainin

g

useful lives on a strai

g

ht-line basis. Th

e

re

d

uct

i

on

i

n

d

eprec

i

at

i

on expense resu

l

ts

f

rom a

d

ecrease

i

nt

h

e carry

i

ng va

l

ue o

f

O

ld

C

l

earw

i

re PP&

E

64