Clearwire 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

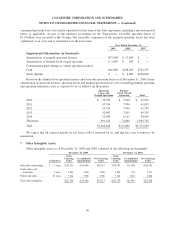

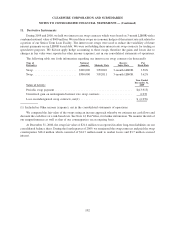

4. In

ves

tm

e

nt

s

I

nvestments as o

f

Decem

b

er 31, 2009 an

d

2008 cons

i

st o

f

t

h

e

f

o

ll

ow

i

ng (

i

nt

h

ousan

d

s):

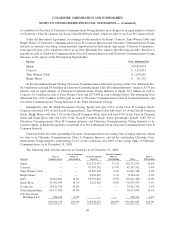

C

ost

G

ains Losses Fair Value

C

ost

G

ains Losses Fair Value

G

ross

U

nrealized

G

ross

U

nrealize

d

December

31, 2009

December

31, 2008

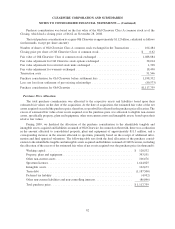

S

hort-ter

m

U.S. Government and

Agency Issues . . . . $2,106,584 $ 231 $(154) $2,106,661 $1,899,529 $2,220 $— $1,901,749

L

on

g

-ter

m

U.S. Government and

Agency Issues . . . . 74,670 — (1

5

4) 74,

5

16 — — — —

O

ther debt securities . . . 8,959 4,212 — 13,171 18,974 — — 18,974

Tota

ll

ong-ter

m

.

.....

.

8

3,629 4,212

(

1

5

4

)

87,687 18,974 — — 18,974

T

o

t

a

lin

ves

tm

e

nt

s

.....

$

2,190,213

$

4,443

$

(308)

$

2,194,348

$

1,918,503

$

2,220

$

—

$

1,920,723

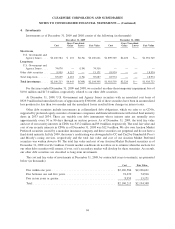

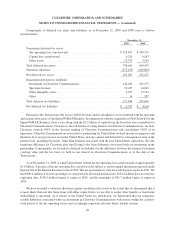

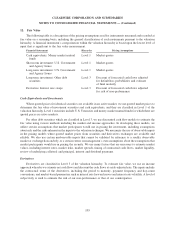

For the years ended December 31, 2009 and 2008, we recorded an other-than-temporary impairment loss o

f

$

10.0 million and

$

17.0 million, respectivel

y

, related to our other debt securities

.

At Decem

b

er 31, 2009, U.S. Government an

d

Agency Issues secur

i

t

i

es w

i

t

h

an amort

i

ze

d

cost

b

as

i

so

f

$929.9 million had unrealized losses of approximatel

y

$308,000. All of these securities have been in an unrealized

l

oss pos

i

t

i

on

f

or

l

ess t

h

an two mont

h

san

d

t

h

e unrea

li

ze

dl

osses resu

l

te

df

rom c

h

anges

i

n

i

nterest rates.

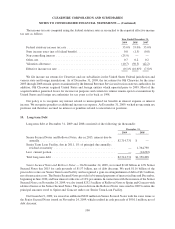

O

ther debt securities include investments in collateralized debt obligations, which we refer to as CDOs

,

s

upporte

dby

pre

f

erre

d

equ

i

t

y

secur

i

t

i

es o

fi

nsurance compan

i

es an

dfi

nanc

i

a

li

nst

i

tut

i

ons w

i

t

h

state

dfi

na

l

matur

i

t

y

d

ates

i

n 2033 an

d

2034. T

h

ese are var

i

a

bl

e rate

d

e

b

t

i

nstruments w

h

ose

i

nterest rates are norma

lly

rese

t

approximately every 30 or 90 days through an auction process. As of December 31, 2009, the total fair value

and cost of our security interests in CDOs was

$

13.2 million and

$

9.0 million, respectively. The total fair value and

c

ost of our securit

y

interests in CDOs as of December 31, 2008 was $12.9 million. We also own Auction Market

P

referred securities issued b

y

a monoline insurance compan

y

and these securities are perpetual and do not have a

fi

na

l

state

d

matur

i

ty. In Ju

l

y 2009, t

h

e

i

ssuer’s cre

di

t rat

i

ng was

d

owngra

d

e

d

to CC an

d

Caa2

b

y Stan

d

ar

d

& Poor’s

and Mood

y

’s ratin

g

services, respectivel

y

and the total fair value and cost of our Auction Market Preferre

d

s

ecurities was written down to $0. The total fair value and cost of our Auction Market Preferred securities as of

D

ecember 31

,

2008 was

$

6.1 million. Current market conditions do not allow us to estimate when the auctions for

our ot

h

er

d

e

b

t secur

i

t

i

es w

ill

resume,

if

ever, or

if

a secon

d

ar

y

mar

k

et w

ill d

eve

l

op

f

or t

h

ese secur

i

t

i

es. As a resu

l

t

,

our other debt securities are classified as lon

g

-term investments

.

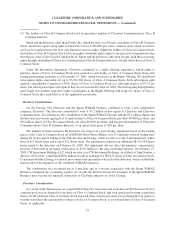

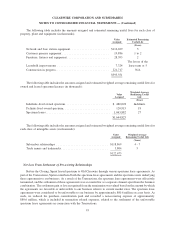

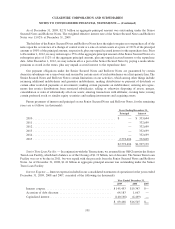

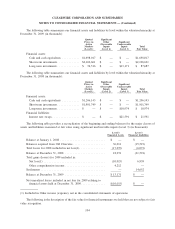

T

he cost and fair value of investments at December 31, 2009, b

y

contractual

y

ears-to-maturit

y

, are presente

d

b

elow (in thousands):

C

ost Fair Valu

e

D

ue within one yea

r

.

....................................... $2

,

106

,

584 $2

,

106

,

66

1

D

ue between one and five

y

ear

s

...............................

74,670 74,

5

1

6

D

ue in ten

y

ears or

g

reate

r

...................................

8,9

5

9 13,171

T

ota

l

...................................................

$

2

,

190

,

213

$

2

,

194

,

348

94

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)