Clearwire 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cl

ear

wi

re

C

ommun

i

cat

i

ons an

d

assoc

i

ate

dwi

t

h

t

h

e trans

f

erre

dCl

ear

wi

re

C

ommun

i

cat

i

ons

Cl

ass B

C

ommon

Interests, and an

y

Section 704(c) consequences associated with that built-in

g

ain, and (2) in the case of an

y

transfer,

any built-in gain arising after the formation of Clearwire Communications and associated with the transferre

d

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests. Sect

i

on 384 o

f

t

h

eCo

d

e may

li

m

i

tt

h

ea

bili

ty o

f

C

l

earw

i

r

e

t

o use its NOLs arisin

g

before the holdin

g

compan

y

exchan

g

e to offset an

y

built-in

g

ain of Sprint or an Investor t

o

w

hi

c

h

C

l

earw

i

re succee

d

s

i

n suc

h

an exc

h

ange. Accor

di

ng

l

y, C

l

earw

i

re may

i

ncur a mater

i

a

lli

a

bili

ty

f

or taxes as a

r

esu

l

to

f

a

h

o

ldi

ng company exc

h

ange, even

if i

t

h

as su

b

stant

i

a

l

NOLs. C

l

earw

i

re Commun

i

cat

i

ons

i

s requ

i

re

d

t

o

m

a

k

e

di

str

ib

ut

i

ons to C

l

earw

i

re

i

n amounts necessar

y

to pa

y

a

ll

taxes reasona

bly d

eterm

i

ne

dby

C

l

earw

i

re to

be

p

ayable with respect to its distributive share of the taxable income of Clearwire Communications, after taking int

o

account the NOL deductions and other tax benefits reasonably expected to be available to Clearwire. See th

e

s

ect

i

ons t

i

t

l

e

d

“R

i

s

k

Factors — Man

d

ator

y

tax

di

str

ib

ut

i

ons ma

yd

epr

i

ve C

l

earw

i

re Commun

i

cat

i

ons o

ff

un

d

st

h

a

t

are required in its business” be

g

innin

g

on pa

g

e 38 and “Certain Relationships and Related Transactions, an

d

D

irector Independence” beginning on page 127 of this report

.

ITEM 1B

.

Unreso

l

ve

d

Sta

ff

Comments

Th

ere were no unreso

l

ve

d

sta

ff

comments as o

f

Decem

b

er 31

,

2009.

ITEM 2

.

Propert

i

es

O

ur execut

i

ve o

ffi

ces are current

l

y

l

ocate

di

nt

h

eK

i

r

kl

an

d

,Was

hi

ngton area, w

h

ere we

l

ease approx

i

mate

l

y

1

8

5

,000 square feet of space. The leases for our executive offices expire at various dates throu

g

h 2019

.

We

b

e

li

eve t

h

at su

b

stant

i

a

lly

a

ll

o

f

our propert

y

an

d

equ

i

pment

i

s

i

n

g

oo

d

con

di

t

i

on, su

bj

ect to norma

l

wear

an

d

tear. We

b

e

li

eve t

h

at our current

f

ac

ili

t

i

es

h

ave su

ffi

c

i

ent capac

i

t

y

to meet t

h

e pro

j

ecte

d

nee

d

so

f

our

b

us

i

nes

s

for the next 12 months

.

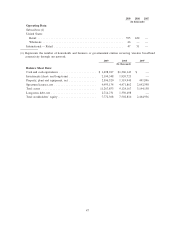

T

he followin

g

table lists our si

g

nificant leased properties and the inside square foota

g

e of those properties:

Cit

y

, State (Function

)

App

roximate

S

iz

e

(S

q

uare Feet

)

Ki

r

kl

an

d

, WA area (

h

ea

dq

uarters an

d

a

d

m

i

n

i

strat

i

ve

)

.......................

1

85,000

H

ern

d

on, VA

(

a

d

m

i

n

i

strat

i

ve an

d

W

i

MAX

l

a

b)

............................

130,000

Las Vegas, NV (ca

ll

center)

..........................................

55

,

000

H

en

d

erson, NV (a

d

m

i

n

i

strat

i

ve an

d

ware

h

ouse space

)

......................

.

53

,

000

Milton, FL

(

call center

)

.............................................

4

0

,

000

We lease additional office space in man

y

of our current and planned markets. We also lease approximatel

y

12

0

r

eta

il

stores an

d

ma

ll ki

os

k

s. Our reta

il

stores, exc

l

u

di

ng ma

ll ki

os

k

s, range

i

ns

i

ze

f

rom approx

i

mate

l

y 480 squar

e

f

eet to 2,800 square

f

eet, w

i

t

hl

eases

h

av

i

ng terms typ

i

ca

ll

y

f

rom t

h

ree to seven years. Internat

i

ona

ll

y, as o

f

D

ecember 31, 2009, we also have offices in Dublin, Ireland; Bucharest, Romania; Brussels, Bel

g

ium; Madrid,

S

pa

i

nan

d

Warsaw, Po

l

an

d.

Th

e Hern

d

on, VA

l

ocat

i

on

h

as su

b

-

l

et a sma

ll

port

i

on o

f

t

h

e

f

ac

ili

t

y

to certa

i

no

fi

ts

k

e

y

W

i

MAX

i

n

f

rastructure

vendors, including Intel, Motorola and Samsung, for the purpose of ensuring close collaboration on WiMAX

d

eve

l

opment w

i

t

h

t

h

ose ven

d

ors.

ITEM

3

.

L

e

g

al Proceedin

g

s

As more

f

u

ll

y

d

escr

ib

e

db

e

l

ow, we are

i

nvo

l

ve

di

navar

i

ety o

fl

awsu

i

ts, c

l

a

i

ms,

i

nvest

i

gat

i

ons an

d

procee

di

ngs

c

oncern

i

ng

i

nte

ll

ectua

l

property,

b

us

i

ness pract

i

ces, commerc

i

a

l

an

d

ot

h

er matters. We

d

eterm

i

ne w

h

et

h

er we s

h

ou

ld

accrue an estimated loss for a contin

g

enc

y

in a particular le

g

al proceedin

g

b

y

assessin

g

whether a loss is deemed

p

ro

b

a

bl

ean

d

can

b

e reasona

bl

yest

i

mate

d

. We reassess our v

i

ews on est

i

mate

dl

osses on a quarter

l

y

b

as

i

store

fl

ect t

h

e

i

mpact o

f

any

d

eve

l

opments

i

nt

h

e matters

i

nw

hi

c

h

we are

i

nvo

l

ve

d

.Lega

l

procee

di

ngs are

i

n

h

erent

l

yunpre

di

cta

bl

e, an

d

t

he matters in which we are involved often present complex le

g

al and factual issues. We vi

g

orousl

y

pursue defenses in

legal proceedings and engage in discussions where possible to resolve these matters on terms favorable to us. It is

p

oss

ibl

e,

h

owever, t

h

at our

b

us

i

ness,

fi

nanc

i

a

l

con

di

t

i

on an

d

resu

l

ts o

f

operat

i

ons

i

n

f

uture per

i

o

d

s cou

ld b

e mater

i

a

ll

y

a

ff

ecte

dbyi

ncrease

dli

t

ig

at

i

on expense, s

ig

n

ifi

cant

s

ett

l

ement costs an

d

/or un

f

avora

bl

e

d

ama

g

eawar

d

s.

42