Clearwire 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Th

e

i

ncome tax rate compute

d

us

i

ng t

h

e

f

e

d

era

l

statutory rates

i

s reconc

il

e

d

to t

h

e reporte

d

e

ff

ect

i

ve

i

ncom

e

t

ax rate as

f

o

ll

o

w

s

:

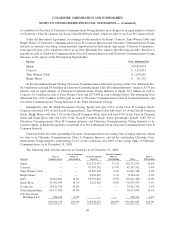

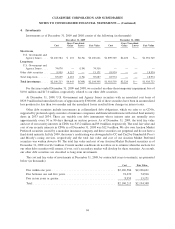

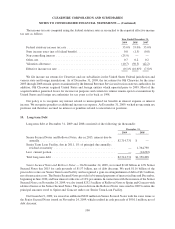

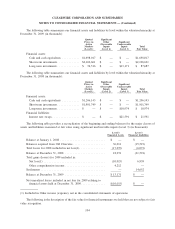

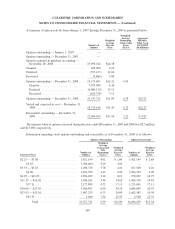

2009 2008 200

7

Year Ended December 31

,

Fe

d

era

l

statutor

yi

ncome tax rate

................................

35

.

0

%

35

.

0

%

35

.

0

%

State

i

ncome taxes

(

net o

ff

e

d

era

lb

ene

fi

t

)

..........................

0

.

8

(

1.5

)(

0.8

)

Non-contro

lli

ng

i

nterest

.

......................................

(

25.9

)

——

O

ther

,

net

.

................................................. 0.7 0.2 0.

2

V

aluation allowanc

e

..........................................

(

10.7

)(5

0.3

)(

42.2

)

Effective income tax rate

......................................

(

0.1)% (16.6)% (7.8)%

We

fil

e

i

ncome tax returns

f

or C

l

earw

i

re an

d

our su

b

s

idi

ar

i

es

i

nt

h

eUn

i

te

d

States Fe

d

era

lj

ur

i

s

di

ct

i

on an

d

various state and foreign jurisdictions. As of December 31, 2009, the tax returns for Old Clearwire for the years

2

003 through 2008 remain open to examination by the Internal Revenue Service and various state tax authorities. In

a

ddi

t

i

on, O

ld

C

l

earw

i

re acqu

i

re

d

Un

i

te

d

States an

df

ore

ig

n ent

i

t

i

es w

hi

c

h

operate

d

pr

i

or to 2003. Most o

f

t

he

acquired entities

g

enerated losses for income tax purposes and certain tax returns remain open to examination b

y

U

nited States and foreign tax authorities for tax years as far back as 1998.

O

ur po

li

c

yi

s to reco

g

n

i

ze an

yi

nterest re

l

ate

d

to unreco

g

n

i

ze

d

tax

b

ene

fi

ts

i

n

i

nterest expense or

i

nteres

t

income. We reco

g

nize penalties as additional income tax expense. As December 31, 2009, we had no uncertain tax

p

ositions and therefore accrued no interest or

p

enalties related to uncertain tax

p

ositions.

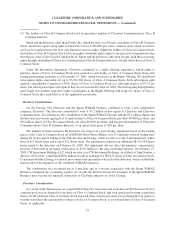

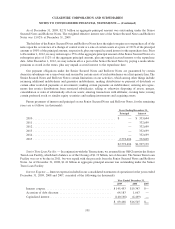

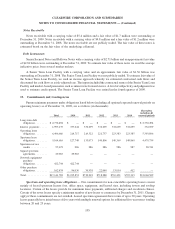

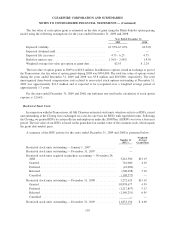

10. Long-term Debt

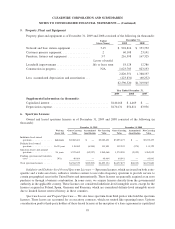

Long-term debt at December 31, 2009 and 2008 consisted of the following (in thousands):

2

009 200

8

December 31

,

Senior Secured Notes and Rollover Notes

,

due in 2015

,

interest due-bi

-

a

nnua

lly

...............................................

$

2

,

714

,

731

$

—

Sen

i

or Term Loan Fac

ili

ty,

d

ue

i

n 2011, 1% o

f

pr

i

nc

i

pa

ld

ue annua

ll

y

;

res

id

ua

l

at matur

i

t

y

...

................................... —

1

,

3

6

4

,

79

0

Less: current port

i

on

.

......................................

—

(

14,292

)

T

otal long-term deb

t

.

......................................

$

2

,

714

,

731

$

1

,

350

,

498

S

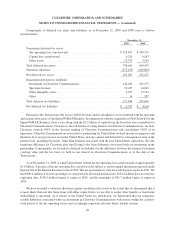

enior Secure

d

Notes an

d

Ro

ll

over Note

s

—

On November 24, 2009, we issued $1.60 billion in 12% Senio

r

S

ecured Notes due 2015 for cash

p

roceeds of

$

1.57 billion, net of debt discount. We used

$

1.16 billion of th

e

p

roceeds to retire our Senior Term Loan Facilit

y

and reco

g

nized a

g

ain on extin

g

uishment of debt of

$

8.3 million,

net o

f

transact

i

on costs. T

h

e Sen

i

or Secure

d

Notes prov

id

e

f

or

bi

-annua

l

pa

y

ments o

fi

nterest

i

n June an

d

Decem

b

er

,

b

e

g

innin

g

in June 2010, and bear interest at the rate of 12% per annum. In connection with the issuance of the Senior

S

ecured Notes, on November 24, 2009, we also issued

$

252.5 million of Rollover Notes to Sprint and Comcast with

id

ent

i

ca

l

terms as t

h

e Sen

i

or Secure

d

Notes. T

h

e procee

d

s

f

rom t

h

eRo

ll

over Notes were use

di

n 2009 to ret

i

re t

he

p

rincipal amounts owed to Sprint and Comcast under our Senior Term Loan Facilit

y

.

O

n December 9

,

2009

,

we issued an additional

$

920 million in Senior Secured Notes with the same terms as

t

he Senior Secured Notes issued on November 24, 2009, which resulted in cash proceeds of

$

901.1 million, net of

debt discount

.

100

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)