Clearwire 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We acqu

i

re

d

our

d

e

b

t as a resu

l

to

f

t

h

e acqu

i

s

i

t

i

on o

f

O

ld

C

l

earw

i

re on Novem

b

er 28, 2008; t

h

ere

f

ore we

did

n

ot incur an

y

interest expense durin

g

2007

.

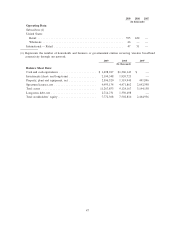

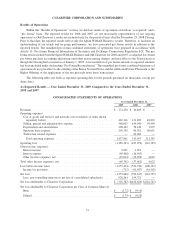

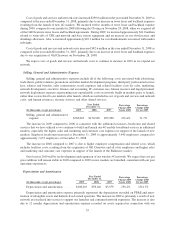

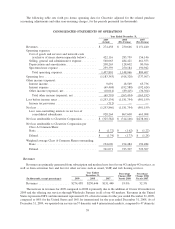

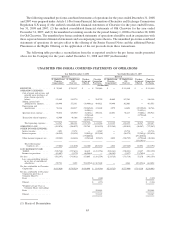

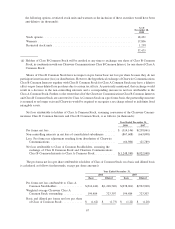

Other Income (Expense), Ne

t

(

In thousands, except percenta

g

es) 2009 2008 2007

P

ercenta

g

e

Change 2009

V

ersus 2008

P

ercenta

ge

C

hange 2008

V

ersus 2007

Y

ear

E

n

d

e

d

D

ecember 31

,

O

t

h

er-t

h

an-temporar

yi

mpa

i

rment

l

os

s

o

n

i

n

v

estment

s

................

$

(10,015) $(17,036) $ — 41.2% N/M

Loss on un

d

es

ig

nate

d

swap contracts

,

net.........................

(6

,97

6) (6

,072

)

— 14.9% N/M

Ga

i

non

d

e

b

text

i

ngu

i

s

h

ment

.......

8,

252 — — N/M N/M

O

the

r

........................

(

1,27

5)

900 4,022

(

241.8

)

%

(

77.6

)

%

Tota

l

.........................

$

(10,014) $(22,208) $4,022 54.9% (652.2)

%

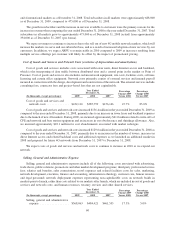

D

uring 2009, we recorded an other-than-temporary impairment loss of

$

10.0 million on our auction rate

s

ecur

i

t

i

es. Dur

i

n

g

t

h

e

y

ear en

d

e

d

Decem

b

er 31, 2008, we

i

ncurre

d

ot

h

er-t

h

an-temporar

yi

mpa

i

rment

l

osses o

f

$17.0 million related to these securities. We ac

q

uired our auction rate securities as a result of the ac

q

uisition of Old

Clearwire on November 28, 2008; therefore we did not incur any other-than-temporary impairment losses during

200

7.

D

uring November 2009, we recorded a gain of $8.3 million in connection with the retirement of our Senio

r

Term Loan Facility and terminated the swap contracts

.

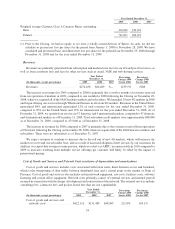

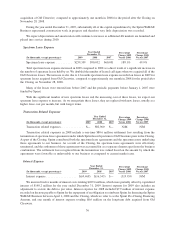

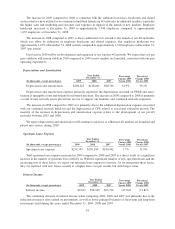

I

ncome T

a

x Provisio

n

(

In thousands, except percentages

)

2009 2008 2007

P

ercenta

g

e

Change 2009

Versus

2008

P

ercenta

ge

C

hange 2008

Versus

200

7

Y

ear Ende

d

D

ecember

31,

I

ncome tax

p

rovisio

n

.............

.

$

(

712

)

$

(

61,607

)

$

(

16,362

)

98.8%

(

276.5

)

%

Th

e

d

ecrease

i

nt

h

e

i

ncome tax prov

i

s

i

on

f

or 2009 compare

d

to 2008

i

spr

i

mar

ily d

ue to t

h

ec

h

an

g

e

i

n our

deferred tax position as a result of the Closing. Prior to the Closing, the income tax provision was primarily due to

i

ncrease

dd

e

f

erre

dli

a

bili

t

i

es

f

rom a

ddi

t

i

ona

l

amort

i

zat

i

on ta

k

en

f

or

f

e

d

era

li

ncome tax purposes

b

yt

h

e Spr

i

n

t

Wi

MAX Bus

i

ness on certa

i

n

i

n

d

e

fi

n

i

te-

li

ve

dli

cense

d

spectrum. As a resu

l

to

f

t

h

eC

l

os

i

n

g

,t

h

eon

ly

Un

i

te

d

State

s

t

emporar

y

difference is the basis difference associated with our investment in Clearwire Communications, a

p

artners

hi

p

f

or Un

i

te

d

States

i

ncome tax purposes.

T

he increase in the income tax provision for 2008 compared to 2007 is primaril

y

due to increased deferred ta

x

li

a

bili

t

i

es

f

rom a

ddi

t

i

ona

l

amort

i

zat

i

on ta

k

en

f

or

f

e

d

era

li

ncome tax purposes

b

yt

h

e Spr

i

nt W

i

MAX Bus

i

ness on

c

erta

i

n

i

n

d

e

fi

n

i

te-

li

ve

dli

cense

d

spectrum pr

i

or to t

h

eC

l

os

i

ng. T

h

e ongo

i

ng

diff

erence

b

etween

b

oo

k

an

d

tax

amortization resulted in an additional deferred income tax provision of $61.4 million in 2008 prior to the Closin

g

.

We pro

j

ect t

h

at t

h

e partners

hi

pw

ill h

ave a

ddi

t

i

ona

ll

osses

i

nt

h

eUn

i

te

d

States

i

n 2010. We

d

o not

b

e

li

eve suc

h

losses will be realizable at a more likel

y

than not level and accordin

g

l

y

, the pro

j

ected additional losses allocated t

o

us

i

n 2010 w

ill

not resu

l

t

i

naUn

i

te

d

States tax prov

i

s

i

on or

b

ene

fi

t

f

or 2010

.

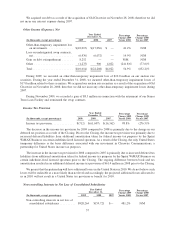

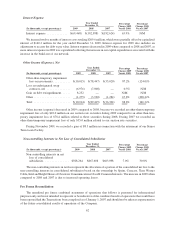

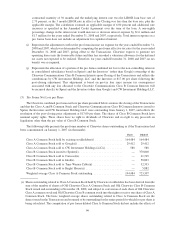

Non-contro

ll

ing Interests in Net Loss o

f

Conso

l

i

d

ate

d

Su

b

si

d

iaries

(

In thousands, except percentages

)

2009 2008 200

7

P

ercenta

g

e

Change 2009

Versus

2008

P

ercenta

ge

C

hange 2008

Versus

200

7

Year Ended

December

31

,

Non-controlling interests in net loss of

conso

lid

ate

d

su

b

s

idi

ar

i

es

.

.........

$

928

,

264

$

159

,

721

$

— 481.2% N/

M

5

7