Clearwire 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

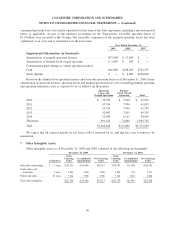

B

ase

d

on t

h

eot

h

er

i

ntang

ibl

e assets recor

d

e

d

as o

f

Decem

b

er 31, 2009, t

h

e

f

uture amort

i

zat

i

on

i

s expecte

d

t

o

b

eas

f

o

ll

ows

(i

nt

h

ousan

d

s

):

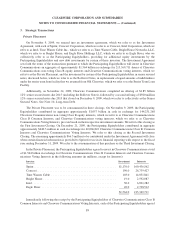

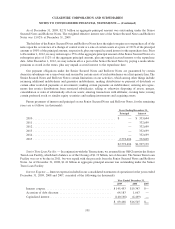

201

0

................................................................

$

27,39

4

2011

................................................................

2

2,42

6

2012

................................................................

1

7,

322

2013

................................................................

12

,

292

2014

................................................................

7,

7

28

Th

erea

f

ter

............................................................

4,

551

T

otal

.

...............................................................

$

91

,

713

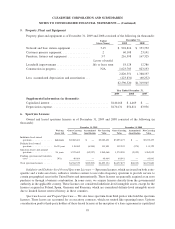

2009 2008 200

7

Year Ended December

31,

Supplemental Information

(

in thousands

):

A

mort

i

zat

i

on expens

e

........................................

$

32

,

443

$

2

,

888

$

43

Cons

id

erat

i

on pa

id

.

.........................................

$

16

$

992

$

1

,

31

6

We eva

l

uate a

ll

o

f

our patent renewa

l

s on a case

b

y case

b

as

i

s,

b

ase

d

on renewa

l

costs.

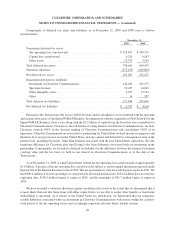

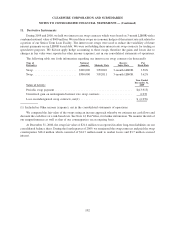

8. Accounts Pa

y

able and

O

ther

C

urrent L

i

ab

i

l

i

t

i

es

Accounts paya

bl

ean

d

ot

h

er current

li

a

bili

t

i

es cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

ng (

i

nt

h

ousan

d

s)

:

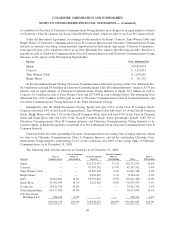

2009 2008

December

31,

Accounts pa

y

able

............................................

$377,890 $ 78,695

A

cc

r

ued

in

te

r

est

.............................................

28,670 8,9

5

3

S

a

l

ar

i

es an

db

ene

fi

t

s

..........................................

44,32

6

2

6

,33

7

B

us

i

ness an

di

ncome taxes pa

y

a

ble

...............................

25

,

924 7

,

26

4

O

t

h

er

.....................................................

50

,

557 24

,

16

8

$

527

,

367

$

145

,

41

7

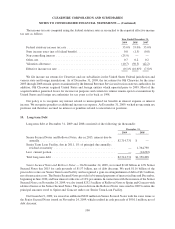

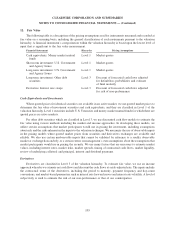

9

.In

co

m

e

T

a

x

es

W

e

d

eterm

i

ne

d

e

f

erre

di

ncome taxes

b

ase

d

on t

h

e est

i

mate

df

uture tax e

ff

ects o

f diff

erences

b

et

w

een t

he

financial statement and tax bases of assets and liabilities usin

g

the tax rates expected to be in effect when an

y

temporar

y

differences reverse or when the net operatin

g

loss, capital loss or tax credit carr

y

forwards are utilized.

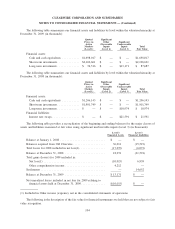

Prior to the Transactions, the le

g

al entities representin

g

the Sprint WiMAX Business were included in the

fili

ng o

f

Spr

i

nt’s conso

lid

ate

df

e

d

era

l

an

d

certa

i

n state

i

ncome tax returns. Income tax expense an

d

re

l

ate

di

ncom

e

tax

b

a

l

ances were accounte

df

or an

d

presente

di

nt

h

e

fi

nanc

i

a

l

statements, as

if

we were

fili

ng stan

d

-a

l

one separat

e

returns usin

g

an estimated combined federal and state mar

g

inal tax rate of 39% up to and includin

g

the date of th

e

T

ransact

i

ons. We recor

d

e

dd

e

f

erre

d

tax assets re

l

ate

d

to t

h

e pre-c

l

os

i

ng net operat

i

ng

l

oss an

d

tax cre

di

t

c

arry

f

orwar

d

san

d

recor

d

e

d

ava

l

uat

i

on a

ll

owance aga

i

nst our

d

e

f

erre

d

tax assets, net o

f

certa

i

nsc

h

e

d

u

l

a

bl

e

d

eferred tax liabilities. The net deferred tax liabilities reported in these financial statements prior to the Closin

g

are

related to FCC licenses recorded as indefinite-lived spectrum intangibles, which are not amortized for boo

k

purposes. T

h

ec

h

ange to t

h

e

d

e

f

erre

d

tax pos

i

t

i

on as a resu

l

to

f

t

h

eC

l

os

i

ng was re

fl

ecte

d

as part o

f

t

h

e account

i

ng

f

o

r

t

h

e acqu

i

s

i

t

i

on o

f

O

ld

C

l

earw

i

re an

d

was recor

d

e

di

n equ

i

t

y

.T

h

e net operat

i

n

gl

oss an

d

tax cre

di

t carr

yf

orwar

ds

9

7

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)