Clearwire 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Upon

li

qu

id

at

i

on,

di

sso

l

ut

i

on or w

i

n

di

ng up, t

h

eC

l

ass A Common Stoc

k

w

ill b

e ent

i

t

l

e

d

to any asset

s

r

ema

i

n

i

ng a

f

ter payment o

f

a

ll d

e

b

ts an

dli

a

bili

t

i

es o

f

C

l

earw

i

re, w

i

t

h

t

h

e except

i

on o

f

certa

i

nm

i

n

i

ma

lli

qu

id

at

i

on

r

i

g

hts provided to the Class B Common Stockholders, which are described below.

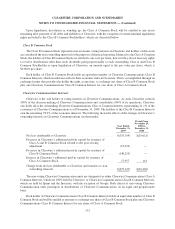

Cl

ass B

C

ommon

S

toc

k

T

he Class B Common Stock represents non-economic votin

g

interests in Clearwire and holders of this stoc

k

are cons

id

ere

d

t

h

e non-contro

lli

ng

i

nterests

f

or t

h

e purposes o

ffi

nanc

i

a

l

report

i

ng. I

d

ent

i

ca

l

to t

h

eC

l

ass A Common

S

toc

k

,t

h

e

h

o

ld

ers o

f

C

l

ass B Common Stoc

k

are ent

i

t

l

e

d

to one vote per s

h

are,

h

owever t

h

ey

d

o not

h

ave any r

i

g

h

ts

t

o receive distributions other than stock dividends paid proportionall

y

to each outstandin

g

Class A and Class B

Common Stockholder or upon liquidation of Clearwire, an amount equal to the par value per share, which is

$

0.0001 per share

.

Each holder of Class B Common Stock holds an equivalent number of Clearwire Communications Class

B

Common Interests, w

hi

c

hi

nsu

b

stance re

fl

ects t

h

e

i

r econom

i

c sta

k

e

i

nC

l

earw

i

re. T

hi

s

i

s accomp

li

s

h

e

d

t

h

rou

gh

an

e

xc

h

an

g

e

f

eature t

h

at prov

id

es t

h

e

h

o

ld

er t

h

er

igh

t, at an

y

t

i

me, to exc

h

an

g

e one s

h

are o

f

C

l

ass B Common Stoc

k

p

lus one Clearwire Communications Class B Common Interest for one share of Class A Common Stock.

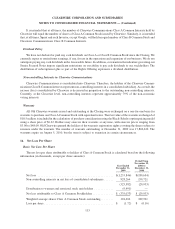

Cl

earwire

C

ommunications Interests

C

learwire is the sole holder of votin

g

interests in Clearwire Communications. As such, Clearwire control

s

1

00% o

f

t

h

e

d

ec

i

s

i

on ma

ki

ng o

f

C

l

earw

i

re Commun

i

cat

i

ons an

d

conso

lid

ates 100% o

fi

ts operat

i

ons. C

l

earw

i

re

a

l

so

h

o

ld

sa

ll

o

f

t

h

e outstan

di

n

g

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass A Common Interests represent

i

n

g

21.1% o

f

t

he

e

conomics of Clearwire Communications as of December 31, 2009. The holders of the Class B Common Interests

own t

h

e rema

i

n

i

ng 78.9% o

f

t

h

e econom

i

c

i

nterests. T

h

e

f

o

ll

ow

i

ng s

h

ows t

h

ee

ff

ects o

f

t

h

ec

h

anges

i

nC

l

earw

i

re’s

owners

hi

p

i

nterests

i

nC

l

earw

i

re Commun

i

cat

i

ons (

i

nt

h

ousan

d

s):

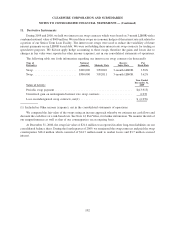

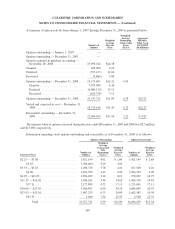

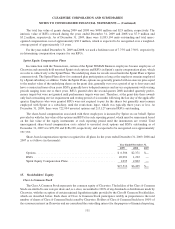

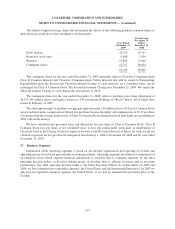

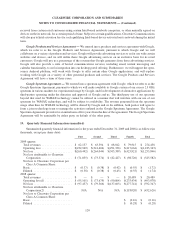

Yea

r

E

n

ded

December 31,

2009

P

e

r

iod

Fr

om

N

ovember

29,

2008

t

o

December 31,

200

8

Net

l

oss attr

ib

uta

bl

eto

Cl

ear

wi

re . .

.

..........................

$(

319,199

)$(

29,621

)

D

ecrease

i

nC

l

earw

i

re’s a

ddi

t

i

ona

l

pa

id

-

i

n cap

i

ta

lf

or

i

ssuance o

f

Cl

ass A an

d

B Common Stoc

k

re

l

ate

d

to t

h

e post-c

l

os

i

n

g

adj

ustment

............................................

(

33,

6

32

)—

D

ecrease

i

nC

l

earw

i

re’s a

ddi

t

i

ona

l

pa

id

-

i

n cap

i

ta

lf

or

i

ssuance o

f

Cl

ass B

C

ommon

S

toc

k

..................................

(

140,253

)—

I

ncrease

i

nC

l

earw

i

re’s a

ddi

t

i

ona

l

pa

id

-

i

n cap

i

ta

lf

or

i

ssuance o

f

Cl

ass A

C

ommon

S

toc

k

..................................

17

,

957 161

Ch

ange

f

rom net

l

oss attr

ib

uta

bl

etoC

l

earw

i

re an

d

trans

f

ers to non

-

contro

lli

ng

i

nterests .....................................

$(

475,127

)$(

29,460

)

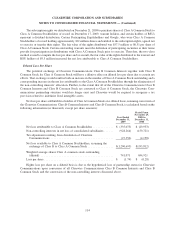

Th

e non-vot

i

ng C

l

earw

i

re Commun

i

cat

i

on un

i

ts are

d

es

i

gnate

d

as e

i

t

h

er C

l

earw

i

re Commun

i

cat

i

ons C

l

ass A

Common Interests, w

hi

c

h

are 100%

h

e

ld by

C

l

earw

i

re, or C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests,

w

hich are held by Sprint and the Investors, with the exception of Google. Both classes of non-voting Clearwir

e

Commun

i

cat

i

on un

i

ts part

i

c

i

pate

i

n

di

str

ib

ut

i

ons o

f

C

l

earw

i

re Commun

i

cat

i

ons on an equa

l

an

d

proport

i

onat

e

b

as

i

s

.

Eac

hh

o

ld

er o

f

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests

h

o

ld

s an equ

i

va

l

ent num

b

er o

f

C

l

ass

B

Common Stoc

k

an

d

w

ill b

e ent

i

t

l

e

d

at an

y

t

i

me to exc

h

an

g

e one s

h

are o

f

C

l

ass B Common Stoc

k

p

l

us one C

l

earw

i

re

Communications Class B Common Interest for one share of Class A Common Stock

.

112

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)