Clearwire 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sp

rin

t

— Spr

i

nt ass

i

gne

d

,w

h

ere poss

ibl

e, certa

i

n costs to us

b

ase

d

on our actua

l

use o

f

t

h

es

h

are

d

serv

i

ces,

whi

c

hi

nc

l

u

d

e

d

o

ffi

ce

f

ac

ili

t

i

es an

d

management serv

i

ces,

i

nc

l

u

di

ng treasury serv

i

ces,

h

uman resources, supp

ly

c

hain mana

g

ement and other shared services, up throu

g

h the Closin

g

. Where direct assi

g

nment of costs was no

t

p

oss

ibl

e or pract

i

ca

l

, Spr

i

nt use

di

n

di

rect met

h

o

d

s,

i

nc

l

u

di

ng t

i

me stu

di

es, to est

i

mate t

h

e ass

i

gnment o

fi

ts costs t

o

us, w

hi

c

h

were a

ll

ocate

d

to us t

h

roug

h

a management

f

ee. T

h

ea

ll

ocat

i

ons o

f

t

h

ese costs were re-eva

l

uate

d

p

eriodicall

y

. Sprint char

g

ed us mana

g

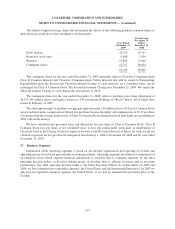

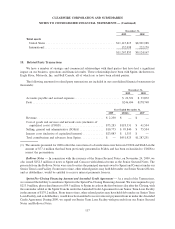

ement fees for such services of $171.1 million in the

y

ear ended December 31,

2

008 and

$

115.0 million in the year ended December 31, 2007. Additionally, we have entered into lease agreement

s

wi

t

h

Spr

i

nt

f

or var

i

ous sw

i

tc

hi

n

gf

ac

ili

t

i

es an

d

transm

i

tter an

d

rece

i

ver s

i

tes

f

or w

hi

c

h

we recor

d

e

d

rent expense o

f

$28.2 million, $36.4 million and $2.0 million in the

y

ears ended December 31, 2009, 2008 and 2007, respectivel

y

.

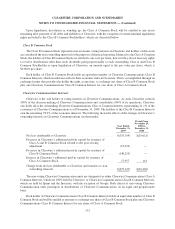

R

elationships among Certain Stockholders, Directors, and Officers of Clearwire —Fo

ll

ow

i

n

g

t

h

e com

-

p

letion of the Transactions and the post-closing adjustments, Sprint, through a wholly-owned subsidiary Sprin

t

Ho

ld

Co LLC, owne

d

t

h

e

l

ar

g

est

i

nterest

i

nC

l

earw

i

re w

i

t

h

an e

ff

ect

i

ve vot

i

n

g

an

d

econom

i

c

i

nterest

i

nC

l

earw

i

re o

f

approximatel

y

56% and the Investors collectivel

y

owned a 29% interest in Clearwire. See Note 3, State

g

ic

Transactions, for discussion re

g

ardin

g

the post-closin

g

ad

j

ustment.

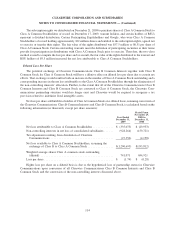

Ea

g

le River is the holder of 3

5

,922,9

5

8 shares of our outstandin

g

Class A Common Stock and 2,612,

5

16 shares

o

f

our C

l

ass B Common Stoc

k

,w

hi

c

h

represents an approx

i

mate 4% owners

hi

p

i

nterest

i

nC

l

earw

i

re. Eag

l

eR

i

ver

Inc., which we refer to as ERI, is the mana

g

er of Ea

g

le River. Each entit

y

is controlled b

y

Crai

g

McCaw, a director

of Clearwire. Mr. McCaw and his affiliates have si

g

nificant investments in other telecommunications businesses

,

s

ome o

f

w

hi

c

h

may compete w

i

t

h

us current

l

yor

i

nt

h

e

f

uture. It

i

s

lik

e

l

y Mr. McCaw an

dhi

sa

ffili

ates w

ill

cont

i

nue

t

o make additional investments in telecommunications businesses.

As of December 31, 2009, Ea

g

le River held warrants entitlin

g

it to purchase

6

13,333 shares of Class A

Common Stock at an exercise price of

$

15.00 per share and warrants to purchase 375,000 shares of Class A

Common Stock at an exercise price of

$

3.00 per share. As of December 31, 2009, the remaining life of the warrants

w

as

3

.

9y

ears.

C

ertain of our officers and directors provide additional services to Ea

g

le River, ERI and their affiliates for

w

hich they are separately compensated by such entities. Any compensation paid to such individuals by Eagle River

,

E

RI an

d

/or t

h

e

i

ra

ffili

ates

f

or t

h

e

i

r serv

i

ces

i

s

i

na

ddi

t

i

on to t

h

e compensat

i

on pa

id by

us

.

Fo

ll

ow

i

n

g

t

h

eC

l

os

i

n

g

,C

l

earw

i

re, Spr

i

nt, Ea

gl

eR

i

ver an

d

t

h

e Investors a

g

ree

d

to enter

i

nto an equ

i

t

yh

o

ld

ers

’

a

g

reement, which set forth certain ri

g

hts and obli

g

ations of the equit

y

holders with respect to

g

overnance of

Clearwire, transfer restrictions on our common stock, rights of first refusal and pre-emptive rights, among other

thi

ngs. In a

ddi

t

i

on, we

h

ave a

l

so entere

di

nto a num

b

er o

f

commerc

i

a

l

agreements w

i

t

h

Spr

i

nt an

d

t

h

e Investors

w

hich are outlined below.

Additionall

y

, the wife of Mr. Salemme, our Executive Vice President, Strate

gy

, Polic

y

and External Affairs is a

G

roup V

i

ce Pres

id

ent at T

i

me Warner Ca

bl

e. S

h

e was not

di

rect

l

y

i

nvo

l

ve

di

n any o

f

our transact

i

ons w

i

t

h

T

i

me

W

arner

C

a

bl

e.

D

avis Wri

gh

t Tremaine LL

P

—

T

h

e

l

aw

fi

rm o

f

Dav

i

sWr

i

g

h

t Trema

i

ne LLP serves as our pr

i

mary outs

id

e

c

ounsel, and handles a variet

y

of corporate, transactional, tax and liti

g

ation matters. Mr. Wolff, our former Chie

f

Execut

i

ve O

ffi

cer,

i

s marr

i

e

d

to a partner at Dav

i

sWr

i

g

h

t Trema

i

ne. As a partner, Mr. Wo

lff

’s spouse

i

s ent

i

t

l

e

d

t

o

sh

are

i

n a port

i

on o

f

t

h

e

fi

rm’s tota

l

pro

fi

ts, a

l

t

h

oug

h

s

h

e

h

as not rece

i

ve

d

any compensat

i

on

di

rect

l

y

f

rom us. For t

h

e

y

ears ended December 31, 2009 and 2008, we paid $4.1 million and $907,000 to Davis Wri

g

ht Tremaine for le

g

a

l

s

ervices. This does not include fees paid by Old Clearwire

.

Master Site Agreement

—

We entered into a master site agreement with Sprint, which we refer to as th

e

Master S

i

te A

g

reement, pursuant to w

hi

c

h

Spr

i

nt an

d

we w

ill

esta

bli

s

h

t

h

e contractua

lf

ramewor

k

an

d

proce

d

ure

s

f

or t

h

e

l

eas

i

n

g

o

f

tower an

d

antenna co

ll

ocat

i

on s

i

tes to eac

h

ot

h

er. Leases

f

or spec

ifi

cs

i

tes w

ill b

ene

g

ot

i

ate

dby

S

print and us on request by the lessee. The leased premises may be used by the lessee for any activity in connectio

n

118

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)