Clearwire 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

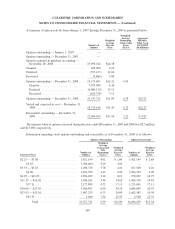

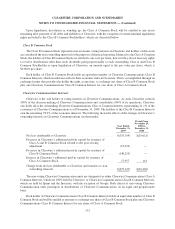

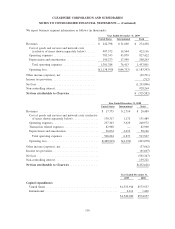

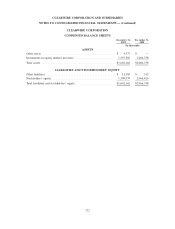

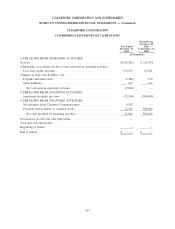

2009 2008

D

ecember 31,

T

o

t

a

l

asse

t

s

U

n

i

te

dS

tates ..........................................

$

11

,

115

,

815

$

8

,

901

,

988

I

n

te

rn

at

i

o

n

al

..........................................

.

1

5

2

,

038 222

,

179

$11,267,853 $9,124,167

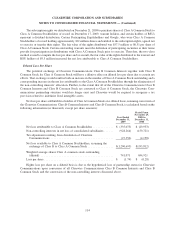

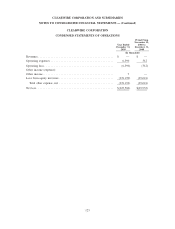

18. Related Party Transaction

s

We

h

ave a num

b

er o

f

strateg

i

can

d

commerc

i

a

l

re

l

at

i

ons

hi

ps w

i

t

h

t

hi

r

d

part

i

es t

h

at

h

ave

h

a

d

as

i

gn

ifi

cant

i

mpact on our

b

us

i

ness, operat

i

ons an

dfi

nanc

i

a

l

resu

l

ts. T

h

ese re

l

at

i

ons

hi

ps

h

ave

b

een w

i

t

h

Spr

i

nt, t

h

e Investors,

E

a

g

le River, Motorola, Inc. and Bell Canada, all of which are or have been related parties.

T

he followin

g

amounts for related part

y

transactions are included in our consolidated financial statements (i

n

th

ousan

d

s

):

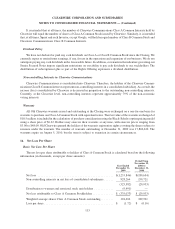

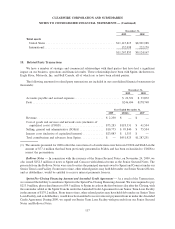

2009 200

8

December 31

,

Accounts pa

y

a

bl

ean

d

accrue

d

expenses ............................

$

22

,

521

$

33

,

87

2

D

e

b

t

......................................................

$

246

,

494

$

178

,

748

2

009 2008(1) 2007

Y

ear Ended December

31,

R

evenue

.

........................................

$

2

,230 $ — $ —

C

ost o

f

goo

d

san

d

serv

i

ces an

d

networ

k

costs (

i

nc

l

us

i

ve o

f

ca

p

italized costs) (COGS)

..........................

$

75,283 $118,331 $ 41,554

Se

lli

ng, genera

l

an

d

a

d

m

i

n

i

strat

i

ve (SG&A)

...............

$

10

,

773

$

95

,

840

$

75

,

554

I

nterest costs (

i

nc

l

us

i

ve o

f

cap

i

ta

li

ze

di

nterest

)

............

.

$

23

,

883

$

1

,

353

$

—

T

otal contributions and advances from Sprint ..............

$—

$

451

,

925

$

1

,

287

,

25

1

(1) The amounts

p

resented for 2008 reflect the correction of a classification error between COGS and SG&A in the

amount of

$

77.4 million that had been previousl

y

presented in SG&A and has been reclassified to COGS t

o

c

orrect t

h

e

p

resentat

i

on.

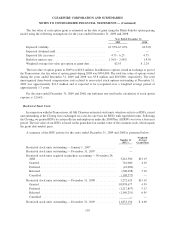

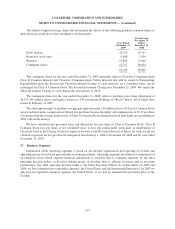

R

o

ll

over Note

s

— In connection with the issuance of the Senior Secured Notes, on November 24, 2009, w

e

also issued

$

252.5 million of notes to Sprint and Comcast with identical terms as the Senior Secured Notes. Th

e

p

roceeds from the Rollover Notes were used to retire the

p

rinci

p

al amounts owed to S

p

rint and Comcast under our

S

enior Term Loan Facilit

y

. From time to time, other related parties ma

y

hold debt under our Senior Secured Notes

,

an

d

as

d

e

b

t

h

o

ld

ers, wou

ld b

e ent

i

t

l

e

d

to rece

i

ve

i

nterest payments

f

rom us.

Sprint Pre-Closing Financing Amount and Amended Credit Agreement — As a resu

l

to

f

t

h

e Transact

i

ons

,

we assumed the liability to reimburse Sprint for the Sprint Pre-Closing Financing Amount. We were required to pa

y

$

213.0 million, plus related interest of

$

4.5 million, to Sprint in cash on the first business day after the Closing, with

th

e rema

i

n

d

er a

dd

e

d

as t

h

e Spr

i

nt Tranc

h

eun

d

er t

h

e Amen

d

e

d

Cre

di

tA

g

reement

f

or our Sen

i

or Term Loan Fac

ili

t

y

i

n the amount of $179.2 million. From time to time, other related parties ma

y

have held debt under our Senior Ter

m

Loan Fac

ili

ty, an

d

as

d

e

b

t

h

o

ld

ers, wou

ld h

ave

b

een ent

i

t

l

e

d

to rece

i

ve

i

nterest payments

f

rom us un

d

er t

h

e Amen

d

e

d

Cre

di

t Agreement. Dur

i

ng 2009, we repa

id

our Sen

i

or Term Loan Fac

ili

ty w

i

t

h

procee

d

s

f

rom our Sen

i

or Secure

d

Notes and Rollover Notes.

117

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)