Clearwire 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

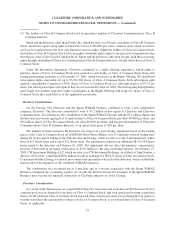

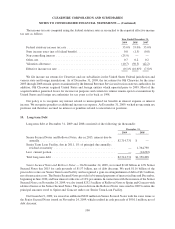

As of December 31, 2009,

$

2.71 billion in aggregate principal amount was outstanding under the Senior

S

ecure

d

Notes an

d

Ro

ll

over Notes. T

h

ewe

i

g

h

te

d

e

ff

ect

i

ve

i

nterest rate o

f

t

h

e Sen

i

or Secure

d

Notes an

d

Ro

ll

ove

r

N

otes was 13.02% at December 31, 2009.

T

he holders of the Senior Secured Notes and Rollover Notes have the right to require us to repurchase all of th

e

n

otes upon t

h

e occurrence o

f

ac

h

an

g

eo

f

contro

l

event or a sa

l

eo

f

certa

i

n assets at a pr

i

ce o

f

101% o

f

t

h

epr

i

nc

i

pa

l

amount or 100% o

f

t

h

epr

i

nc

i

pa

l

amount, respect

i

ve

ly

,p

l

us an

y

unpa

id

accrue

di

nterest to t

h

e repurc

h

ase

d

ate. Pr

i

o

r

t

o December 1, 2012, we ma

y

redeem up to 3

5

% of the a

gg

re

g

ate principal amount of the Senior Secured Notes at

a

r

e

d

empt

i

on pr

i

ce o

f

112% o

f

t

h

e aggregate pr

i

nc

i

pa

l

amount, p

l

us any unpa

id

accrue

di

nterest to t

h

e repurc

h

ase

d

ate. A

f

ter Decem

b

er 1, 2012, we ma

y

re

d

eem a

ll

or a part o

f

t

h

e Sen

i

or Secure

d

Notes

by

pa

yi

n

g

ama

k

e-w

h

o

l

e

p

remium as stated in the terms, plus an

y

unpaid accrued interest to the repurchase date

.

O

ur payment obligations under the Senior Secured Notes and Rollover Notes are guaranteed by certai

n

d

omest

i

csu

b

s

idi

ar

i

es on a sen

i

or

b

as

i

san

d

secure

db

y certa

i

n assets o

f

suc

h

su

b

s

idi

ar

i

es on a

fi

rst-pr

i

or

i

ty

li

en. T

he

S

en

i

or Secure

d

Notes an

d

Ro

ll

over Notes conta

i

n

li

m

i

tat

i

ons on our act

i

v

i

t

i

es, w

hi

c

h

amon

g

ot

h

er t

hi

n

g

s

i

nc

l

u

d

e

i

ncurring additional indebtedness and guarantee indebtedness; making distributions or payment of dividends or

c

ertain other restricted payments or investments; making certain payments on indebtedness; entering into agree

-

m

ents t

h

at restr

i

ct

di

str

ib

ut

i

ons

f

rom restr

i

cte

d

su

b

s

idi

ar

i

es; se

lli

n

g

or ot

h

erw

i

se

di

spos

i

n

g

o

f

assets; mer

g

er

,

c

onsolidation or sales of substantiall

y

all of our assets; enterin

g

transactions with affiliates; creatin

g

liens; issuin

g

c

ertain preferred stock or similar equity securities and making investments and acquiring assets

.

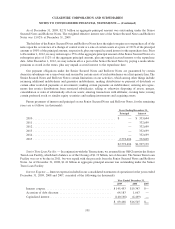

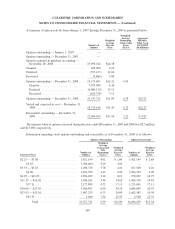

Future payments o

fi

nterest an

d

pr

i

nc

i

pa

l

on our Sen

i

or Secure

d

Notes an

d

Ro

ll

over Notes,

f

or t

h

e rema

i

n

i

ng

y

ears are as follows (in thousands)

:

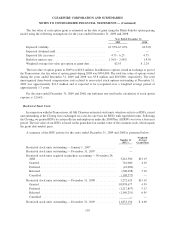

Principal Interest

Years Endin

g

December 31

,

2010

................................................... $ —

$

3

33,644

2011

...................................................

—

3

32,

6

99

2012

...................................................

—

3

32,

6

99

2013

...................................................

—

3

32

,6

99

2

0

14...................................................

—

3

32

,6

99

201

5

...................................................

2,

772

,

494 332

,

699

$

2,772,494 $1,997,13

9

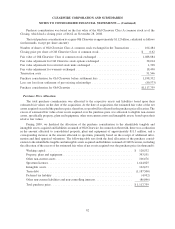

S

enior Term Loan Faci

l

ity — In con

j

unct

i

on w

i

t

h

t

h

e Transact

i

ons, we assume

df

rom O

ld

C

l

earw

i

re t

h

e Sen

i

or

T

erm Loan Facilit

y

, which had a balance as of the Closin

g

of $1.19 billion, net of discount. The Senior Term Loa

n

Facilit

y

was set to be due in 2011, but was repaid with the proceeds from the Senior Secured Notes and Rollover

Notes. As of December 31, 2008,

$

1.41 billion in aggregate principal amount was outstanding under the Senior

T

erm Loan Fac

ili

t

y

.

I

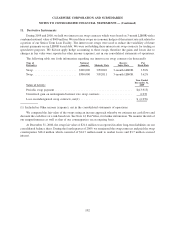

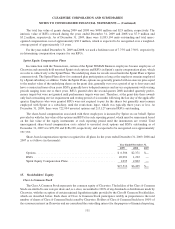

nterest Expense — Interest expense included in our consolidated statements of operations for the

y

ears ende

d

D

ecember 31, 2009, 2008 and 2007, consisted of the following (in thousands):

2

009

2

008

2

007

Y

ear Ended December 31

,

I

nterest coupo

n

.........................................

$

1

45

,

453

$

19

,

347

$

—

A

cc

r

et

i

o

n

o

f

debt d

i

scou

n

t

................................ 64

,

183 1

,

667 —

C

a

p

italized interest

......................................

(140,168) (4,469) —

$ 69,468 $16,545 $—

101

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)