Clearwire 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12. Fa

i

r Valu

e

Th

e

f

o

ll

ow

i

ng ta

bl

e

i

sa

d

escr

i

pt

i

on o

f

t

h

epr

i

c

i

ng assumpt

i

ons use

df

or

i

nstruments measure

d

an

d

recor

d

e

d

a

t

f

a

i

rva

l

ue on a recurr

i

n

gb

as

i

s,

i

nc

l

u

di

n

g

t

h

e

g

enera

l

c

l

ass

ifi

cat

i

on o

f

suc

hi

nstruments pursuant to t

h

eva

l

uat

i

o

n

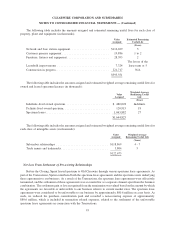

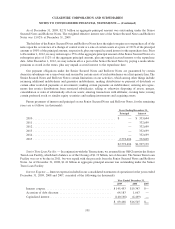

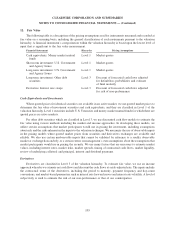

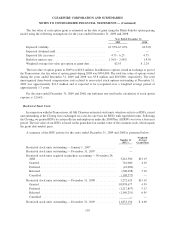

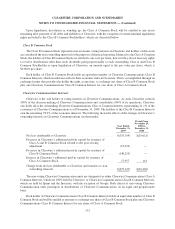

hierarchy. A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of

i

nput that is significant to the fair value measurement.

F

inancial Instrument Hierarchy Pricin

g

Assumptions

C

ash equivalents: Mone

y

market mutual

fu

n

ds

Level 1 Market

q

uote

s

Short-term investment: U.S. Governmen

t

a

nd A

g

enc

y

Issues

Level 1 Market

q

uote

s

Lon

g

-term investment: U.S. Governmen

t

a

nd A

g

enc

y

Issues

Level 1 Market

q

uote

s

Lon

g

-term investment: Other deb

t

secu

ri

t

i

es

Level 3 Discount of forecasted cash flows ad

j

uste

d

for default/loss

p

robabilities and estimat

e

of final maturit

y

D

erivative: Interest rate swaps Level 3 Discount of forecasted cash flows ad

j

uste

d

for risk of non-

p

erformance

C

ash Equivalents and Investment

s

W

h

ere quote

d

pr

i

ces

f

or

id

ent

i

ca

l

secur

i

t

i

es are ava

il

a

bl

e

i

n an act

i

ve mar

k

et, we use quote

d

mar

k

et pr

i

ces t

o

determine the fair value of investment securities and cash equivalents, and the

y

are classified in Level 1 of the

va

l

uat

i

on

hi

erarc

h

y. Leve

l

1 secur

i

t

i

es

i

nc

l

u

d

e U.S. Treasur

i

es an

d

money mar

k

et mutua

lf

un

d

s

f

or w

hi

c

h

t

h

ere are

q

uote

d

pr

i

ces

i

n act

i

ve mar

k

ets.

For ot

h

er

d

e

b

t secur

i

t

i

es w

hi

c

h

are c

l

ass

ifi

e

di

nLeve

l

3

,

we use

di

scounte

d

cas

hfl

ow mo

d

e

l

s to est

i

mate t

he

f

a

i

rva

l

ue us

i

n

g

var

i

ous met

h

o

d

s

i

nc

l

u

di

n

g

t

h

e mar

k

et an

di

ncome approac

h

es. In

d

eve

l

op

i

n

g

t

h

ese mo

d

e

l

s, w

e

utilize certain assumptions that market participants would use in pricing the investment, including assumption

s

a

b

out r

i

s

k

an

d

t

h

er

i

s

k

s

i

n

h

erent

i

nt

h

e

i

nputs to t

h

eva

l

uat

i

on tec

h

n

i

que. We max

i

m

i

ze t

h

e use o

f

o

b

serva

bl

e

i

nput

s

i

nt

h

epr

i

c

i

n

g

mo

d

e

l

sw

h

ere quote

d

mar

k

et pr

i

ces

f

rom secur

i

t

i

es an

dd

er

i

vat

i

ves exc

h

an

g

es are ava

il

a

bl

ean

d

r

eliable. We also use certain unobservable inputs that cannot be validated b

y

reference to a readil

y

observable

m

ar

k

et or exc

h

ange

d

ata an

d

re

l

y, to a certa

i

n extent, on management’s own assumpt

i

ons a

b

out t

h

e assumpt

i

ons t

h

at

m

ar

k

et part

i

c

i

pants wou

ld

use

i

npr

i

c

i

ng t

h

e secur

i

ty. We use many

f

actors t

h

at are necessary to est

i

mate mar

k

et

values, includin

g

interest rates, market risks, market spreads, timin

g

of contractual cash flows, market liquidit

y

,

r

ev

i

ew o

f

un

d

er

l

y

i

ng co

ll

atera

l

an

d

pr

i

nc

i

pa

l

,

i

nterest an

ddi

v

id

en

d

payments

.

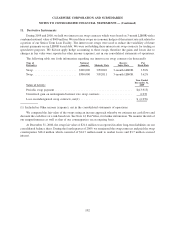

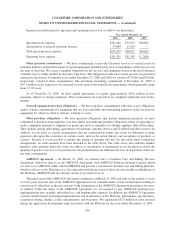

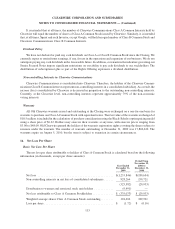

Derivative

s

D

erivatives are classified in Level 3 of the valuation hierarch

y

. To estimate fair value, we use an incom

e

approach whereby we estimate net cash flows and discount the cash flows at a risk-adjusted rate. The inputs includ

e

th

e contractua

l

terms o

f

t

h

e

d

er

i

vat

i

ves,

i

nc

l

u

di

ng t

h

e per

i

o

d

to matur

i

ty, payment

f

requency an

dd

ay-coun

t

c

onventions, and market-based parameters such as interest rate forward curves and interest rate volatilit

y

. A level of

s

ub

j

ectivit

y

is used to estimate the risk of our non-performance or that of our counterparties

.

1

03

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)