Clearwire 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

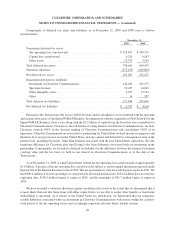

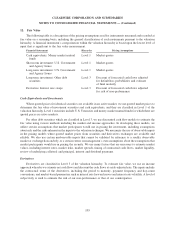

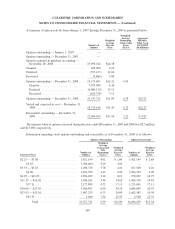

C

omponents o

fd

e

f

erre

d

tax assets an

dli

a

bili

t

i

es as o

f

Decem

b

er 31, 2009 an

d

2008 were as

f

o

ll

ows

(

in thousands)

:

2009

2

008

D

ecember 31

,

Noncurrent

d

e

f

erre

d

tax assets

:

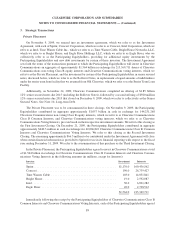

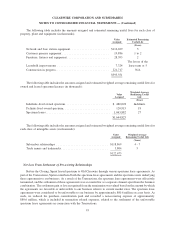

Net operating loss carryforward ...............................

$

718

,

853 $ 590

,

76

7

C

apital loss carr

y

forward.

...................................

6

,230 6,187

Other assets

.............................................

1

3,

5

73 3,

5

19

T

ota

ld

e

f

erre

d

tax assets

...

...................................

738,656 600,47

3

V

a

l

uat

i

on a

ll

o

w

anc

e

.........................................

(

573,165

)(

349,001

)

N

et

d

e

f

erre

d

tax asset

s

.

...................................... 16

5,

491 2

5

1

,

47

2

N

oncurrent deferred tax liabilities

:

I

n

v

estment

i

n

Cl

ear

wi

re

C

ommun

i

cat

i

on

s

........................

142

,

434 221

,

3

7

3

Spectrum

li

censes

.........................................

19,43

7

14,943

Ot

h

er

i

ntang

ibl

e assets. . .

...................................

9,93

7

19,113

O

t

h

er ..................................................

36

2

0

7

T

otal deferred tax liabilities .

.

.................................

.

171

,

844 2

55,

63

6

N

et deferred tax liabilities

..

.

..................................

$

6,353 $ 4,16

4

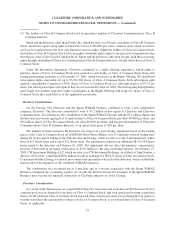

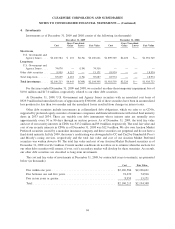

Pursuant to the Transactions, the assets of Old Clearwire and its subsidiaries were combined with the s

p

ectru

m

an

d

certa

i

not

h

er assets o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness. In con

j

unct

i

on w

i

t

h

t

h

e acqu

i

s

i

t

i

on o

f

O

ld

C

l

earw

i

re

b

yt

h

e

S

print WiMAX Business, these assets along with the

$

3.2 billion of capital from the Investors were contributed to

C

l

earw

i

re Commun

i

cat

i

ons. C

l

earw

i

re

i

st

h

eso

l

e

h

o

ld

er o

f

vot

i

n

gi

nterests

i

nC

l

earw

i

re Commun

i

cat

i

ons. As suc

h

,

Clearwire controls 100% of the decision making of Clearwire Communications and consolidates 100% of it

s

o

p

erations. Clearwire Communications is treated as a

p

artnershi

p

for United States federal income tax

p

ur

p

oses an

d

t

h

ere

f

ore

d

oes not pay

i

ncome tax

i

nt

h

eUn

i

te

d

States an

d

any current an

dd

e

f

erre

d

tax consequences ar

i

se at t

h

e

p

artner

l

eve

l

,

i

nc

l

u

di

n

g

C

l

earw

i

re. Ot

h

er t

h

an

b

a

l

ances assoc

i

ate

d

w

i

t

h

t

h

e non-Un

i

te

d

States operat

i

ons, t

h

eon

ly

temporary

diff

erence

f

or C

l

earw

i

re a

f

ter t

h

eC

l

os

i

ng

i

st

h

e

b

as

i

s

diff

erence assoc

i

ate

d

w

i

t

h

our

i

nvestment

i

nt

h

e

p

artnership. Consequentl

y

, we recorded a deferred tax liabilit

y

for the difference between the financial statemen

t

c

arr

yi

n

g

va

l

ue an

d

t

h

e tax

b

as

i

swe

h

o

ld i

n our

i

nterest

i

nC

l

earw

i

re Commun

i

cat

i

ons as o

f

t

h

e

d

ate o

f

t

he

T

ransactions

.

As o

f

Decem

b

er 31, 2009, we

h

a

d

Un

i

te

d

States

f

e

d

era

l

tax net operat

i

n

gl

oss carr

yf

orwar

d

so

f

approx

i

mate

ly

$

1.6 billion. A portion of the net operating loss carryforward is subject to certain annual limitations imposed under

S

ection 382 of the Internal Revenue Code of 198

6

. The net operatin

g

loss carr

y

forwards be

g

in to expire in 2021. We

h

ad

$

386.4 million of tax net operating loss carryforwards in foreign jurisdictions;

$

234.2 million have no statutory

e

xpiration date, $130.5 million be

g

ins to expire in 2015, and the remainder of $21.7 million be

g

ins to expire in

2

0

1

0.

We have recorded a valuation allowance against our deferred tax assets to the extent that we determined that i

t

i

s more

lik

e

ly

t

h

an not t

h

at t

h

ese

i

tems w

ill

e

i

t

h

er exp

i

re

b

e

f

ore we are a

bl

e to rea

li

ze t

h

e

i

r

b

ene

fi

ts or t

h

at

f

uture

d

eductibilit

y

is uncertain. As it relates to the United States tax

j

urisdiction, we determined that our temporar

y

taxable difference associated with our investment in Clearwire Communications will reverse within the carr

y

for

-

ward period of the net operating losses and accordingly represents relevant future taxable income.

99

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)