Clearwire 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

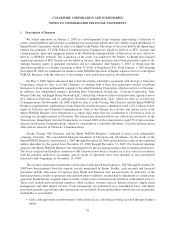

t

o contr

ib

ute to C

l

earw

i

re

i

ts C

l

earw

i

re Commun

i

cat

i

ons Vot

i

ng Interests

i

nexc

h

ange

f

or an equa

l

num

b

er o

f

s

h

ares

of Clearwire’s Class B common stock, par value

$

0.0001 per share, which we refer to as Class B Common Stock.

Un

d

er t

h

e Investment A

g

reement,

i

nexc

h

an

g

e

f

or t

h

e purc

h

ase

by

Spr

i

nt, Comcast, T

i

me Warner Ca

bl

ean

d

Bright House of Clearwire Communications Class B Common Interests and Clearwire Communications Voting

Interests in amounts exceeding certain amounts stipulated in the Investment Agreement, Clearwire Communica-

ti

ons a

g

ree

d

to pa

y

a

f

ee, w

hi

c

h

we re

f

er to as an Over A

ll

otment Fee, equa

l

to t

h

e

f

o

ll

ow

i

n

g

amounts. Suc

hf

ee

i

s

p

a

y

able in cash, or Clearwire Communications Class B Common Interests and Clearwire Communications Votin

g

Interests, at the option of the Participating Equityholder:

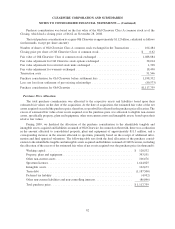

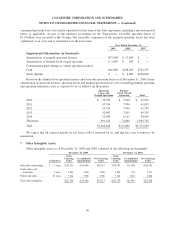

I

nvesto

r

O

ver Allotment Fee

S

p

rint

.

.......................................................

.

$

18

,

878

,

934

C

omcast

.

......................................................

$

3,13

5

,91

1

T

ime Warner Cabl

e

...............................................

$

1

,6

5

9,287

B

r

igh

t House

.

..................................................

$

315,325

At t

h

e Secon

d

Investment C

l

os

i

n

g

,C

l

earw

i

re Commun

i

cat

i

ons

d

e

li

vere

d

a port

i

on o

f

t

h

e Over A

ll

otment Fee,

$

6.9 million in cash and $9.5 million in Clearwire Communications Class B Common Interests, valued at $7.33

p

e

r

i

nterest, and an equal number of Clearwire Communications Voting Interests to Sprint,

$

2.7 million in cash t

o

Comcast,

$

1.4 million in cash to Time Warner Cable and

$

275,000 in cash to Bri

g

ht House. The remainin

g

Over

A

llotment Fee of $3.2 million will be

p

aid in cash or Clearwire Communications Class B Common Interests an

d

C

l

earw

i

re Commun

i

cat

i

ons Vot

i

ng Interests at t

h

eT

hi

r

d

Investment C

l

os

i

ng

.

I

mmediately after the Third Investment Closing, Sprint will own 71.

5

% of the Class B Common Stock

,

Comcast will own 11.9% of the Class B Common Stock, Time Warner Cable will own

6

.2% of the Class B Common

S

tock, Bri

g

ht House will own 1.1% of the Class B Common Stock, Intel will own 8.9% of the Class B Commo

n

S

tock and Eagle River will own 0.4% of the Class B Common Stock. These percentages include 1,287,78

5

of

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests an

d

C

l

earw

i

re Commun

i

cat

i

ons Vot

i

n

g

Interests to

b

e

i

ssued to Sprint, as Sprint has a

g

reed to accept half of its Over Allotment Fee in Clearwire Communications Class B

Common Interests.

Cl

earw

i

re

h

o

ld

sa

ll

o

f

t

h

e outstan

di

ng C

l

earw

i

re Commun

i

cat

i

ons non-vot

i

ng C

l

ass A equ

i

ty

i

nterests, w

hi

c

h

we re

f

er to as C

l

earw

i

re Commun

i

cat

i

ons C

l

ass A Common Interests, an

d

a

ll

t

h

e outstan

di

ng C

l

earw

i

re Com-

m

unications Votin

g

Interests, representin

g

21.1% of the economics and 100% of the votin

g

ri

g

hts of Clearwir

e

Communications as of December 31

,

2009

.

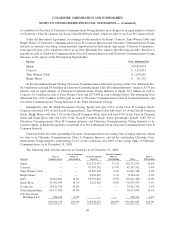

T

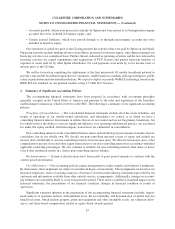

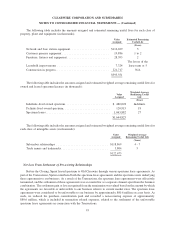

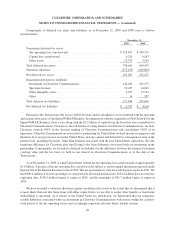

he following table lists the interests in Clearwire as of December 31, 2009:

I

n

ves

t

o

r

C

lass

A

C

ommon

S

toc

k

C

lass A Commo

n

S

tock

%

O

utstand

i

ng

C

lass B

C

ommon

S

tock

(

1

)

Class B Common

S

tock

%

O

utstand

i

ng Tota

l

Total

%

O

utstand

i

n

g

S

p

rin

t

........... —

—

5

24,732,

5

33 71.

5

%

5

24,732,

5

33

5

6.4%

C

omcast

.......... — —

87

,

367

,

362 11.9% 87

,

367

,

362 9.4

%

Time Warner Cable . . — — 4

5

,807,398 6.2% 4

5

,807,398 4.9

%

Br

igh

t House

...... — —

8

,3

6

4,243 1.1% 8,3

6

4,243 0.9

%

Intel

.

............

3

6

,

666

,

666 18.6% 65

,

354

,

820 8.9% 102

,

021

,

486 11.0%

Ea

gl

eR

i

ver

.

......

35

,922,9

5

8 18.3% 2,612,

5

16 0.4% 38,

5

3

5

,474 4.1

%

Goog

l

e Inc. .

......

29,411,765 14.9% — — 29,411,765 3.1

%

O

ther Shareholders . . 94

,

177

,

091 47.9% — — 94

,

177

,

091 10.1

%

C

WIn

v

estment

H

oldings LLC . . . . 588,235 0.3% — — 588,235 0.1

%

1

96,766,71

5

100.0% 734,238,872 100.0% 931,00

5

,

5

87 100.0

%

90

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)