Clearwire 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

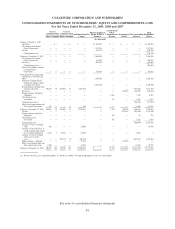

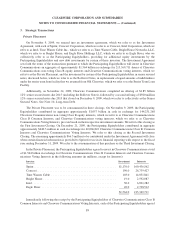

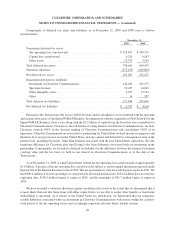

(1) The holders of Class B Common Stock hold an e

q

uivalent number of Clearwire Communications Class

B

C

ommon Interests.

Sprint and the Investors, other than Goo

g

le, Inc, which we refer to as Goo

g

le, own shares of Class B Common

S

tock, which have equal voting rights to Clearwire’s Class A,

$

0.0001 par value, common stock, which we refer t

o

as Class A Common Stock, but have onl

y

limited economic ri

g

hts. Unlike the holders of Class A Common Stock

,

t

he holders of Class B Common Stock, have no ri

g

ht to dividends and no ri

g

ht to an

y

proceeds on liquidation other

th

an t

h

e par va

l

ue o

f

t

h

eC

l

ass B Common Stoc

k

. Spr

i

nt an

d

t

h

e Investors, ot

h

er t

h

an Goog

l

e,

h

o

ld

t

h

e

i

r econom

ic

r

i

g

hts throu

g

h ownership of Clearwire Communications Class B Common Interests. Goo

g

le owns shares of Class

A

Common Stock

.

Un

d

er t

h

e Investment A

g

reement, C

l

earw

i

re comm

i

tte

d

to a r

igh

ts o

ff

er

i

n

g

, pursuant to w

hi

c

h

r

igh

ts t

o

p

urc

h

ase s

h

ares o

f

C

l

ass A Common Stoc

k

were

g

rante

d

to eac

hh

o

ld

er o

f

C

l

ass A Common Stoc

k

a

l

on

g

w

i

t

h

certain participatin

g

securities as of December 17, 2009, which we refer to as the Ri

g

hts Offerin

g

. We distributed

s

u

b

scr

i

pt

i

on r

i

g

h

ts exerc

i

sa

bl

e

f

or up to 93,903,300 s

h

ares o

f

C

l

ass A Common Stoc

k

. Eac

h

su

b

scr

i

pt

i

on r

i

g

ht

entitled a shareholder to purchase 0.4336 shares of Class A Common Stock at a subscription price of

$

7.33 pe

r

s

hare. The subscription ri

g

hts will expire if the

y

are not exercised b

y

June 21, 2010. The Participatin

g

Equit

y

holders

an

d

Goog

l

ewa

i

ve

d

t

h

e

i

r respect

i

ve r

i

g

h

ts to part

i

c

i

pate

i

nt

h

eR

i

g

h

ts O

ff

er

i

ng w

i

t

h

respect to s

h

ares o

f

C

l

ass A

Common Stoc

k

t

h

ey eac

hh

o

ld

as o

f

t

h

e app

li

ca

bl

e recor

dd

ate.

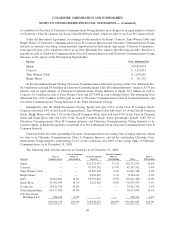

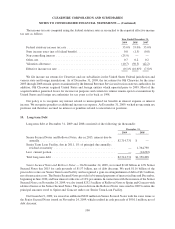

B

usiness

C

om

b

ination

s

O

n the Closin

g

, Old Clearwire and the Sprint WiMAX business combined to form a new independent

compan

y

, Clearwire. The Investors contributed a total of $3.2 billion of new equit

y

to Clearwire and Clearwir

e

Communications. In exchange for the contribution of the Sprint WiMAX business and the

$

3.2 billion, Sprint an

d

t

he Investors received an a

gg

re

g

ate of 25 million shares of Class A Common Stock, par value $0.0001 per share, an

d

5

05 million shares of Class B Common Stock,

p

ar value $0.0001

p

er share, and an e

q

uivalent number of Clearwir

e

Communications Class B Common Interests, at an initial share price of

$

20 per share

.

Th

e num

b

er o

f

s

h

ares

i

ssue

d

to t

h

e Investors was su

bj

ect to a post-c

l

os

i

n

g

a

dj

ustment

b

ase

d

on t

h

e tra

di

n

g

p

rices of the Class A Common Stock on NASDAQ Global Select Market over 1

5

randomly-selected trading days

d

ur

i

ng t

h

e 30-

d

ay per

i

o

d

en

di

ng on t

h

e 90t

hd

ay a

f

ter t

h

eC

l

os

i

ng, w

hi

c

h

we re

f

er to as t

h

eA

dj

ustment Date, w

i

t

ha

floor of

$

17.00 per share and a cap of

$

23.00 per share. The ad

j

ustment resulted in an additional 28,235,294 shares

b

ein

g

issued to the Investors on Februar

y

26, 2009. The ad

j

ustment did not affect the purchase consideration;

however it did result in an equity reallocation of

$

33.6 million to the non-controlling interests. On February 27

,

2

009, CW Investment Ho

ldi

ngs LLC, w

hi

c

h

we re

f

er to as CW Investment Ho

ldi

ngs, an a

ffili

ate o

f

Jo

h

n Stanton, a

director of Clearwire, contributed $10.0 million in cash in exchan

g

e for 588,235 shares of Class A Common Stock.

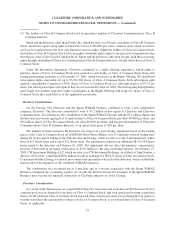

Concurrent w

i

t

h

t

h

eC

l

os

i

ng, we entere

di

nto commerc

i

a

l

agreements w

i

t

h

eac

h

o

f

t

h

e Investors, w

hi

c

h

esta

bli

s

h

t

he

f

ramewor

kf

or

d

eve

l

opment o

f

t

h

e com

bi

ne

d

W

i

MAX

b

us

i

nesses

.

T

he combination was accounted for as a

p

urchase and as a reverse ac

q

uisition with the S

p

rint WiMA

X

Business considered the accounting acquirer. As a result, the historical financial statements of the Sprint WiMA

X

Bus

i

ness

h

ave

b

ecome t

h

e

fi

nanc

i

a

l

statements o

f

C

l

earw

i

re e

ff

ect

i

ve as o

f

t

h

eC

l

os

i

n

g

.

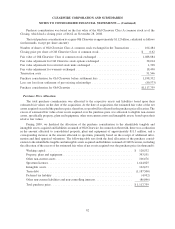

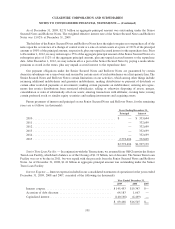

Purc

h

ase Consi

d

eration

As a result of the Transactions, we ac

q

uired Old Clearwire’s net assets and each share of Old Clearwire Class

A

common stock was exchanged for one share of Class A Common Stock, and each option and warrant to purchas

e

sh

ares o

f

O

ld

C

l

earw

i

re C

l

ass A Common Stoc

k

an

d

eac

h

s

h

are o

f

restr

i

cte

d

stoc

k

was exc

h

an

g

e

df

or an opt

i

on o

r

w

arrant to

p

urc

h

ase t

h

e same num

b

er o

f

s

h

ares o

f

C

l

ass A Common Stoc

k

, or a restr

i

cte

d

s

h

are o

f

C

l

ass A Common

S

tock, as a

pp

licable.

91

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)