Clearwire 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

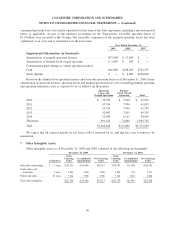

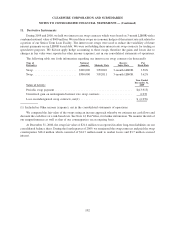

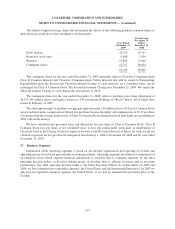

Expense recor

d

e

d

re

l

ate

d

to spectrum an

d

operat

i

ng

l

eases was as

f

o

ll

ows (

i

nt

h

ousan

d

s):

2009 2008 200

7

Y

ear Ended December

31,

S

p

ectrum

l

ease ex

p

ense . . .

.............................

$201,461 $72,923 $60,05

1

A

mort

i

zat

i

on o

f

prepa

id

spectrum

li

cense

s

.................

.

5

7

,

898 17

,

109 —

T

ota

l

spectrum

l

ease expense

............................

$

259

,

359

$

90

,

032

$

60

,

05

1

O

perat

i

n

gl

ease expense . .

.

.............................

$245,351 $51,345 $ 2,000

O

t

h

er s

p

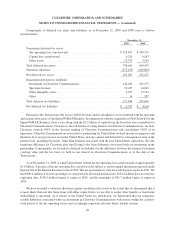

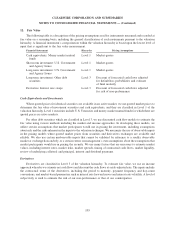

ectrum commitments —We

h

ave comm

i

tments to prov

id

eC

l

earw

i

re serv

i

ces to certa

i

n

l

essors

in

launched markets, and reimbursement of capital equipment and third-part

y

service expenditures of the lessors ove

r

th

e term o

f

t

h

e

l

ease. We accrue a mont

hl

yo

bli

gat

i

on

f

or t

h

e serv

i

ces an

d

equ

i

pment

b

ase

d

on t

h

e tota

l

est

i

mate

d

ava

il

a

bl

e serv

i

ce cre

di

ts

di

v

id

e

db

yt

h

e term o

f

t

h

e

l

ease. T

h

eo

bli

gat

i

on

i

sre

d

uce

d

as actua

li

nvo

i

ces are presente

d

and paid to the lessors. Durin

g

the

y

ears ended December 31, 2009 and 2008 we satisfied $779,000 and $76,000,

r

espect

i

ve

l

y, re

l

ate

d

to t

h

ese comm

i

tments. T

h

e max

i

mum rema

i

n

i

ng comm

i

tment at Decem

b

er 31, 2009

is

$

95.7 million and is expected to be incurred over the term of the related lease agreements, which generally range

f

rom 15-30

y

ears.

A

s of December 31, 2009, we have si

g

ned a

g

reements to acquire approximatel

y$

30.0 million in new

s

pectrum, su

bj

ect to c

l

os

i

n

g

con

di

t

i

ons. T

h

ese transact

i

ons are expecte

d

to

b

e comp

l

ete

d

w

i

t

hi

nt

h

e next twe

l

ve

months

.

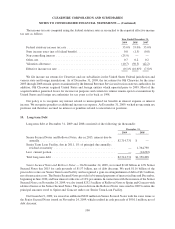

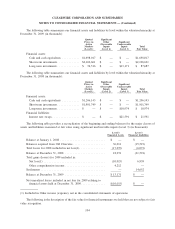

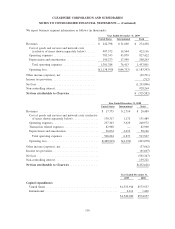

N

etwor

k

e

q

ui

p

ment

p

urc

h

ase o

bl

igation

s

—

We

h

ave purc

h

ase comm

i

tments w

i

t

h

ta

k

e-or-pay o

bli

gat

i

ons

and/or volume commitments for equipment that are non-cancelable and outstandin

g

purchase orders for networ

k

equ

i

pment

f

or w

hi

c

h

we

b

e

li

eve

d

e

li

very

i

s

lik

e

l

y to occur

.

O

ther purchase obligation

s

—

We have purchase obli

g

ations that include minimum purchases we have

committed to purchase from suppliers over time and/or unconditional purchase obligations where we guarantee t

o

ma

k

eam

i

n

i

mum payment to supp

li

ers

f

or goo

d

san

d

serv

i

ces regar

dl

ess o

f

w

h

et

h

er supp

li

ers

f

u

ll

y

d

e

li

ver t

h

em

.

T

h

e

yi

nc

l

u

d

e, amon

g

ot

h

er t

hi

n

g

s, a

g

reements

f

or

b

ac

kh

au

l

, customer

d

ev

i

ces an

d

IT re

l

ate

d

an

d

ot

h

er serv

i

ces. I

n

addition, we are part

y

to various arran

g

ements that are conditional in nature and create an obli

g

ation to mak

e

p

ayments only upon the occurrence of certain events, such as the actual delivery and acceptance of products o

r

s

erv

i

ces. Because

i

t

i

s not poss

ibl

etopre

di

ct t

h

et

i

m

i

n

g

or amounts t

h

at ma

yb

e

d

ue un

d

er t

h

ese con

di

t

i

ona

l

arran

g

ements, no such amounts have been included in the table above. The table above also excludes blanket

p

urchase order amounts where the orders are sub

j

ect to cancellation or termination at our discretion or where th

e

q

uant

i

ty o

f

goo

d

s or serv

i

ces to

b

e purc

h

ase

d

or t

h

e payment terms are un

k

nown

b

ecause suc

h

purc

h

ase or

d

ers ar

e

not firm commitments

.

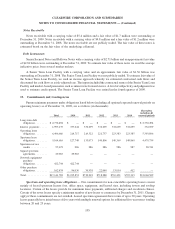

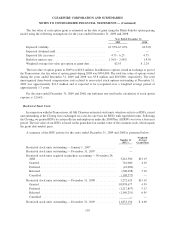

AMDOCS A

g

reemen

t

— On Marc

h

31, 2009, we entere

di

nto a Customer Care an

d

B

illi

ng Serv

i

ce

s

Ag

reement, which we refer to as the AMDOCS A

g

reement, with AMDOCS Software S

y

stems Limited, which

w

e refer to as AMDOCS, under which AMDOCS will provide a customized customer care and billing platform

,

whi

c

h

we re

f

er to as t

h

eP

l

at

f

orm, to us. In connect

i

on w

i

t

h

t

h

e prov

i

s

i

on o

f

t

h

ese serv

i

ces an

d

t

h

e esta

bli

s

h

ment o

f

th

eP

l

at

f

orm, AMDOCS w

ill

a

l

so

li

cense certa

i

no

fi

ts so

f

tware to us

.

T

he initial term of the AMDOCS Agreement commences on March 31, 2009 and ends on the earliest to occur

o

f

seven years

f

rom t

h

e

d

ate o

f

t

h

e AMDOCS Agreement (to

b

e exten

d

e

d

un

d

er certa

i

nc

i

rcumstances re

l

at

i

ng t

o

c

onversion of subscribers to the new s

y

stem) or the termination of the AMDOCS A

g

reement pursuant to its terms,

as defined. Under the terms of the AMDOCS A

g

reement, we are required to pa

y

AMDOCS licensin

g

fees,

i

mp

l

ementat

i

on

f

ees, mont

hl

ysu

b

scr

ib

er

f

ees, an

d

re

i

m

b

ursa

bl

e expenses. In a

ddi

t

i

on, t

h

e AMDOCS Agreemen

t

c

ontains detailed terms

g

overnin

g

implementation and maintenance of the Platform; performance specifications

;

acceptance testin

g

; char

g

es, credits and pa

y

ments; and warranties. We capitalized $52.9 million in costs incurred

d

ur

i

ng t

h

e app

li

cat

i

on

d

eve

l

opment stage assoc

i

ate

d

w

i

t

h

t

h

eP

l

at

f

orm

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2009

.

10

6

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)